A new report from the Capital Markets Authority has laid bare the financial toll of Kenya’s recent social unrest, revealing that investors at the Nairobi Securities Exchange (NSE) saw Sh34 billion in paper wealth vanish over the last quarter.

In the three months leading up to September, investors watched as the NSE’s market capitalisation shrank by 2.01 per cent to Sh1.67 trillion, a steep decline from Sh1.71 trillion the previous quarter.

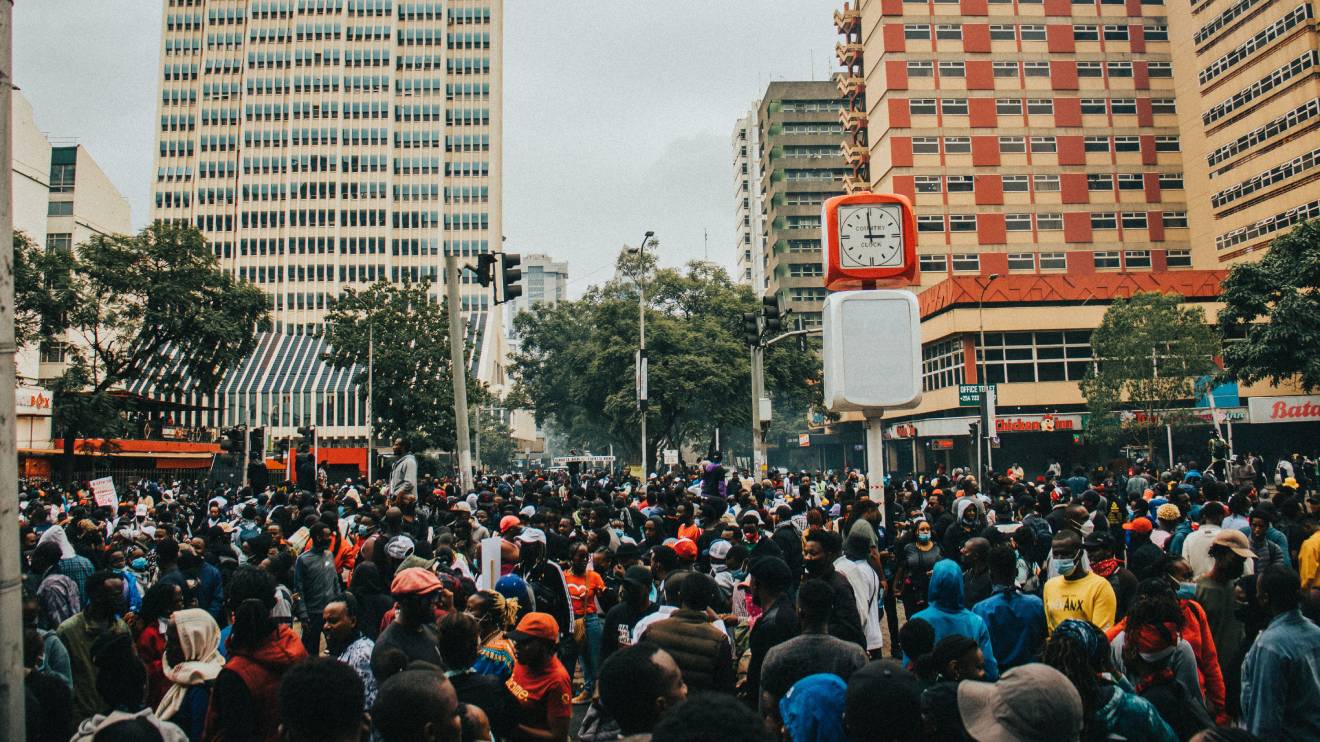

This report comes on the heels of nationwide protests driven by Kenya’s Gen Z, whose calls for change brought parts of the capital to a standstill and cast uncertainty across business sectors.

Despite a stabilising Kenyan shilling and a generally recovering economy, the effects of June’s demonstrations are still reverberating through the market.

Investors found themselves hesitant amid the disruption, slowing down trading activity, with share volumes dropping slightly by 0.65 per cent to 1.092 billion from 1.097 billion in the prior quarter.

Read More

While the CMA report leaves questions unanswered, further insight from the Kenya Institute for Public Policy Research and Analysis (KIPPRA) draws a direct line between these financial fluctuations and the summer protests.

“The period was marred by political tensions - mostly occasioned by the Gen Z-driven demonstrations - raising uncertainties among investors, which worsened market conditions,” the KIPPRA analysis reveals.

Beyond the equity market, the bond sector too took a hit. Bond turnover plummeted by 29.37 per cent, with Sh323.61 billion in trades compared to Sh458.2 billion in the prior quarter.

Yet, despite these discouraging figures, the third quarter wasn’t entirely bleak; several key indicators show resilience.

Notably, equity turnover surged by nearly 49 per cent, climbing to Sh28.39 billion from Sh19.07 billion—a hopeful sign for market recovery in the face of socio-political turbulence.

Looking year-on-year, the NSE recorded a notable rise in investor wealth, with total paper wealth climbing by Sh183 billion and multiple indices pointing to a reinvigorated market.

The index tracking Kenya’s biggest companies rose 17.69 per cent, hitting 1,775.67 points this quarter, up from 1,508.75 points in Q3 of 2023.

The NSE All Share Index posted a 2.33 per cent gain, and equity turnover rose slightly from Sh17.22 billion to Sh17.39 billion.

Interestingly, while political upheaval often sends foreign investors scrambling, their stance remained largely calm amid Kenya’s protests.

Foreign inflows continued to outpace outflows with a net inflow of Sh0.63 billion, though this figure was down from the Sh2.98 billion posted in the previous quarter.

Bond trading showed a similarly promising year-on-year picture, with turnover jumping by 119.5 per cent to Sh391.04 billion, up from Sh196.30 billion in Q3 of 2023.

Derivatives, an area of increasing interest at the bourse, also performed well. Turnover in this sector grew by 21.9 per cent to Sh45.3 million, with the number of contract deals and trading volume rising by 11.14 per cent and 18.63 per cent, respectively.

This mixed report reflects both the impact of political tensions and the resilience of Kenya’s market in navigating uncertainty.

For now, the NSE’s cautious recovery path continues, but investors will be keeping a close eye on political developments, hoping for a smoother ride in the coming months.

-1757663582.jpeg)