A new era of fiscal accountability is dawning for Kenya’s State corporations as the government tightens its grip on public finances.

Chief Executives of these entities are now facing unprecedented pressure to deliver substantial dividends to the national coffers.

The Performance Contracting Guidelines for the 2024/25 financial year, unveiled last Friday, have introduced stringent measures for the management of State-owned enterprises (SOEs), aligning them with President William Ruto’s push for financial prudence.

A key provision of the guidelines mandates commercial SOEs to remit 80 per cent of their post-tax profits to the Exchequer.

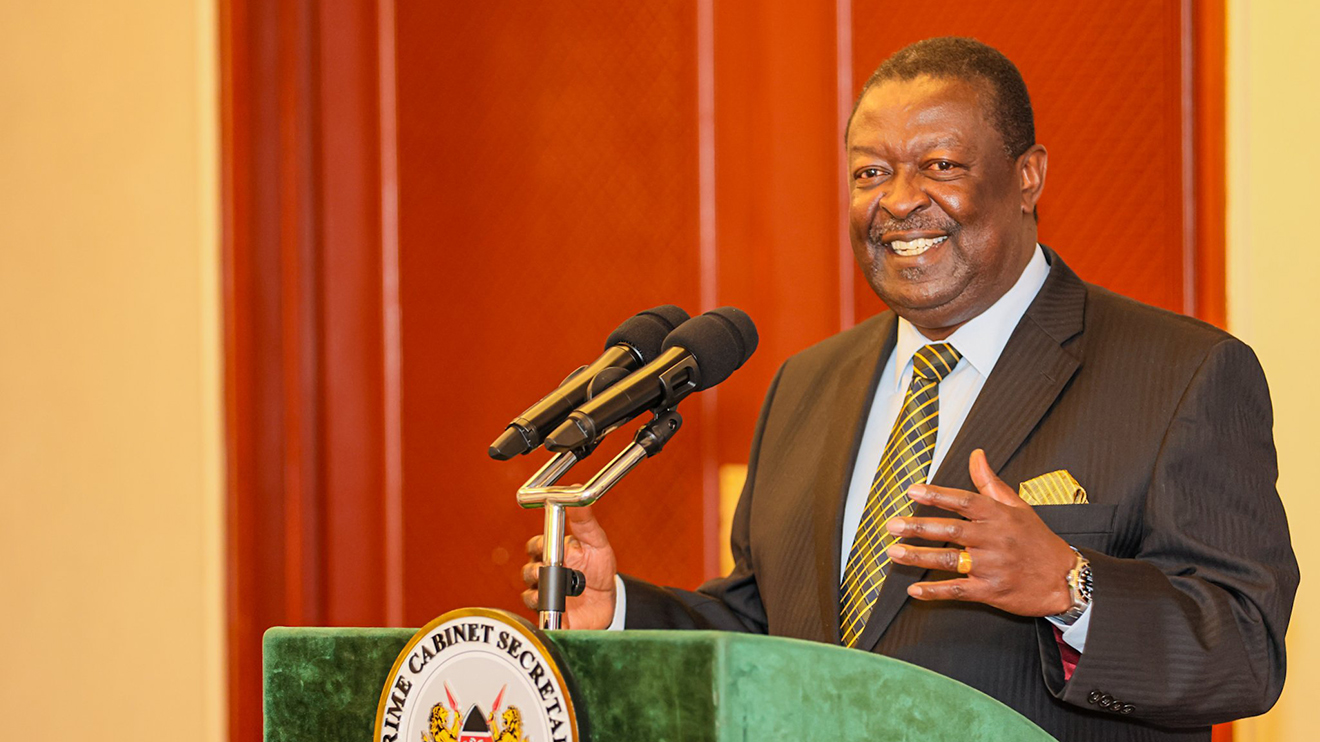

This directive, issued by Prime Cabinet Secretary Musalia Mudavadi, is a direct implementation of a presidential order made in March.

Read More

“All commercial State corporations should provide 80 per cent of profit after tax for payment of dividends as provided in the National Treasury Circular No 2/2024 of March 27,” Mudavadi stated in the guidelines.

Kenya boasts 46 commercial SOEs, predominantly operating in the transport and energy sectors.

These include high-profile entities such as Kenya Airports Authority, Kenya Electricity Generation Company, Kenya Power, and Kenya Railways.

The new measures are part of a broader government strategy to enhance the financial performance of SOEs, which have often been criticised for inefficiency and financial mismanagement.

President Ruto has been vocal about the need to restructure and streamline the parastatal sector to improve its contribution to the economy.

“The money that some parastatals make does not belong to their boards or management. It belongs to the people of Kenya as a return on investment. We have to shut down some of those loss-making parastatals. We must end excess capacity,” Ruto declared during a meeting with parastatal chiefs in March.

In addition to the dividend requirement, SOE CEOs must also achieve a 30 per cent reduction in operational, administrative, and staff remuneration costs.

They are further tasked with allocating 30 percent of tender value to youth, women, and persons with disabilities, as well as sourcing 40 per cent of goods and services locally.

Failure to meet these performance indicators will result in penalties for the CEOs.

The guidelines also impose stringent asset management requirements, including the mandatory preparation of quarterly and annual asset registers.

The government aims to transform the performance of State corporations, with the new directives marking a significant step in this direction.

Whether these measures will yield the desired results remains to be seen.

One thing is certain: the days of lavish spending and questionable returns for Kenya’s State corporations could be over.