Even as Kenya’s fiscal challenges continue, the country’s monetary policy is slated to benefit from a renewed focus to managing the reducing external liquidity concerns.

This is contained in Standard Chartered’s global Market Outlook Report 2024 that reveals that US and other economies might witness sharply slower growth and sliding inflation in 2024.

The Report titled “Sailing with the Wind” is a compilation of views by the financial firm’s Chief Investment Officer outlining the Bank’s investment strategy for the year ahead.

Standard Chartered Chief Investment Officer for Africa, Middle East and Europe at Manpreet Gill urged investors to match their investment objectives with long-term projections and focus on building portfolios that can withstand drawdowns.

“A key element of our advisory is that investors need to retain a strict investing discipline – they should not force sell, whether it be due to emotional or financial needs, and they should pivot to avoid excessive, permanent losses,” indicated Gill.

Read More

Equity and bond markets are looking at a good year, banking on a shift in CBK policy to support growth even as it remains on watch in case macro winds shift to a harder landing.

Standard Chartered also told investors to expect lending rates to stabilize, amid fluctuations in forex and the country’s tax regime continues to structure the operating environment.

“Being able to spot where asset class risk/reward appears the most attractive will be key for Kenyan investors. For many, this will mean taking prudent steps to retain investments and look for long term returns,” stated Standard Chartered Head of Wealth Management, East Africa Paul Njoki.

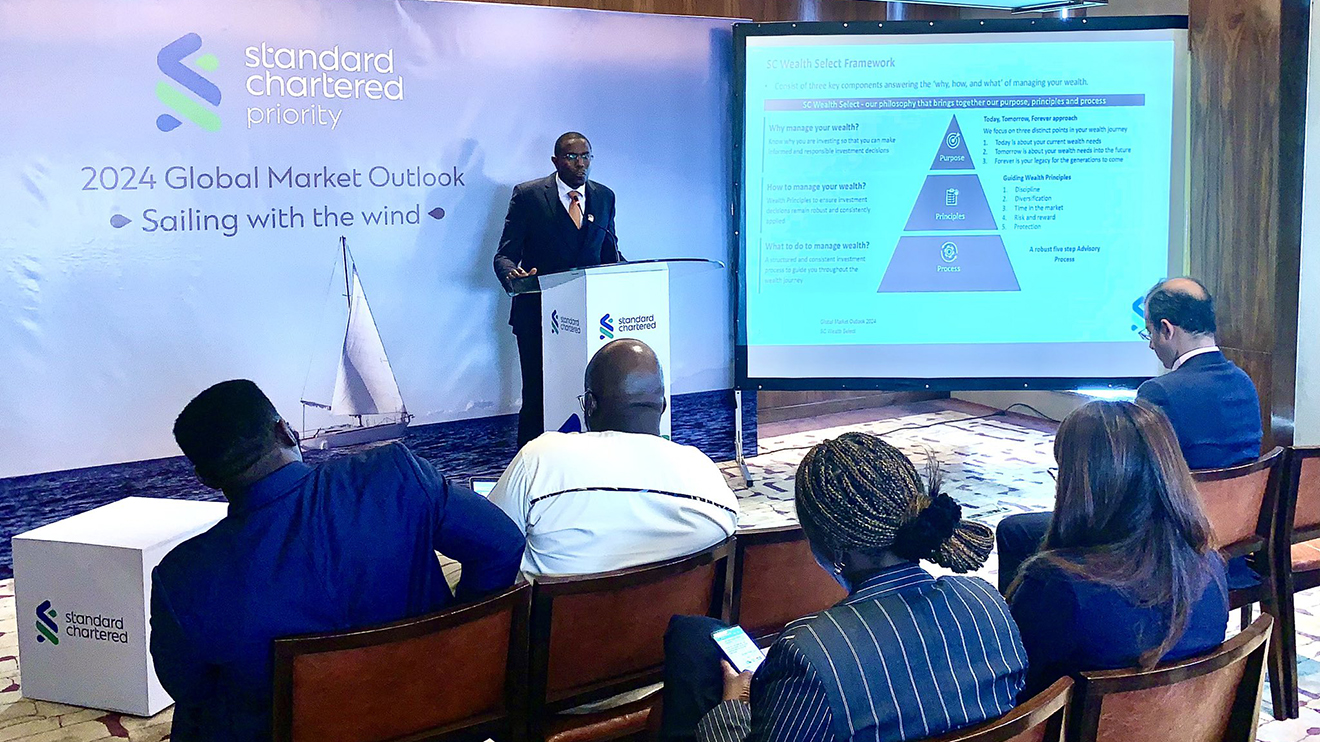

Due to these leading factors, Njoki says Stanchart launched an all-inclusive investment framework to enable clients to grow strategic portfolios to protect and grow their wealth.

“The framework, named SC Wealth Select, allows customers to review and allocate assets in line with their today, tomorrow and forever goals and in response to the investment climate,” added Njoki.

The new solution is an addition to the bank’s wealth management capabilities, including local and International advisory, property management and entry level SC Shilingi Funds.

The Report advises that for foundation allocations, the highest convictions are in:

(i) High quality Developed Market government bonds, particularly with longer maturities

(ii) Global equities heading into early 2024, led by the US and Japan, and more broadly

(iii) Global equities and global bonds, which are likely to deliver cash-beating performance.

The team’s Opportunistic allocations look to take advantage of stock and sector dispersion to capture short term opportunities, with a view to:

(i) Buy communication services, technology and healthcare equity sectors in the US,

(ii) Buy consumer discretionary, communication services and technology sectors in China, and

(iii) Play the USD range.