Consolidated Bank has achieved a financial comeback with a net profit of Sh21.6 million for the six months ending 30 June 2025, reversing years of losses and signalling recovery under its ongoing turnaround efforts.

This improvement follows a Sh76.8 million loss reported during the same period last year and comes as part of a broader strategy aimed at expanding the Bank’s balance sheet and diversifying income sources.

The lender also posted a total comprehensive income of Sh12 million, compared to a Sh84.9 million deficit recorded in the first half of 2024.

Total assets surged by 19 per cent year-on-year, climbing to Sh18.4 billion from Sh15.5 billion.

Over the same period, customer deposits grew by 8 per cent to reach Sh12 billion, enabling the Bank to keep a liquidity ratio above 30 per cent, well above the required 20 per cent statutory minimum.

Read More

Net interest income rose by 21 per cent, reaching Sh551 million, up from Sh455 million in the previous year.

However, non-interest income slightly dipped, sliding from Sh315 million to Sh282 million over the six-month period.

Operating costs fell to Sh812 million, representing a 4 per cent reduction from last year’s Sh848 million.

This decline has been attributed to internal efficiency measures, cost controls, and strategic reforms.

However, loan loss provisions saw a marginal increase of 3 per cent, rising from Sh157 million to Sh162 million.

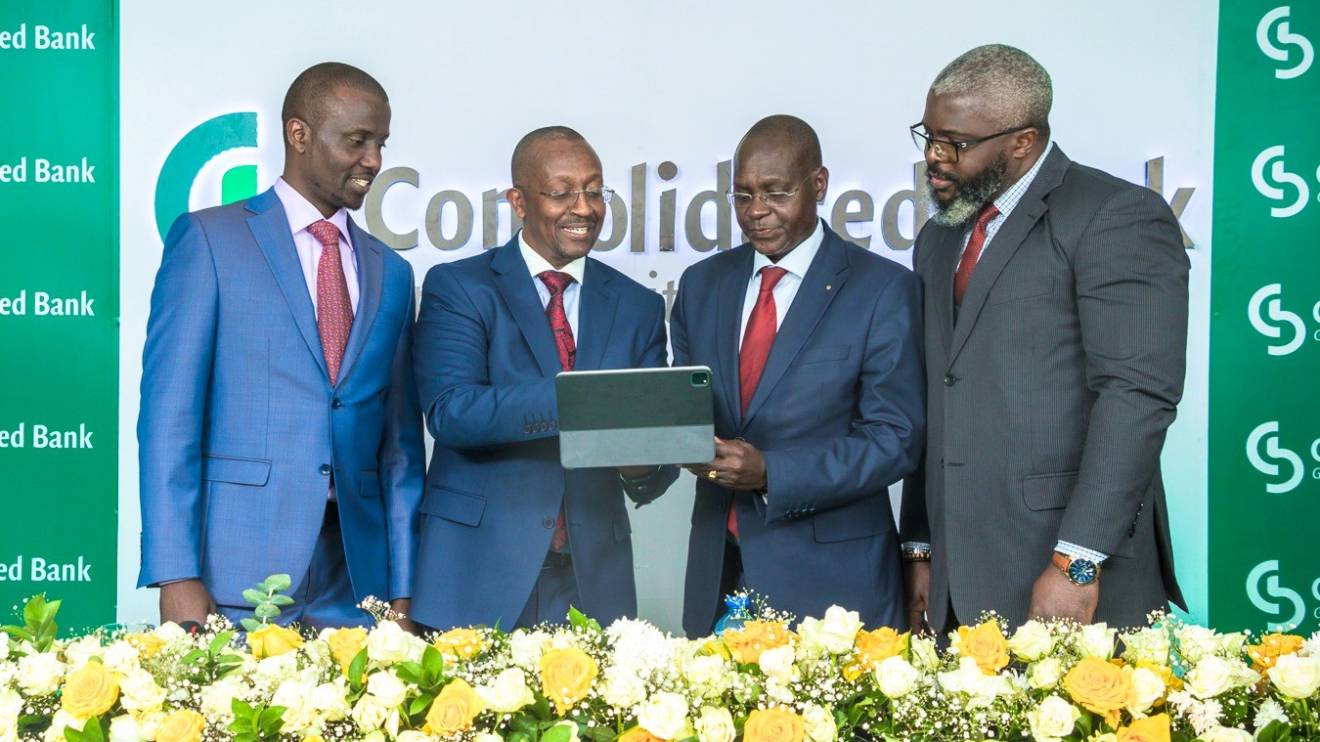

Reflecting on the financial results, Consolidated Bank’s Chief Executive Officer, Sam Muturi, noted that recent changes are beginning to deliver tangible outcomes.

“The Bank’s growth outlook is positive and is gearing up for accelerated growth through improved digital service delivery channels as well as innovative products to serve our customers, especially in the SME and MSME sectors,” Muturi said.

The results mark a notable shift for the Bank, which has spent the past several years in a restructuring phase. Its renewed emphasis on cost efficiency, digital innovation, and SME lending suggests a deliberate pivot towards long-term sustainability.

Whether this momentum carries through to year-end will be watched closely by the market and its stakeholders.