More Kenyans have enrolled on the country’s most popular telco Safaricom’s overdraft service Fuliza with over 1 million individuals signing up for the service over the past 12 months.

In a statement released on Thursday by Safaricom, the value of disbursements via the service has risen up from Sh351.2 billion that was disbursed in the previous year to Sh502.6 billion in the financial year that ended March 2022.

According to Safaricom, the most recent overdrafts translate to SH9.7 billion per week of borrowing between the month of April 2021 and March 2022, which represents a 43.1 per cent increase in comparison to the preceding period of 2020/2021 Sh6.75.

The period under review also recorded an additional 1 million clients enrol for the service and pushed the total number of daily active Fuliza users to 6.9 million.

Read More

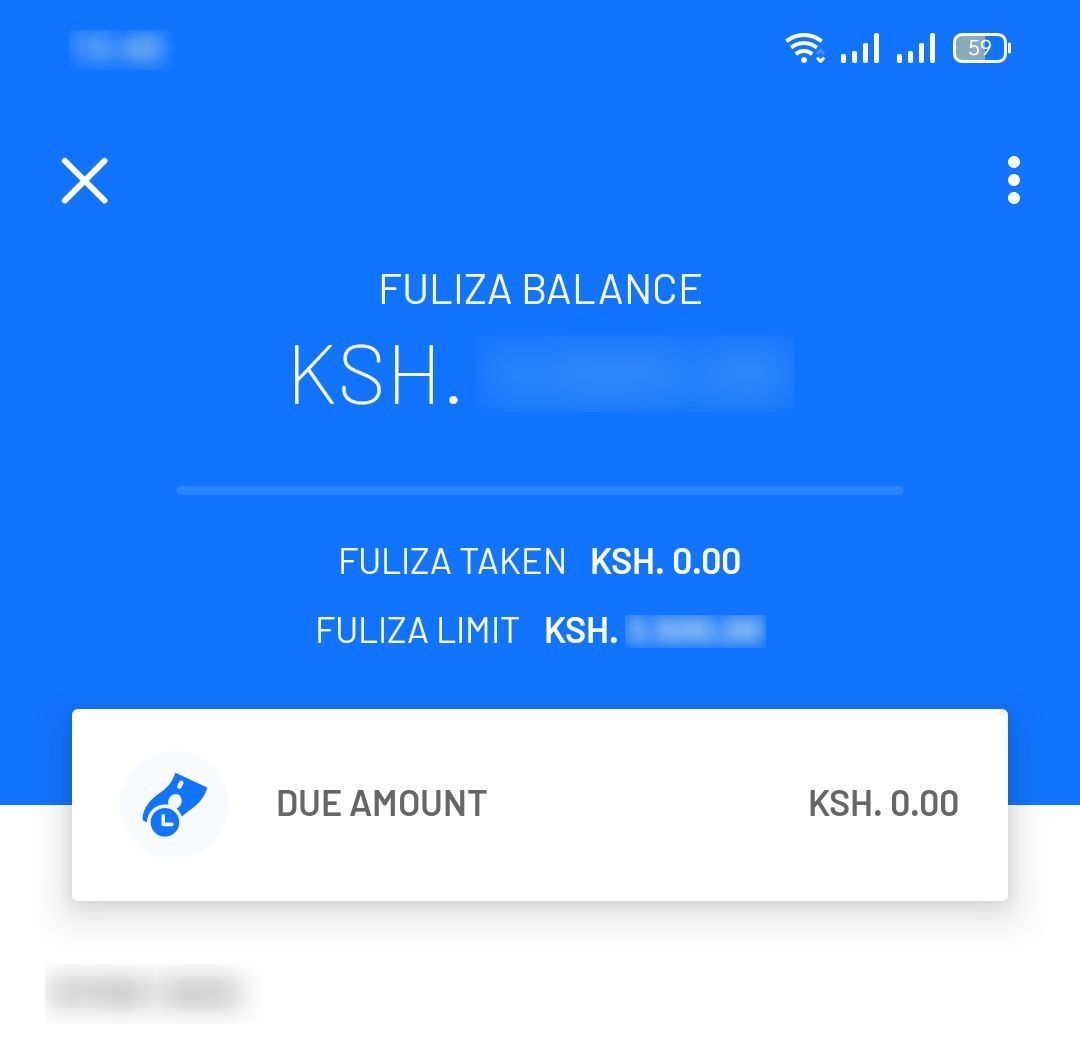

Safaricom also revealed the average ticket size currently stands at Sh345.2 however, the per person borrowing could be higher now that customers are able to make several overdrafts before repaying which is subject to the approved overdraw limit.

Fuliza has grown exponentially edging out other Safaricom-linked mobile loan products such as KCB MPESA and Mshuari.

This is occasioned by the subscribers’ urgency to meet their essential needs such as food, rent or transport because of the rise in the cost of living. Fuliza eased terms have also contributed to the mass exodus to the service.

KCB MPESA loans value took a 9.4 per cent fall to Sh46.3 billion besides its user base growing by 500,000 to hit the 3.8 million mark.

Likewise, Mshwari loans dropped by 8.9 per cent to Sh86.1 billion even as the number of users increased by 700,000.

The telco earned Sh8.54 billion as revenue from the three products with that of Fuliza being Sh5.94 billion signifying a 31 per cent leap in disbursements from the service from Sh4.5 billion.

(1)-1730745141.jpg)

-1730399993.jpg)