Kenya, a nation synonymous with mobile money innovation, might be witnessing a shift in consumer habits.

The recent National Economic Survey 2024 painted a concerning picture: a decline of 600,000 mobile money subscribers in 2023, bringing the total down to 38 million from 38.6 million.

This translates to a 1.55 per cent decrease, marking a significant change in mobile money usage patterns.

Interestingly, despite the subscriber drop, the total value of mobile money transfers actually flourished.

The Kenya National Bureau of Statistics (KNBS) reported a robust 19.6 per cent growth in mobile money transferred between subscribers, reaching Sh5.5 trillion in 2023.

Read More

This suggests Kenyans might be consolidating their accounts and utilizing them for larger transactions, potentially in response to the anticipated rise in fees.

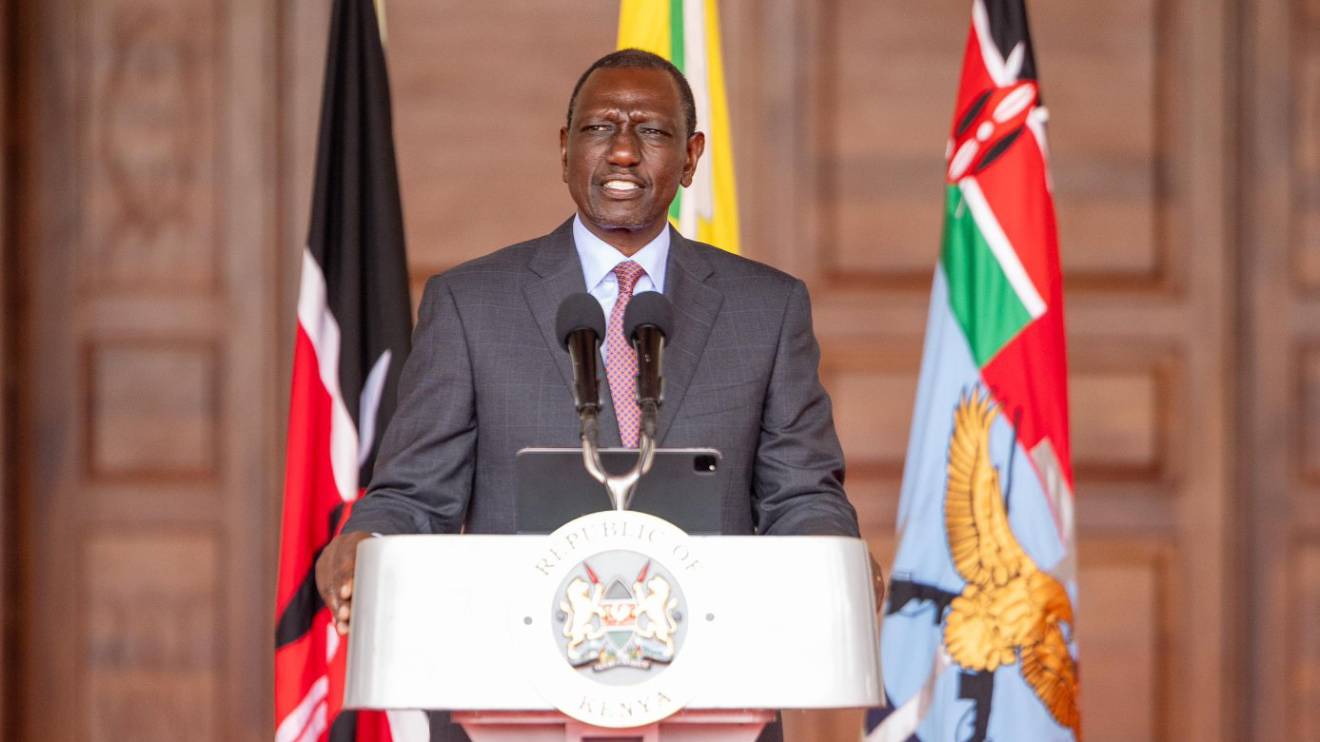

The timing of this trend coincides with the introduction of the 2024 Finance Bill, which proposes a 20% tax hike on mobile airtime, data, and crucially, money transfer fees.

This move by the government aims to raise an additional Sh323 billion.

With telecommunication companies (telcos) bearing the brunt of this increased tax burden, they are likely to pass on these costs to consumers through higher service charges.

A report by the Communications Authority seems to corroborate this, stating, "As of 30th December 2023, mobile money subscriptions dropped to stand at 38 million," attributing the decline to a decrease in overall mobile phone subscriptions.

Kenya, a global leader in mobile money adoption with prominent providers like M-Pesa, Airtel Money, and Telkom Cash, has long been lauded for its convenient and cost-effective financial services.

However, the looming tax hike casts a long shadow over the future of this ubiquitous tool.

As Kenyans brace themselves for potentially higher charges, a question hangs in the air: will the mobile money revolution continue its remarkable progress, or will it face a slowdown?

Only time will tell how Kenyans adapt to the changing landscape.

They might seek out alternative money transfer services, reduce their mobile money usage altogether, or simply absorb the increased costs.

The coming months will be crucial in determining the fate of Kenya's mobile money dominance.

-1722005910.jpg)

(1)-1721988953.jpg)

-1721993827.jpg)