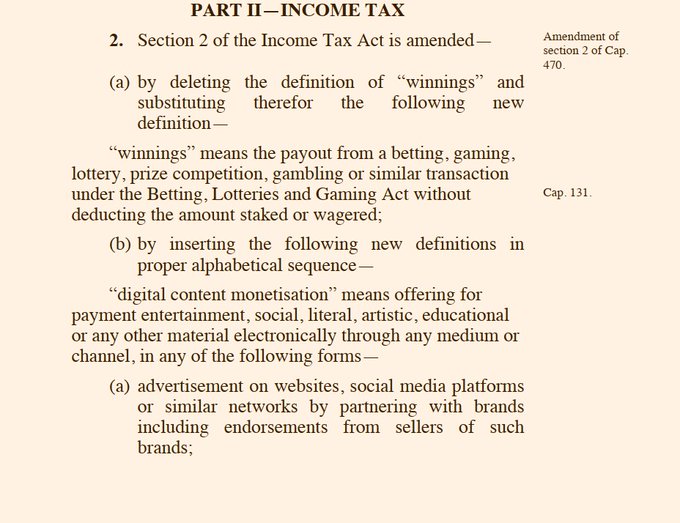

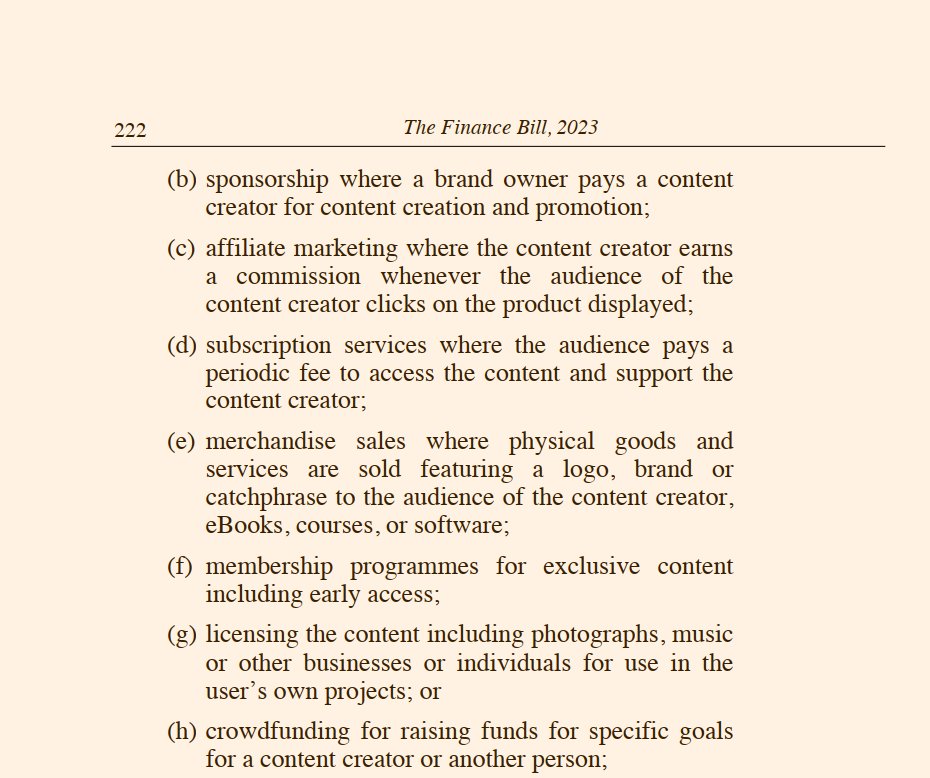

President William Ruto is set to unleash a tax shocker for digital content creators in Kenya, if the proposals by the National Treasury contained in the Finance Bill 2023 are adopted as is.

The raft of measures contained in the Finance Bill 2023 tabled in Parliament proposes various taxes that will reduce the take-home by content creators and digital publishers.

The Bill proposes a 15 per cent Withholding Tax on disbursements from monetisation of content, a move bound to affect many content creators eking a living from digital platforms.

On receiving monies from the monetization on digital platforms, a content creator is expected to remit 15 per cent of their earning to Kenya Revenue Authority within 24 hours.

“A person who is required to deduct the digital asset tax shall, within twenty-four hours after making the deduction, remit the amount so deducted to the Commissioner together with a return of the amount of the payment, the amount of tax deducted, and such other information as the Commissioner may require,” proposes the Bill.

Read More

If MPs adopt the Finance Bill 2023, earnings of thousands of young digital content creators will be adversely affected coming as the digital space has offered a source of living for many unemployed Kenyans.

This comes only months after the top tech companies in the world started applying the standard 16 per cent VAT for any online service offered following the introduction of the Value Added Tax (Digital Marketplace Supply) (Amendment) Regulations, 2022.

-1756110371.jpeg)

-1749231819.jpg)

-1741732649.jpg)

-1756917651.jpg)