The High Court sitting in Machakos County has issued orders barring Kenya Revenue Authority (KRA) from collecting the Minimum Tax.

The conservatory restraining orders will be in effect until a petition filed by the Kitengela Bar Owners Association is heard and determined.

The Minimum Tax that came into effect on January 1, 2021 is calculated at the rate of 1 per cent of a business' gross turnover.

The tax was introduced by the National Treasury through the Finance Act that was signed into law by President Uhuru Kenyatta on June 30, 2020.

Under the Income Tax Act, businesses operating within the country were required to pay a Minimum Tax regardless of whether they make profit or not.

Read More

In their case, the Kitengela Bar Owners Associations argued that the introduction of the Minimum Tax by the National Assembly was unconstitutional and it does not fall under the category of taxes that can be imposed by the National Government.

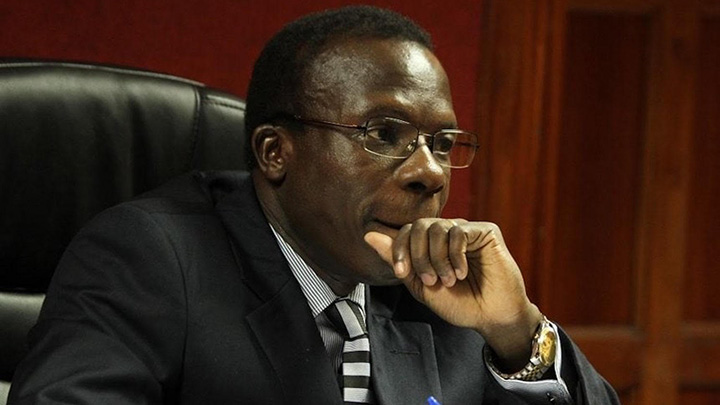

In his ruling, which was issued virtually from Machakos High Court, Justice George Odunga said:

“According to the Petitioners, by its very definition and as is undeniable, the said Minimum Tax does not amount to Value-Added Tax, custom duties nor excise tax, yet the 1st Respondent purports to include it in the category of income tax. However, by dint of section 3 (which is the charging provision) Petition E005 of 2021 Page 5 as read with Section 15(1) of the ITA, Income tax is only chargeable on gains or profit and not as gross turnover as implied by Minimum Tax.”

The ruling went on, "As such, this novel tax cannot be deemed in any manner of form to amount to income tax. It was therefore contended that the action of the 1st Respondent to introduce the said novel tax is not only ultra vires but also contra the Constitution of Kenya 2010."

shares a light moment with the company's Group CEO Dr Patrick Tumbo (right) at a past event-1758121528.jpeg)

-1758116028.jpeg)