The Insurance Regulatory Authority (IRA) has placed Invesco Assurance Company Limited under statutory management, transferring the company’s operations to the regulatory body.

In conjunction with this decision, the IRA has appointed the Policyholders Compensation Fund (PCF) to manage the functions of the beleaguered insurer.

This measure follows a previous directive from December last year when the IRA placed Invesco under liquidation.

Liquidation typically involves winding up business operations and selling off assets to compensate shareholders and creditors.

"Invesco Assurance Company Limited (under statutory management) is not authorized to enter into any new insurance contracts from 14th August 2024," the IRA announced.

Read More

This declaration highlights the immediate cessation of Invesco's new business activities.

The authority further advised, "The insurer’s existing policyholders are advised to immediately seek alternative covers from other licensed insurers to ensure that there is no unnecessary exposure." This advice underscores the urgency for current policyholders to secure their insurance needs elsewhere to avoid potential risks.

Moreover, the IRA assured, "The Policyholders Compensation Fund will compensate the affected claimants as provided for under the Insurance Act, Cap 487 Laws of Kenya."

This guarantee aims to provide some relief to those impacted by Invesco’s financial difficulties.

This development comes amidst a broader context of financial challenges facing insurance companies, driven by a tough economic environment.

The insurance sector has been grappling with significant losses, which have necessitated stringent regulatory interventions to protect policyholders and maintain industry stability.

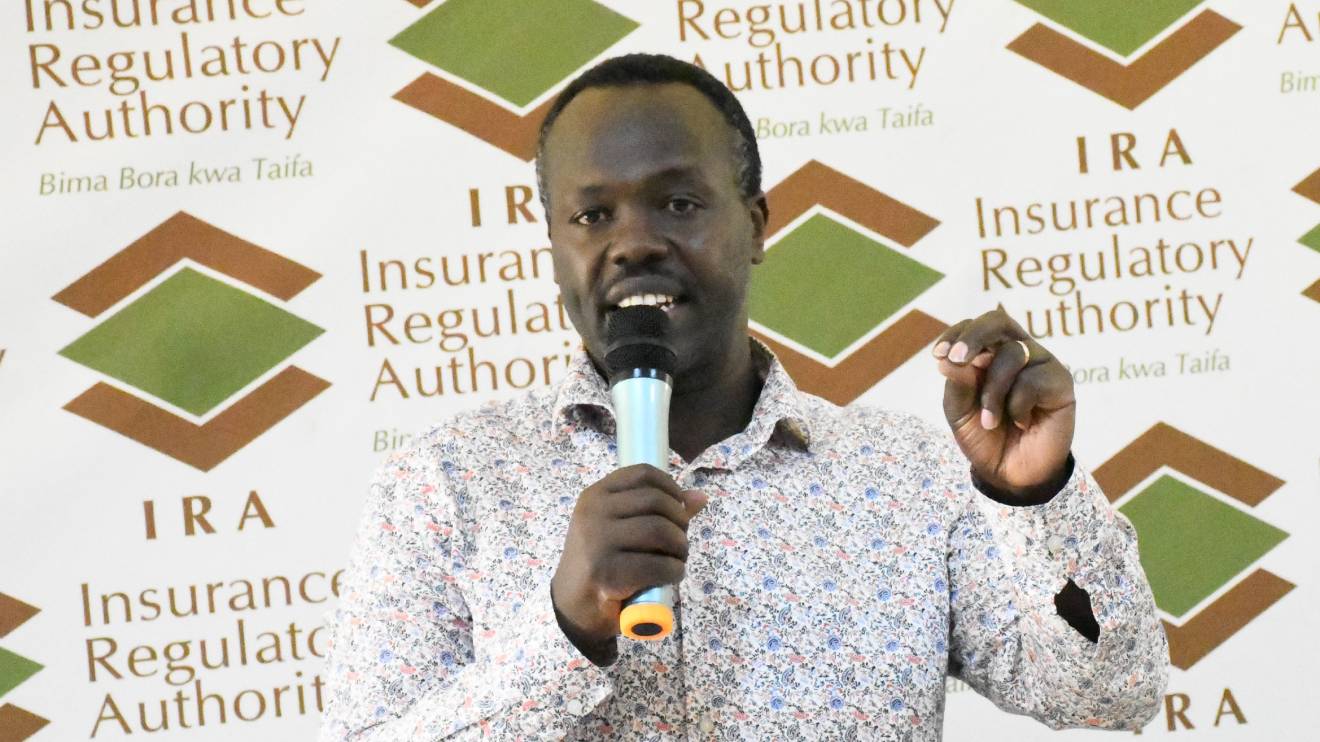

shares a light moment with the company's Group CEO Dr Patrick Tumbo (right) at a past event-1758121528.jpeg)