In a renewed effort to plug the revenue gaps left by the repealed Finance Bill 2024, the government is set to reintroduce eight notable tax measures that had previously ignited widespread public backlash.

Presented through three new proposals—the Tax Laws (Amendment) Bill 2024, Tax Procedures (Amendment) Bill 2024, and Public Finance Management (Amendment) Bill 2024—the measures aim to broaden Kenya’s tax base and address the pressing Sh346 billion fiscal deficit.

This time around, the Treasury is taking a more open approach by releasing a two-page explanation in local newspapers, aiming to clarify the intentions behind each proposal.

Expanding the Digital Tax Net

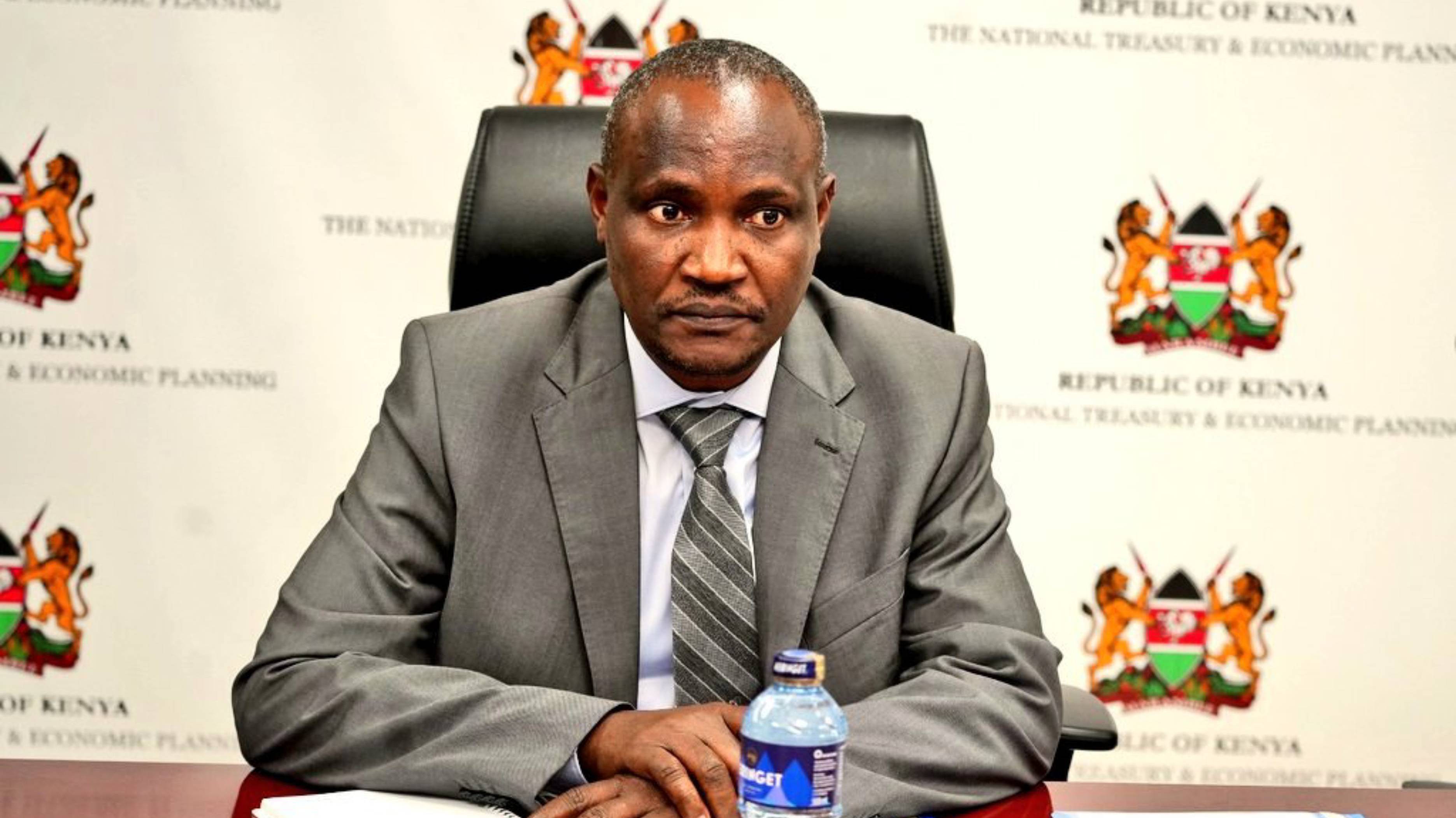

Treasury Cabinet Secretary John Mbadi is hopeful that these adjustments will help stabilise Kenya’s economy, framing the reintroduced measures as an essential step in promoting economic growth.

Read More

Among the prominent features is a push to tap into Kenya’s thriving digital marketplace, expanding tax obligations to include popular digital services.

Income from ride-hailing, food delivery, freelance, and rental services will now be subject to taxation—a move, according to the Treasury, meant to capture a portion of the booming online economy.

“This proposal is to expand the tax base by bringing the income of the owners of the digital platforms that offer the above services into the tax net,” the bill reads in part.

Minimum Top-Up Tax for Multinationals

Notably, the amendments propose a Minimum Top-Up Tax that would require multinational corporations with an annual global turnover exceeding Sh100 billion to pay a minimum tax rate of 15 per cent on their Kenyan operations.

For those working locally, the cap on tax-exempt pension contributions is set to rise to Sh30,000 monthly, enhancing retirement savings for Kenyan employees while incentivising employers to contribute more towards workers’ pensions.

Withholding Tax on Public Entity Supplies

For businesses supplying goods to government offices, the proposed withholding tax brings a new requirement: suppliers will be subject to a 0.5 per cent tax for residents and a 5 per cent rate for non-residents.

For example, if a resident sells goods valued at Sh100,000 to a public entity, they would remit Sh500 in taxes; a non-resident selling the same amount would face a Sh5,000 tax.

