Equity Group has cemented its position as a financial powerhouse, claiming the second-strongest banking brand globally and the top spot in Africa according to Brand Finance’s 2024 Brand Strength and Brand Value rankings.

This remarkable achievement marks Equity Group’s third consecutive year on the prestigious Banking 500 list.

The Kenyan financial giant climbed two impressive spots from its 2023 ranking, securing the coveted number two position in the World’s Top 10 Strongest Banking Brands.

A stellar brand strength index score of 92.5 underscores this jump out of 100, along with an elite AAA+ brand strength rating – a 0.1 point improvement over their 2023 performance.

Equity’s success story extends beyond global recognition. The Group’s brand value also witnessed a significant increase of $22 million, reaching a total of $450 million.

Read More

This impressive valuation secures Equity the tenth position among Africa’s most valuable banking brands.

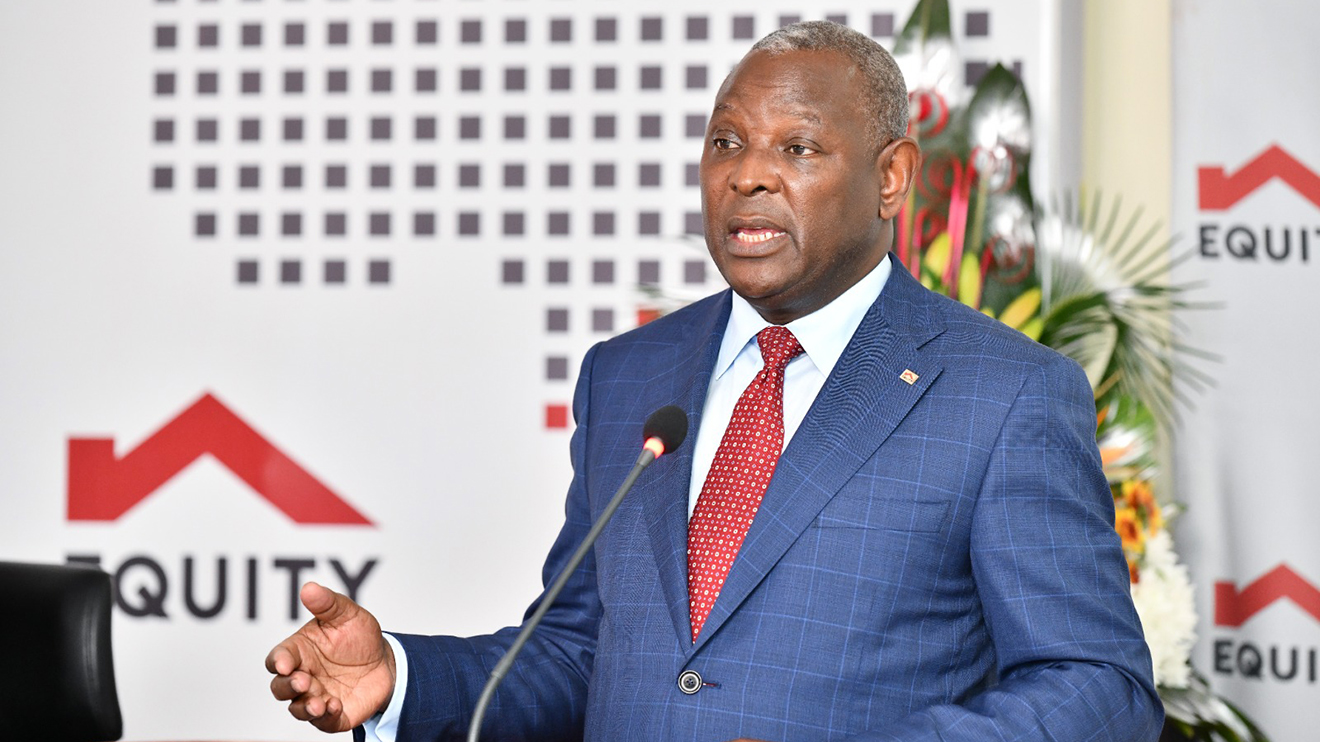

James Mwangi, Equity Group’s Managing Director and CEO, attributes this meteoric rise to the Group’s unwavering commitment to good governance, prioritizing customer needs, and a relentless pursuit of innovation.

“We are further excited to see that four of the top ten strongest banks in the ranking are also from Africa,” said Mwangi.

“As we remain anchored in our purpose of supporting our customers’ everyday lives, this recognition fuels our commitment to innovation and excellence. It drives us to redefine industry standards and pioneer transformative solutions in the financial sector,” he continued.

The prestigious Brand Finance Banking 500 ranking, compiled annually by the world-renowned brand valuation consultancy Brand Finance, assesses 5,000 of the world’s leading brands.

They publish nearly 100 reports each year, providing insightful brand rankings across diverse sectors on a global scale.

The Banking 500 specifically identifies the top 500 most valuable and strongest banking brands worldwide.

While Brand Finance’s research acknowledges trust as a cornerstone in customer banking decisions, it also highlights the growing importance of a clearly defined purpose and the ability to effectively meet customer needs.

The Brand Finance Banking 500 report is considered the industry’s leading authority, employing a robust methodology that evaluates a financial institution’s brand value using a combination of quantitative and qualitative metrics.

These metrics include brand strength, customer loyalty rates, and future revenue forecasts.

Equity’s success isn’t limited to the global stage. The Group’s subsidiaries across the region have also witnessed significant performance improvements in 2023. Equity BCDC, Equity Bank Rwanda, and Equity Bank Tanzania have all made remarkable strides.

Equity’s commitment to South Sudan remains unwavering, evidenced by the recent introduction of new lending products.

They are also actively bolstering their Ugandan entity, which has gained significant market share and influence.

-1714736836.jpeg)