In a bid to provide financial relief to its customers, Equity Bank has announced a significant reduction in interest rates on all Kenya Shilling-denominated credit facilities, effective immediately.

The move comes as a response to the recent decision by the Central Bank of Kenya (CBK) to lower its Central Bank Rate (CBR) from 12.75 per cent to 12.0 per cent, a change that has ripple effects across the economy.

This is the second such reduction in just six months, following a similar cut in September 2024.

The lender’s latest step aims to make credit more affordable and accessible to a wider range of customers, with the goal of fostering greater financial inclusion and supporting overall economic growth in Kenya.

Equity has adjusted its Equity Bank Reference Rate (EBRR), which will now decrease from 17.83 per cent to 17.39 per cent.

Read More

This revised rate will apply to both new and existing loans, marking a significant shift for borrowers across the country.

Additionally, the margin on loans has been capped at 8.5 per cent per annum, providing further relief to businesses and consumers alike, and ensuring that financing remains more accessible at lower costs.

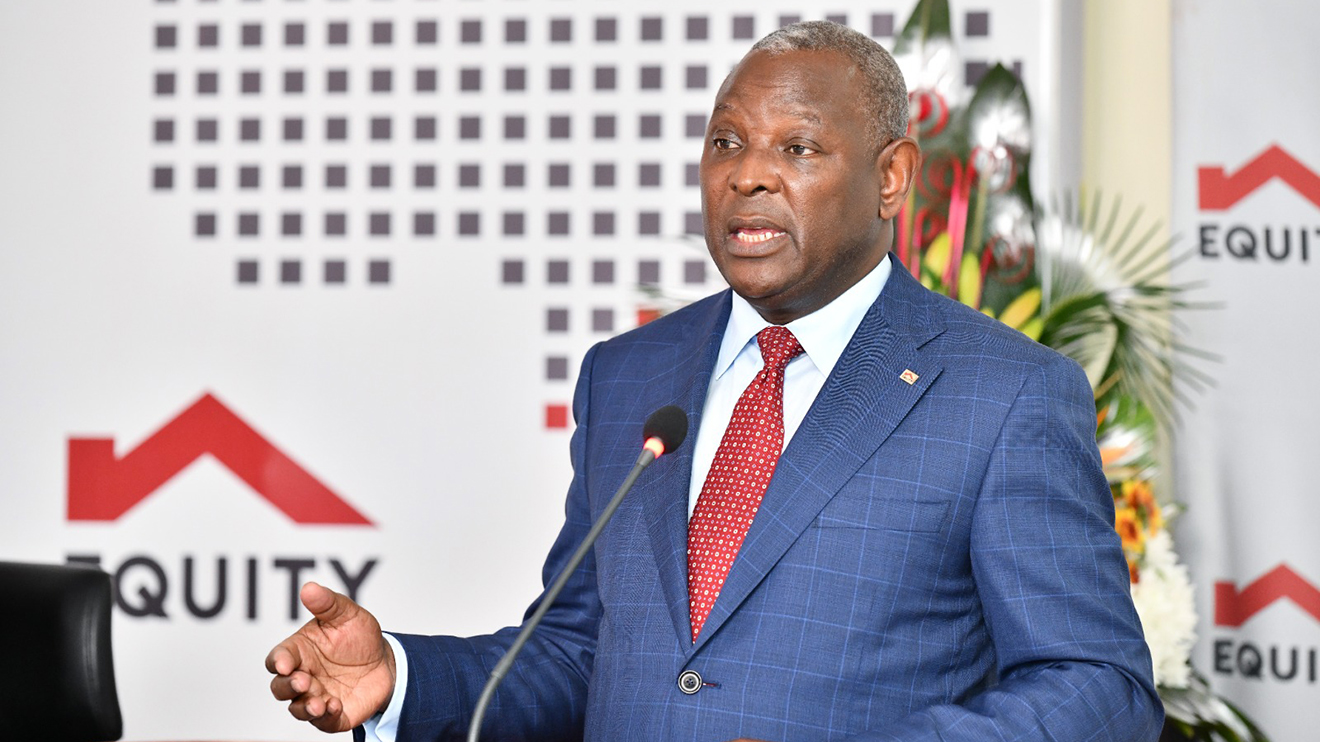

James Mwangi, the CEO of Equity Bank, spoke on the rationale behind the move, emphasising that the decision was in direct response to the CBK’s monetary policy designed to stabilise the economy.

He explained that the reduction in rates is part of a broader strategy to support economic growth while addressing improving inflation rates and other favourable economic indicators.

“The reduction in our EBRR reflects our commitment to supporting Kenya’s economic growth by making credit more affordable for both businesses and households,” Mwangi stated.

“With this move, all of our customers with Kenya Shilling-denominated loans will benefit from lower borrowing costs, enabling them to better manage their financial aspirations.”

The impact of this decision is expected to be far-reaching, with both businesses and households set to gain from lower borrowing costs.

Equity’s strategic move will ease financial pressure on its customers and is also seen as a step towards making credit more accessible for everyone, from entrepreneurs to ordinary households.

This rate reduction is expected to provide much-needed support in these challenging economic times, making it easier for Kenyans to access funds and manage their financial needs more effectively.

shares a light moment with the company's Group CEO Dr Patrick Tumbo (right) at a past event-1758121528.jpeg)

-1758116028.jpeg)