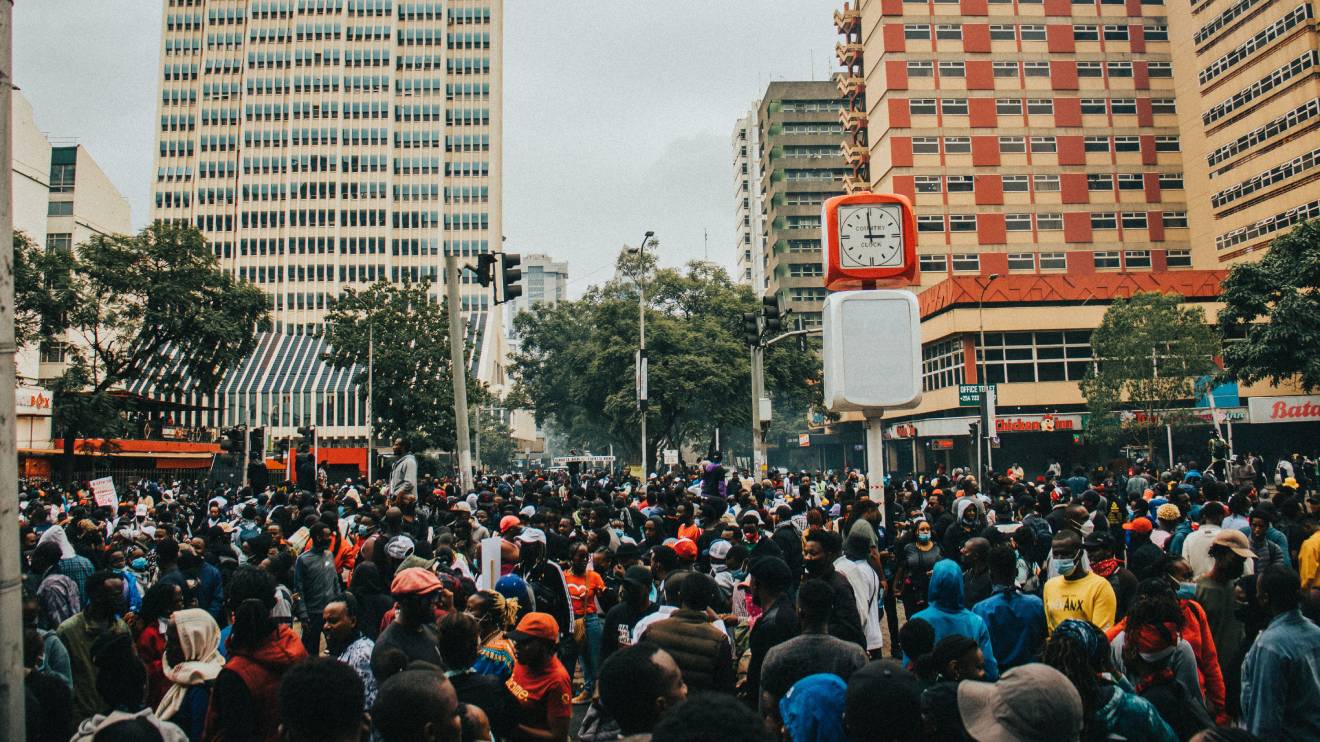

Despite the fact that a modern smartphone was introduced roughly a decade ago, in the last two years there has been a surge in the number of smartphone users in Kenya.

Indeed, due to smartphone penetration, we have witnessed the rise of Kenyan fintech: the increased number of borrowers ended up in numerous applications for financial services obtaining.

However, in many financial institutions, micro-lending companies as well as companies, which are not related to the financial sector, a significant part of the business is offline.

The fact that an abundance of classical offline market players in Kenya has gained access to digital licenses recently leads to the problem of estimation of such potential customers - lack of data, “thin” customer credit profile, etc.

Mikhail Marchenko, Co-Founder of JuicyScore company, the global leader in risk management and antifraud, shares his knowledge about new technologies, which make it possible to conduct a risk assessment through the device - a new offline to online transition tool, which helps to assess the risk of an offline applicant and build applicant’s digital profile without significantly affecting the conversion rate.

Read More

The opportunities that give our new JS App application to offline businesses are quite astonishing. It was designed as New Device Risk Analytics technologies - with this application we can provide any offline business with customer device scoring, including customer assessment supplement via conventional offline sources.

The product will also be helpful for companies that do not have their own IT infrastructure, as well as for businesses creating an MVP and would like to save money on launching it.

What industries JS App - Device Risk Analytics is designed for and in what cases is it applicable?

The solution may be effectively used in any business with offline offices, branches, or stores and where potential customer underwriting or risk assessment is required.

The product will help greatly to those offline businesses, which have problems related to risk assessment of customers with so-called “thin” credit history, for example, young people, retired people, and residents of remote settlements (especially it will be of great use for Kenya - about 70 percent of country’s population live in a rural area).

Let’s imagine a situation where a person enters the bank or micro lender’s office, which is located not far from home or office to open an account, a card or to get a loan.

We can’t help but agree that this is rather a usual scenario because many people are comfortable talking to a real person, who can help to solve all the issues at once (such situation also may occur, speaking about certain categories of borrowers, for example, elder people).

Another example refers to the point of sale, where a consumer purchases and pays for goods and services or any offline store, telecom, or electronics store.

Such people initially do not have the goal of obtaining a financial product but may decide to buy something if a POS loan, credit card, or any BNPL product is available.

