Lipa Later, the buy-now-pay-later (BNPL) startup company which operates in Kenya, Uganda, Rwanda and Nigeria has now been out placed under administration.

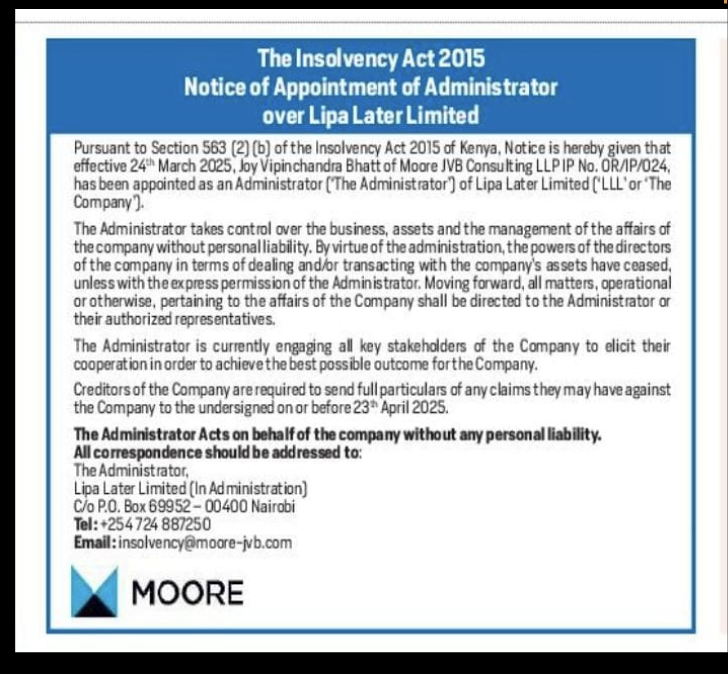

Joy Vipinchandra Bhatt of the Moore JVB Consulting has now been appointed the administrator of Lipa Later Limited, which provides digital credit to consumers.

A notice published by Moore JVB announced that Bhatt had assumed control of the firm’s business, assets, and management affairs from March 24, 2025.

According to the published notice, all matters related to the troubled hire purchase service provider must henceforth be directed to Bhatt or any of its authorized representatives.

The notice further clarified that directors of Lipa Later will no longer be permitted to transact or deal with the firm’s assets without the explicit approval of the administrator.

Read More

“Pursuant to Section 563 (2) (b) of the Insolvency Act 2015 of Kenya, notice is hereby given that effective 24th March 2025, Joy Vipinchandra Bhatt of Moore JVB Consulting LLP has been appointed as an Administrator (‘The Administrator’) of Lipa Later Limited (‘The Company’),” read the notice.

Creditors have been directed to submit full particulars of their claims against Lipa Later by April 23, 2025 even as Bhatt held consultations with stakeholders for a smooth transition.

This comes barely three months after Lipa Later obtained Sh1.36 billion in debt and equity financing from a group of investors to aid their expansion plans into new markets in Africa.

The startup fintech, which was founded in 2018, provides hire purchase services, which involves paying retailers upfront and then collecting installment payments from the buyers.

Lipa Later, founded by Eric Muli and Michael Maina, leverages data analytics to provide consumers with access to credit through proprietary credit-scoring and machine learning.

-1753785125.jpeg)