Kenya’s fuel industry continues to be dominated by just three companies, even though there are 144 oil marketing companies (OMCs) registered in the country.

According to data from the Energy and Petroleum Regulatory Authority (EPRA), Vivo Energy Kenya, Rubis Energy Kenya, and TotalEnergies Marketing Kenya controlled a combined market share of 51.83 per cent by the end of December 2024.

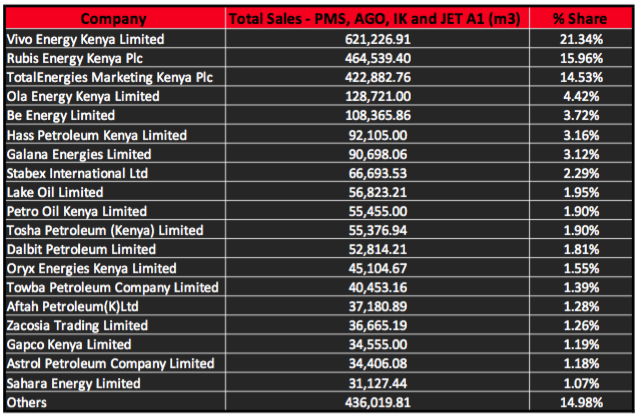

Vivo Energy had the largest share, selling 621,226.91 cubic metres of petrol, diesel, kerosene, and jet fuel, which gave it 21.34 per cent of the market. Rubis Energy followed with 15.96 per cent, and TotalEnergies held 14.53 per cent.

Many of the other registered companies had a much smaller presence. Ola Energy held just 4.42 per cent of the market, Be Energy had 3.72 per cent, Hass Petroleum stood at 3.08 per cent, and Galana Energies had 3.04 per cent.

Companies like Stabex, Lake Oil, Petro Oil Kenya, and Dalbit Petroleum each had less than 2 per cent market share.

Read More

In fact, all other companies outside the top 19 players only accounted for 14.98 per cent of total fuel sales.

To show how the market is shared among the players, EPRA provided a breakdown of sales volumes and market share for each of the major oil marketing companies.

The table below presents the market share for Premium Motor Spirit (petrol), Automotive Gas Oil (diesel), Illuminating Kerosene, and Jet A1 as recorded in December 2024.

EPRA used the Herfindahl–Hirschman Index (HHI) to measure how competitive the fuel market is.

It reported that “the Herfindahl–Hirschman Index (HHI) for the downstream petroleum subsector in 2024 was 0.1050 which was slightly above the Authority’s benchmark of 0.1. This is an indicator of competition in the sector since none of the OMCs have significant market dominance.”

But even though no single company holds an extreme share on its own, the fact that just three firms supply more than half the fuel in Kenya raises concerns.

Many smaller companies are struggling to grow, and consumers end up with fewer choices when it comes to pricing and services.

With the fuel sector opened up for private businesses, the hope was that more players would enter and offer better services or lower prices.

However, the latest numbers suggest that a few companies still control most of the market, and the rest are left to compete over what little is left.

If nothing changes, the risk is that fuel prices and supply could continue to be influenced by a handful of major players—making it harder for smaller firms to grow and for Kenyans to benefit from true market competition.