The Kenya Revenue Authority (KRA) has made modifications to its automated tax payment system, iTax, allowing for the collection of the contentious housing tax even before the Finance Bill is passed by Parliament.

This move has sparked concerns among workers and employers alike, as it further burdens employed Kenyans already struggling with the rising cost of living and stagnant salaries.

The modification entails adapting the P10 Form, typically used for monthly PAYE (Pay-as-You-Earn) filings, to facilitate the collection of the housing tax.

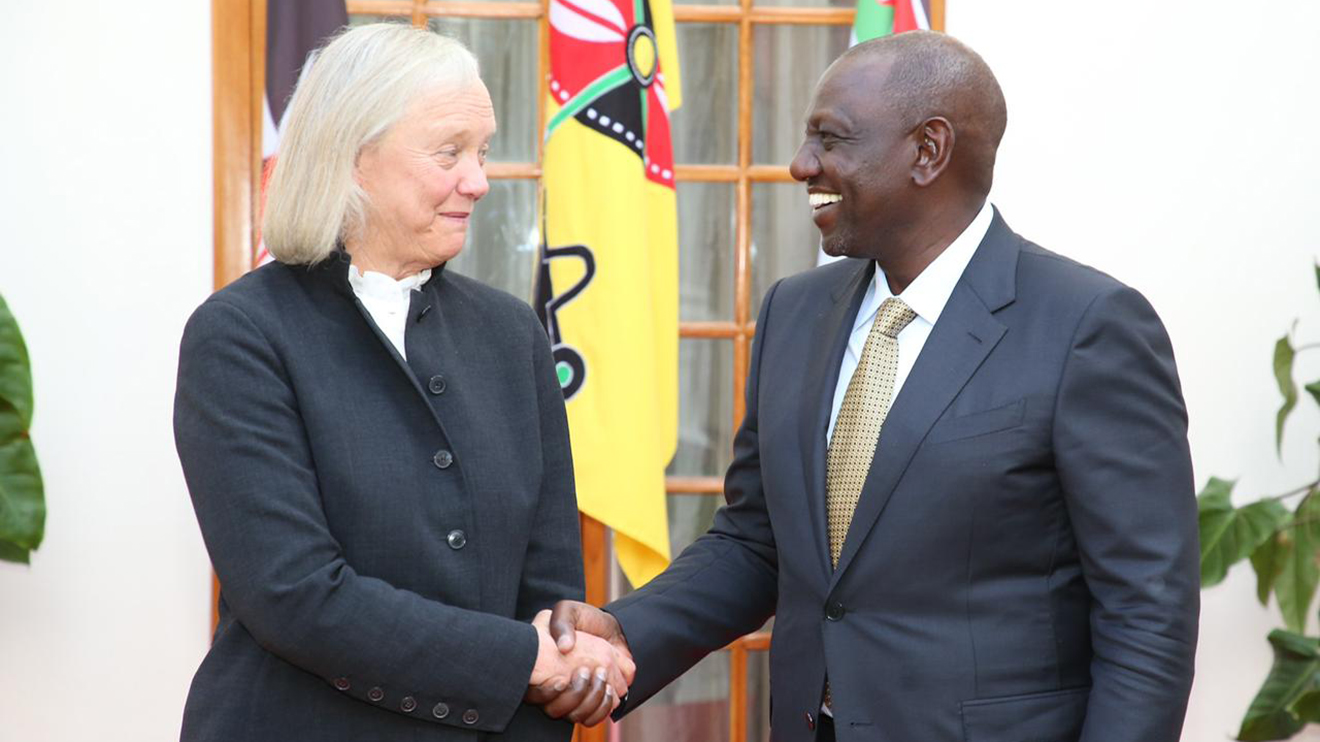

If President William Ruto assents to the Finance Bill, and the tax is approved in its third reading, employers will begin deducting and remitting the tax starting from July 1, 2023.

Nairobi-based tax expert Nikhil Hira acknowledges that the taxman's actions reflect a proactive approach to initiating tax collection, despite the unpopularity of the housing tax among workers and employers.

Read More

"KRA has been slow in changing the iTax, and this time around, they simply want to be proactive," Nikhil remarked.

"Remember the tax will still go through the third reading, and they are simply preparing grounds as they await to start receiving it."

The proposed statutory deduction amplifies the tax burden on employed Kenyans, who are already grappling with the soaring cost of living and a freeze on salary increases.

Furthermore, employers will be compelled to contribute to the fund, adding to the overall cost of doing business in the country.

Initially introduced during President Uhuru Kenyatta's second term, the policy faced rejection before resurfacing under Ruto.

It involves deducting 1.5 per cent from employees' basic pay, a reduced rate from the initial 3.0 per cent, to finance Ruto's ambitious plan to construct affordable housing.

The tax will now be collected by KRA alongside other levies, serving as a compromise by the parliamentary committee to appease taxpayers.

As the controversial housing tax awaits its final legislative approval, its imminent impact on workers and employers remains a matter of concern.

The tax's introduction reflects the government's commitment to its low-cost housing initiative, yet the public is apprehensive about the additional financial strain it may impose on already stretched household budgets.

-1731665904.jpg)

-1731583283.jpg)

-1731566290.jpg)

-1731675695.jpg)