The government has unveiled a budget proposal seeking to raise an additional Sh323.5 billion in taxes next year, a bold move aimed at plugging a gaping hole in the national finances.

This ambitious target comes as the government grapples with the dual challenge of high national debt and sluggish economic growth.

The plan, outlined in the 2024 Budget Policy Statement (BPS), hinges on collecting a total of Sh2.95 trillion in taxes during the 2024/25 fiscal year.

To achieve this, the government is pinning its hopes on far-reaching tax measures targeting previously hard-to-reach sectors like the informal economy, digital platforms, and agricultural activities.

This represents a significant increase from the current fiscal year's target of Sh2.62 trillion, which the Kenya Revenue Authority (KRA) has already missed by a concerning Sh186.2 billion.

Read More

This shortfall, primarily driven by lower-than-expected income tax collections from corporations and employees, underscores the urgency of the government's tax push.

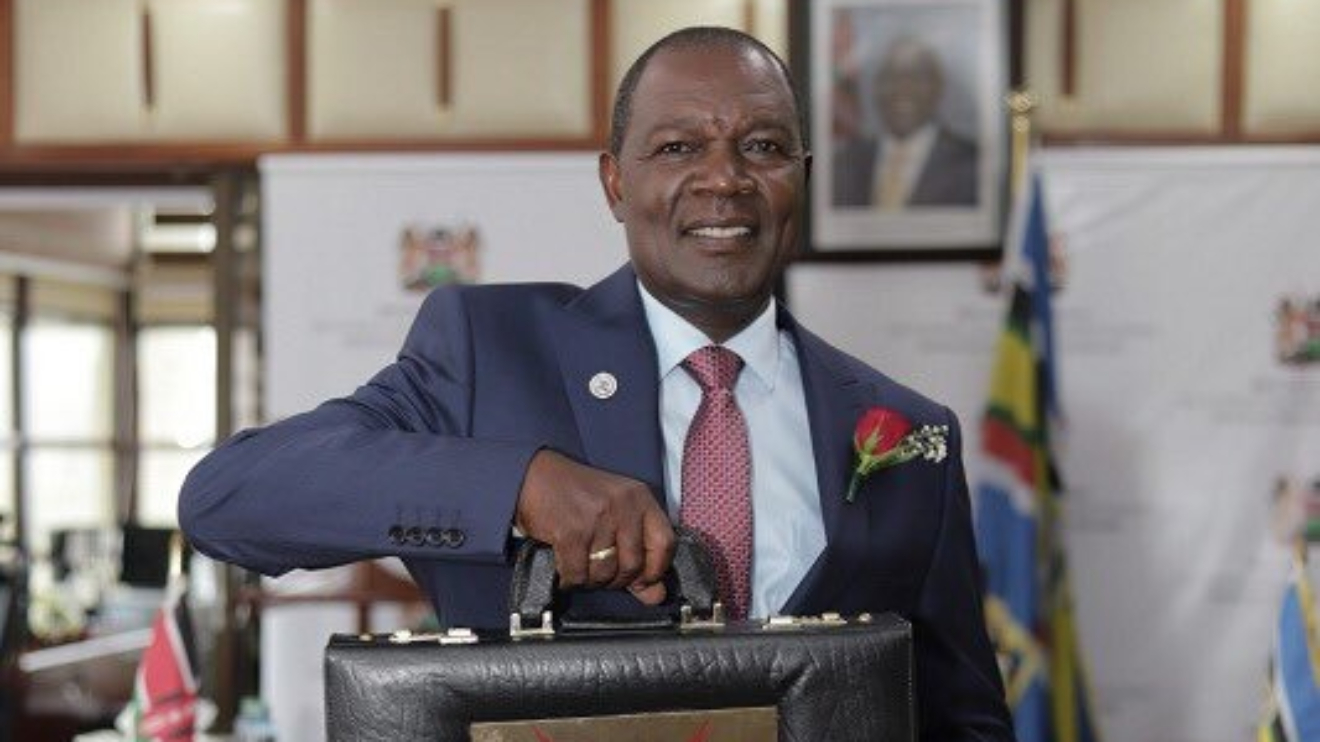

Minister for National Treasury and Economic Planning, Professor Njuguna Ndung'u, emphasized the need for enhanced revenue mobilization while streamlining non-essential spending to achieve fiscal consolidation and protect critical social programs.

"The consolidation will be supported by enhanced revenue mobilisation and rationalisation of non-priority expenditure while protecting essential social and development budget," Ndung'u stated.

However, achieving this ambitious tax target won't be easy. Kenya has a history of falling short of its revenue collection goals, and the proposed measures could face resistance from various sectors.

The informal economy, for example, is notoriously difficult to tax effectively, and concerns exist about stifling the growth of digital platforms and agricultural activities with new levies.

Furthermore, Kenya's reliance on debt financing remains a pressing concern.

The upcoming budget plans to borrow Sh753.2 billion, with a significant portion coming from domestic investors.

While this reduces dependence on foreign creditors, it raises concerns about crowding out private-sector borrowing and potentially hindering economic growth.

To further complicate matters, the country faces a tight deadline for repaying a $2 billion Eurobond in June this year.

To address this, the government recently secured a $1.5 billion Eurobond issuance to buy back part of the maturing debt.

While the government's commitment to fiscal consolidation is commendable, achieving its ambitious tax targets without stifling economic growth will be a delicate balancing act.

The success of this plan will hinge on effectively implementing new tax measures, fostering economic growth, and diversifying its funding sources.

The coming months will be crucial in determining whether Kenya can navigate these challenges and achieve its stated fiscal goals.

-1757663582.jpeg)