Kenyan businesses and consumers are bracing for tougher times with banks set to raise their interest rates after the Central Bank of Kenya (CBK) raised the base lending rate.

CBK’s Monetary Policy Committee (MPC) announced on Tuesday that it had raised the base lending rate by 50 basis points from 12.50 per cent to 13 per cent amid surging inflation.

This comes barely two months after the regulator raised the rate to 12.5 per cent from 10.5 per cent after it also rose from 9.5 per cent back in June 2023 amid a rise in loan defaults.

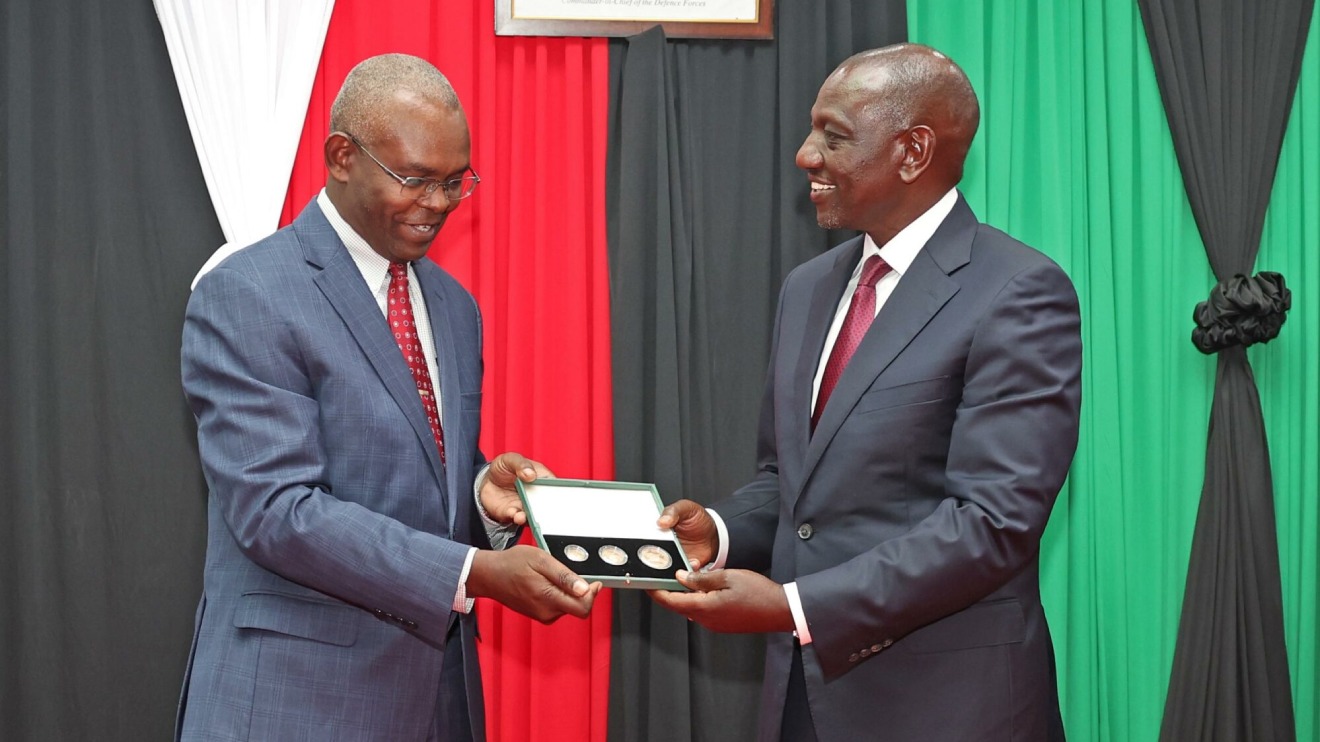

MPC headed by CBK governor Kamau Thugge hiked the base lending rate as inflation and forex pressures persisted despite a plea by Kenya Bankers Association (KBA) to retain the rate at 12.50 per cent.

With the move, which is bound to see loan defaults surge to historic levels, MPC seeks to tame the runaway inflation and tackle the beating of the Kenya Shillings by the US dollar.

Read More

“The proposed action will ensure that inflationary expectations remain anchored, while setting inflation on a firm downward path towards the 5 per cent mid-point of the target range, as well as addressing residual pressures on the exchange rate,” said Thugge in a statement released by MPC on Tuesday.

The CBK Governor added: “The MPC therefore decided to raise the Central Bank Rate from 12.50 per cent to 13 per cent.”

While urging CBK to retain the December rate, KBA noted that Non-Performing Loan (NPL) ratio to gross loans had surged from 14.7 per cent in July 2023 to 15.3 per cent in October 2023.

The raising of the CBK base lending rate to historic levels within three months will greatly increase the cost of borrowing for already struggling individual consumers and businesses.

As a result, the higher interest rates will see consumers and businesses pay dearly for new and running credit facilities and greatly impact saving, investments and revenue collection.

The inflation in Kenya increased to 6.9 per cent in January fueled by food, fuel, and other unrelated items with the volatile Kenyan shilling exchanging at 160 to the US dollar.

-1756917651.jpg)