Kenyans are facing potential hikes in insurance premiums as the industry grapples with the implementation of a new 16 per cent Value Added Tax (VAT) on insurance payouts, introduced by the Finance Act of 2023.

This change, despite industry concerns, became effective on June 26th, 2023, and is expected to impact businesses across the country by raising their annual operating costs.

Leading insurance companies like Jubilee-Allianz are urging customers to review their "sums insured," the maximum compensation amount they expect to receive in case of loss.

This emphasizes the need to align the insured value of assets like buildings and stock with the anticipated payout, as any discrepancy will attract additional premiums based on the revised sums insured.

While the law itself exempts insurance compensation from VAT, the government argues that some businesses claiming input tax on purchased assets receive payouts that already include VAT, creating a tax liability for insurers.

Read More

Businesses are only required to remit VAT on received insurance compensation if the claim relates to an item where input tax was claimed, regardless of whether the payout itself included VAT.

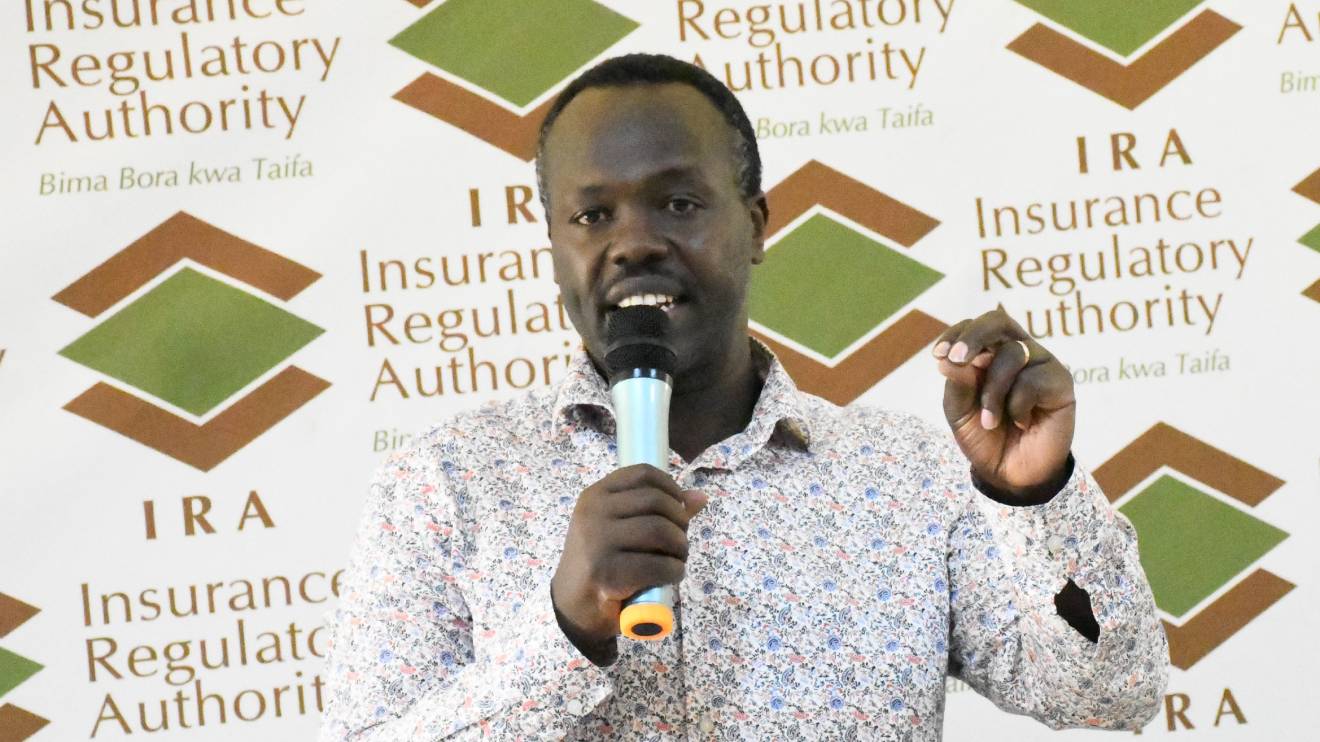

Experts like James Njogu, Head of Group Tax at Britam, anticipate a rise in commercial insurance premiums as companies shield themselves from the additional tax burden.

"With the Act coming into place, now the value of the building you need to mark it up with VAT cover rate, then they (insurers) will charge an appropriate premium," Njogu explains.

"Then in case of an event of fire or anything, when you are compensated it is also inclusive of VAT."

Previously, insurers covered assets without considering VAT, but now, even compensation payouts will include it.

Njogu further highlights that commercial businesses claiming input tax will be most affected, particularly those with General Insurance classes like marine, domestic and industrial fire, private motor vehicle, aviation, and workmen's compensation.

This development comes amidst a backdrop of legal battles between the Kenya Revenue Authority (KRA) and insurance companies.

In 2014, the KRA lost a case seeking Sh380.3 million in taxes from Sony on a Sh4.4 billion payout from Kenindia Assurance Company to Westgate Mall as compensation for the 2013 terrorist attack.

As the insurance industry navigates this new regulatory landscape, Kenyans can expect to see insurance costs increase.

Carefully reviewing insured asset values and understanding the implications of the VAT changes will be crucial for managing these additional expenses.

-1743631116.jpg)