Kenyan cybersecurity solutions distributor Kristel Communication has partnered with German network monitoring software firm Paessler in a move meant to avail networking monitoring software Paessler Router Traffic Grapher (PRTG).

PRTG, which eyes start-ups and SMEs, enables companies to monitor all their systems, devices, traffic, and other applications in their infrastructure while offering real-time alerts.

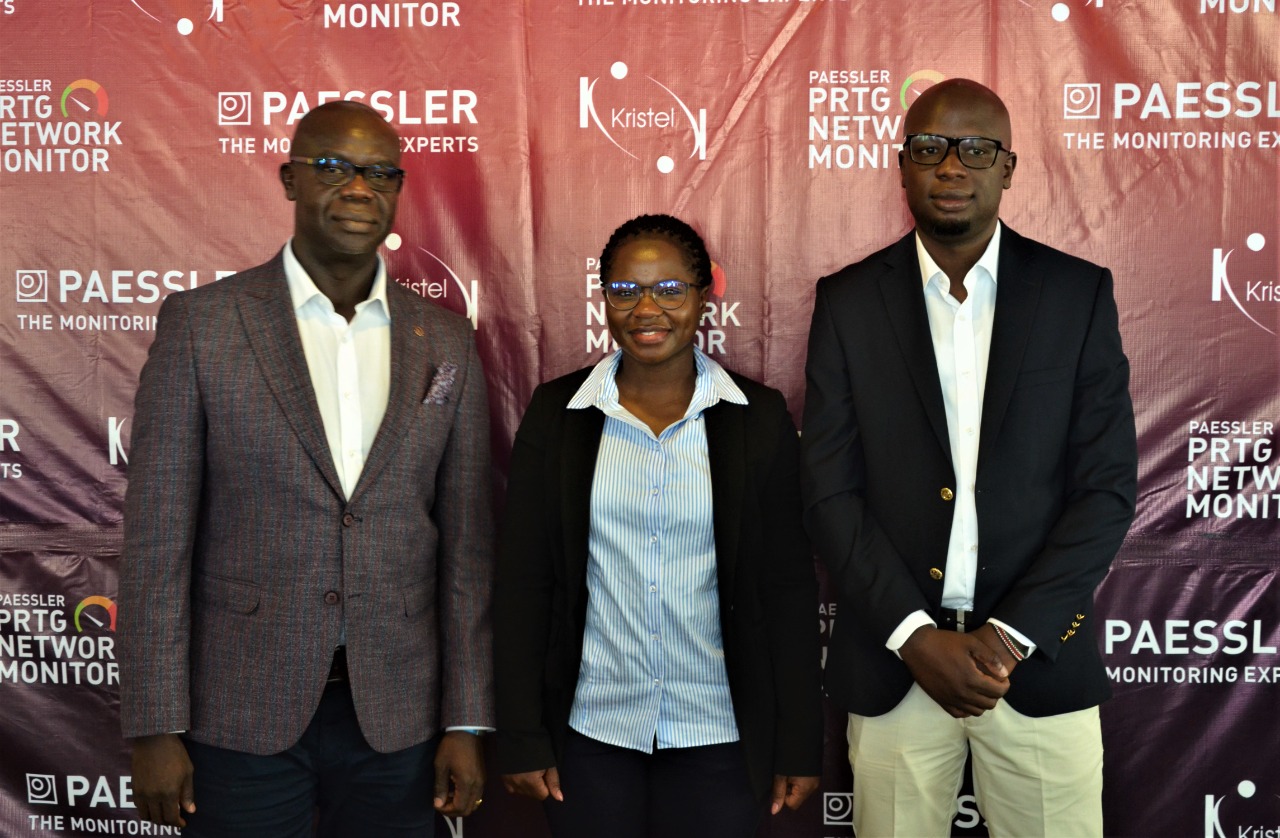

Speaking at the launch of the product in East Africa, Kristen Communication CEO Ben Obinju said the pact is timely as Kenya and the region faces increased cyber security threats targeting businesses.

“As a cybersecurity company, we have been working to ensure all our clients are cyber resilient by helping them mitigate the day-to-day risks that originate from cyber threats. Other than offering strategic advice to our clients we, therefore, deliver strategic solutions to such threats through products such as PRTG which we are launching today,” Obinju said.

According to Paessler, the availability of software in the market will enable local companies to optimize their infrastructure use by enabling systems managers better monitor all their processes.

“Many organizations in the region have their IT faculties monitoring the functionalities of the various tools in their infrastructure which is not their role. PRTG will therefore enable organizations to optimize their It department focus on their roles through a powerful and flexible platform,” said Irene Gorrissen, Business Development and Technical Sales Manager for Africa.

Kristen added that the deployment of the software product was timely, coming at a period after the Covid-19 pandemic when most companies have automated their operations.

“We would like to see the change of the wait-and-see a scenario where IT practitioners would wait for some downtime to be alerted of any problems in the system by organizations automating their monitoring techniques,” said Kristel Chief Operations Officer Simon Otieno.

Players who have already adopted the product include banks, SACCOs and deposit-taking microfinance institutions, mainly those operating mobile applications to extend services.

-1753785125.jpeg)