This also may be a person who wants to buy a car or get an insurance certificate.

In all the above use cases, the service provider collects a potential customer's data, and does verification and underwriting, using device risk assessment only as a part of the verification process. But we believe that device data and a strong digital profile can play a more important role and give much more value in a decision-making process.

Moreover, non-personal data will never lead to the problems connected to data breaches - such data is simply of no use to any fraudster, but can improve the decision-making model significantly.

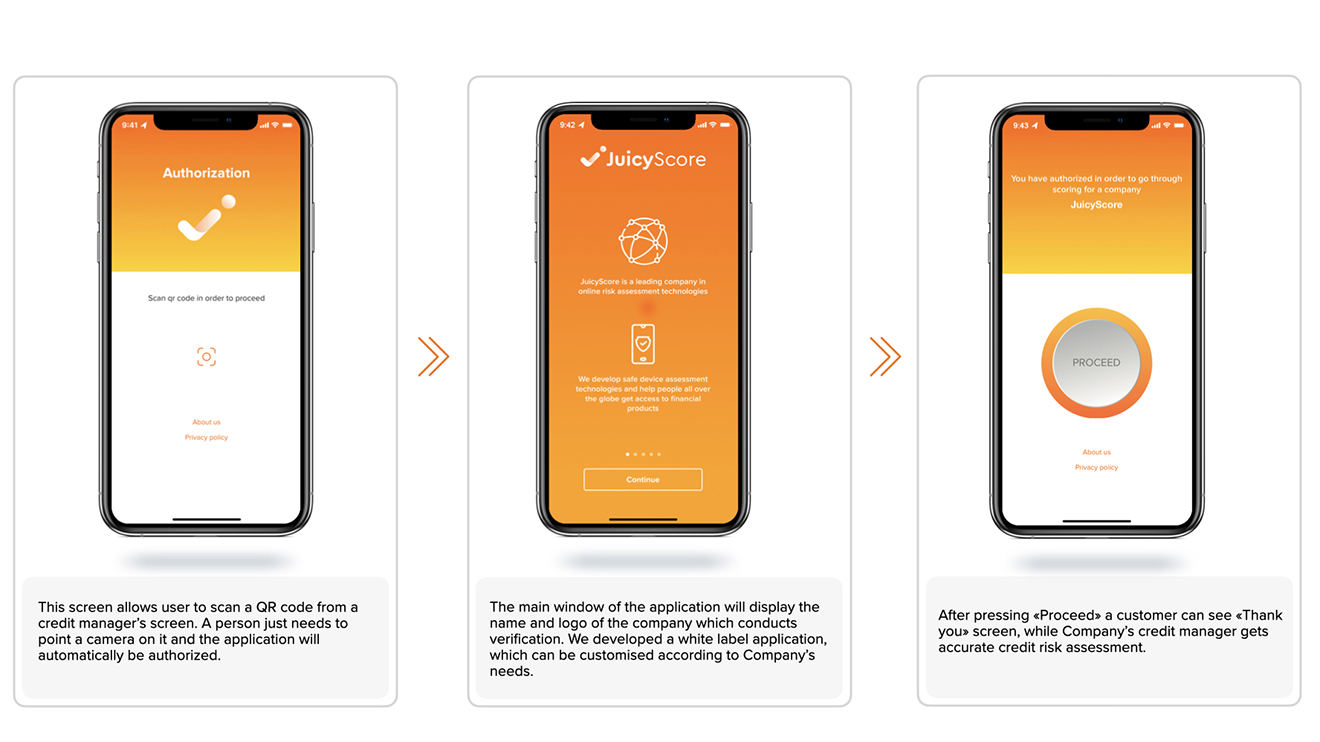

In order to start a borrower should download our application either from Apple Store or Google Play - it is available for iOS and Android (soon will be available on Huawei AppGallery).

When the application is downloaded a client is able to become familiar with the security and data processing policy, grant access to the camera (only when using an app) in order to scan a QR code, and grant access to geolocation.

At the same time, a client can see the logo of the financial company where he is applying for a financial service since the JS App - Device Risk Analytics is a white label (some sort of partnership when a company can provide a service to its customers on behalf of its brand using its partner company's product).

Device risk assessment is seamless for the client (the process takes no more than 30 seconds), practically does not affect the conversion and at the same time significantly improves the quality of the decision made on the side of the financial institution.

Moreover, while most similar solutions use personal data, our JS App - Device Risk Analytics solution does not request access to personal data, passports, or other identity documents.

Offline business can significantly improve its risk assessment models, especially if it is relevant for Kenya since there is a lack of data because the CBK stopped credit-only institution from sharing data with CRB until they receive approval or a license from CBK.

Also, the scope of data sent to CRB is limited for example they do not receive data on income or financial statements.

So, with JS App - Device Risk Analytic*s* it becomes much easier to build a complete digital profile for each client, and not just for those who come to the online channel.

Another opportunity for an offline business is the ability to set up communication with customers more accurately by analyzing those who have previously visited the site, and linking the entire set of devices to each client profile.

Also, there is no need to create your own infrastructure for device evaluation and fingerprinting - JuicyScore provides a turnkey solution + support, and regular (monthly) product updates.

Using this brand-new technology offline businesses get a ready-made module for generating a QR code and viewing the results - the QR code will be tied to a specific financial institution and a specific client application.

Mikhail Marchenko is the Co-Founder of JuicyScore

-1717684065.jpeg)