In a significant gesture of appreciation towards its dutiful citizens, the Kenya Revenue Authority (KRA) is poised to mark the commencement of the Annual Taxpayers' Month on Monday, October 2, 2023.

This development was announced by the authority via a statement it issued on Friday.

"Kenya Revenue Authority (KRA) will on Monday launch the Annual Taxpayer’s Month and unveil its online auction as well as the Tax Amnesty, as a way of giving back to taxpayer," the statement read.

The highly-anticipated event not only celebrates the unwavering dedication of compliant taxpayers but also ushers in an era of digital transformation with the introduction of an online auction.

Read More

Additionally, the authority has extended taxpayers a unique opportunity to avail themselves of the Tax Amnesty.

The Annual Taxpayer’s Month, a month-long celebration, serves as a tribute to those who have dutifully remitted their taxes during the financial year 2022/2023, acknowledging their patriotism in contributing to the nation's welfare.

"KRA celebrates the Taxpayers’ Month annually to appreciate compliant taxpayers for their patriotism in dutifully remitting their taxes in the financial year 2022/2023," the authority said.

This annual observance will also feature a multitude of customer-centric activities, including taxpayer appreciation visits, taxpayer education, the Annual Tax Summit, and Corporate Social Responsibility (CSR) initiatives.

"The event celebrated throughout the month of October, will be marked by customer-centric activities countrywide including taxpayer appreciation visits, taxpayer education, Annual Tax Summit and Corporate Social Responsibility (CSR) activities," the authority said.

It marks a significant departure from tradition as the online auction, previously a physical event held exclusively in Nairobi and Mombasa, is now made accessible to taxpayers across the entire country.

In an eloquent expression of gratitude towards the taxpayers, KRA extends an invitation to all to seize the opportunity presented by the Tax Amnesty.

This act of goodwill, enshrined in the Finance Act 2023, takes into account all taxpayers facing penalties and interests accrued as of December 31, 2022.

From September 1, 2023, to June 2024, taxpayers are permitted to settle their principal tax obligations, with the entirety of penalties and interests being graciously waived.

"In the spirit of giving back to taxpayers, KRA is also calling on taxpayers to take advantage of the Tax Amnesty, introduced through the Finance Act 2023," the statement read.

"The amnesty factors in all taxpayers with penalties and interests accrued as at December 31st 2022. Taxpayers are from September 1, 2023 to June 2024 allowed to settle the principal tax and all their penalties and interests will be waivered."

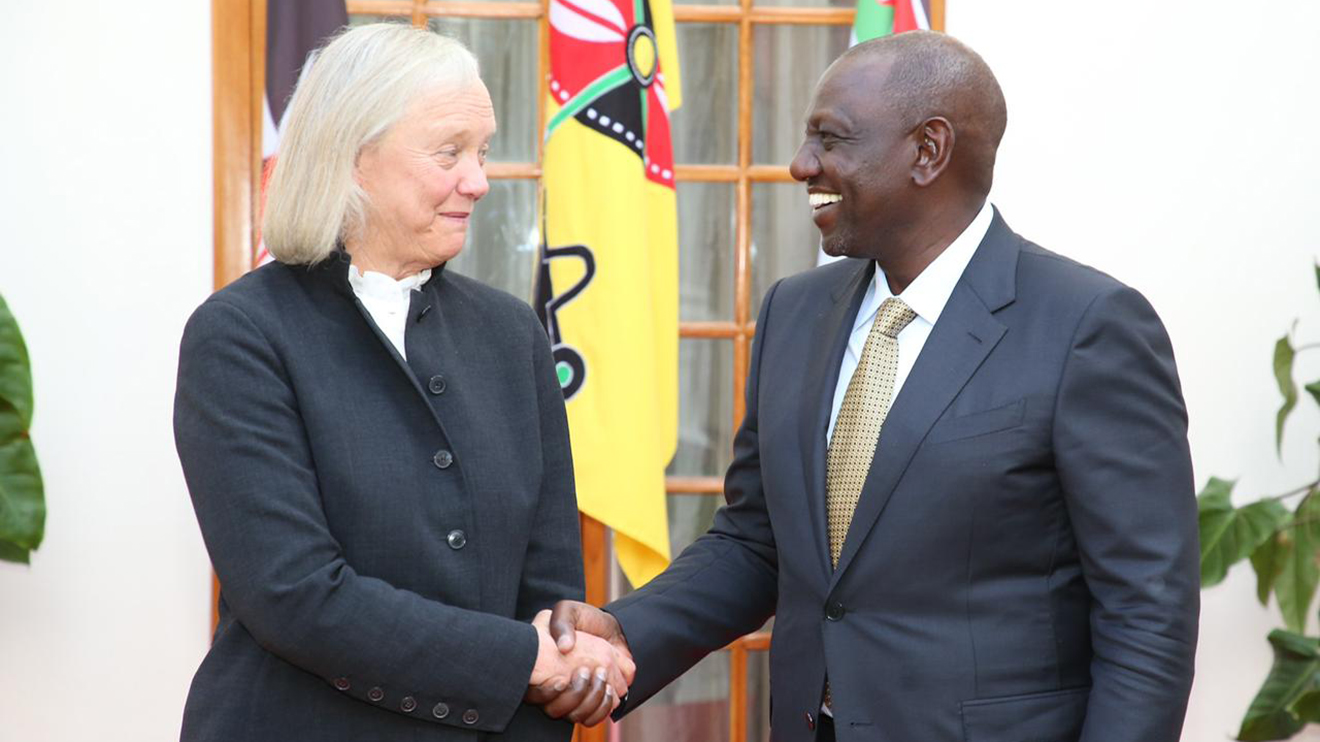

The zenith of the 2023 Taxpayer’s Month celebration will culminate in a prestigious award ceremony, which will be graced by President William Ruto.

This ceremony will be dedicated to the recognition and honouring of distinguished taxpayers who have demonstrated unwavering commitment to tax compliance during the year 2022.

Beyond the realm of accolades, the Taxpayer’s Month serves a more profound purpose. It stands as a veritable platform for exhorting citizens to adhere to their tax obligations, thereby contributing to the national budget and fortifying the pillars of the nation's economy.

According to the KRA, this year, under the overarching theme of "Tunawiri," which translates to "let us prosper," the authority seeks to rally all Kenyan citizens towards the shared goal of fostering the prosperity of Kenya through the conscientious payment of taxes.

The grand inauguration of the Annual Taxpayer’s Month, scheduled for October 2, 2023, will be officiated by the distinguished Cabinet Secretary for National Treasury & Economic Planning, Prof. Njuguna Ndung’u.

Accompanying him will be KRA's esteemed Board Chairman, Anthony Mwaura, and the Commissioner General of KRA, Humphrey Wattanga.

The guest list will include prominent figures from both the private and public sectors.

KRA extends a warm invitation to all taxpayers, urging them to actively engage in the events of the Taxpayer’s Month.

Through their participation, they will have a unique opportunity to provide feedback on various tax-related issues, facilitating the Authority in its continuous endeavour to enhance service delivery and create a more conducive environment for voluntary tax compliance.

In this spirit, KRA invokes the sense of patriotism in the hearts of all citizens, urging them to participate in the Taxpayer’s Month activities, thus contributing to the well-being of the nation and its people.

-1731665904.jpg)

-1731583283.jpg)

-1731566290.jpg)

-1731675695.jpg)