Kenyans are facing an impending surge in fuel prices, with a proposed increase of Sh7.8 per litre for super petrol.

The hike follows a review of the petroleum pricing formula, which has outlined various cost adjustments across the fuel supply chain.

The adjustments, discussed in the Petroleum Pricing Review Meeting, have been attributed to several factors.

Among them is a rise in secondary transportation margins, where the cost of moving fuel from depots to retail stations is expected to increase from Sh0.54 to Sh1.18 per litre for distances under 40 kilometres.

The change has been justified by rising operational costs, with the last adjustment to this margin made in 2010.

Read More

Similarly, wholesale margins for oil marketing companies are set to increase from Sh3.05 to Sh4.76 per litre, reflecting inflationary pressures recorded across 73 licensed oil marketing firms.

Meanwhile, petrol station operators will see their retail operation margins increase from Sh4.14 to Sh6.61 per litre, incorporating factors such as product losses and higher operating expenses.

The review has also proposed basing minimum operational stock financing on the weighted average actual number of stock days in the previous quarter, ensuring a more accurate reflection of inventory costs.

Additionally, product losses will now be divided into categories covering primary storage, pipeline, and secondary storage, a move aimed at enhancing transparency and accountability in the fuel supply chain.

Another key proposal is the inclusion of insurance and risk costs as separate components in the pricing formula, a step intended to align pump prices with actual market conditions.

While super petrol is expected to rise by Sh7.8 per litre, diesel and kerosene prices are projected to increase by Sh7.75 and Sh7.67 per litre, respectively.

The Energy and Petroleum Regulatory Authority (EPRA) has acknowledged the potential impact of these price changes on consumers.

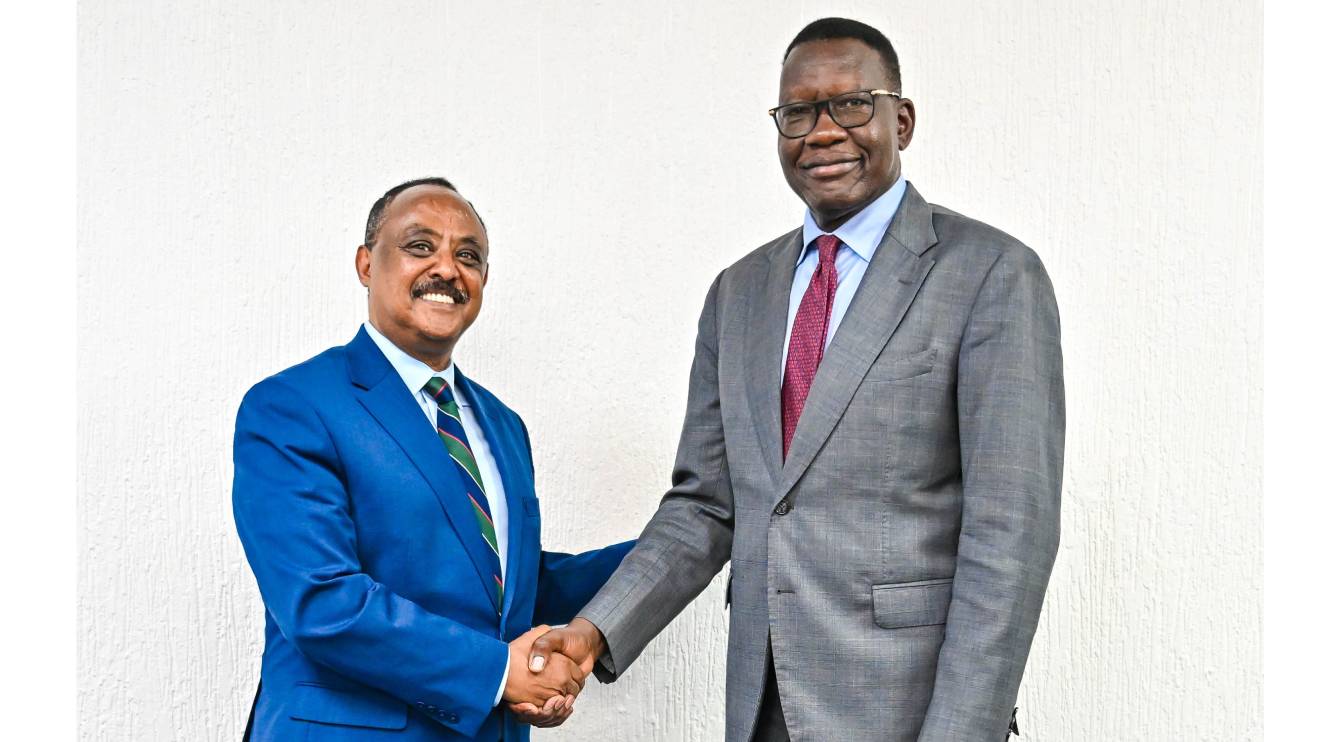

EPRA Director General Daniel Kiptoo has stated that the implementation will be carefully managed to balance consumer affordability and industry competitiveness. “The implementation of these recommendations will be carefully managed to minimize adverse effects on consumers while ensuring the industry remains competitive for investors.”

To cushion consumers from the sudden price shock, EPRA is considering a phased implementation strategy.

This could involve gradual price adjustments, potentially aligned with global oil price declines to offset the local increases.

"We are looking at a mechanism where we implement the recommendations of this report in phases. We want to time it at a point when it will not impact the consumer negatively, and we want to apply it when petroleum pump prices are coming down,” Kiptoo stated

Although the exact date for the new pricing remains unclear, the review has highlighted the necessity of updating Kenya’s fuel pricing model to align with the current realities of the petroleum sector.

Motorists should, therefore, anticipate an increase in fuel costs in the coming months, though the proposed phased approach may soften the immediate impact.

-1753733469.jpeg)