The Treasury’s recalibrated withholding rates aim to create a balance that will, it believes, be fairer than those in the Finance Bill 2024.

Economic Presence Tax for Digital Giants

On the digital front, Kenya is also moving to capture revenue from global online giants. The amended bill proposes the Economic Presence Tax, a 6 per cent levy on revenue generated by non-resident entities that profit from Kenya’s digital market.

This tax would replace the previous Digital Service Tax rate of 1.5 per cent, aligning Kenya with international standards.

CS Mbadi stated that the taxation of digital services will align with international best practices indicating the government’s strategy to adapt its tax regime to reflect global norms in a rapidly evolving digital economy.

Taxation of Infrastructure Bonds

Interest accrued from infrastructure bonds—long prized for their tax-free appeal—will now face a 5 per cent tax for local investors, though the exemption remains for foreign investors to maintain their interest in Kenyan infrastructure projects.

This change, Treasury suggests, could increase public participation in essential development initiatives by attracting a broader pool of investors.

Remote Workers’ Compliance with (Kenya Revenue Authority) KRA

For Kenyans in the remote work sphere, the tax net is set to widen: all Kenyan employees working remotely for local employers must now possess a (Kenya Revenue Authority) KRA PIN.

This measure is aimed at addressing the growing trend of remote employment arrangements, ensuring tax compliance across borders and reducing the potential for revenue leakage.

Tax Relief for Affordable Housing and SHIF Contributions

On a more positive note, contributors to the Affordable Housing Levy and the Social Health Insurance Fund (SHIF) may now receive tax relief on their contributions.

Should Parliament approve the amendments, these payments would become deductible from taxable income, softening the financial impact on individuals while advancing national health and housing priorities.

These proposed measures, bundled together for Parliamentary review, underscore the government’s attempt to recover lost revenues and reshape its tax policies without the shockwaves that accompanied the earlier Finance Bill.

Nonetheless, as these tax demands are reintroduced amid economic hardships, the public may remain cautious, questioning whether the long-term benefits justify the immediate financial strain.

(1)-1730745141.jpg)