Airtel Money, a prominent mobile money services provider in Kenya, announced a significant reduction in its paybill, bulk payment, and wallet-to-bank charges, effective immediately.

The adjustment aims to enhance affordability for its extensive customer base.

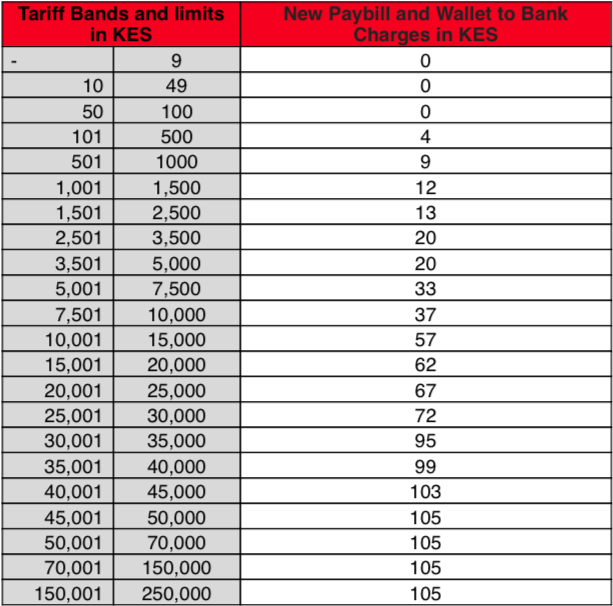

In the latest alterations, Airtel Money's Paybill and Wallet-to-Bank charges have been significantly lowered, offering rates notably below the current market standards in each tariff band.

Airtel Money's decision to lower its paybill and wallet-to-bank charges aligns with the increasing demand for digital payment solutions in Kenya.

Read More

This initiative is set to generate substantial savings for consumers using Airtel Money, particularly when making payments for various government services and e-citizen services.

Given the growing reliance on digital channels for accessing and processing government-related services, the reduction in paybill transaction charges is expected to be warmly welcomed by Kenyan consumers.

Utilizing Airtel Money for e-citizen services will now involve considerably reduced transaction costs, contributing to cost-effectiveness and convenience for the populace.

Anne Kinuthia-Otieno, the Managing Director of Airtel Money Kenya, underscored the company's commitment to its clientele amidst the existing economic challenges. In her statement.

"This move reaffirms our continuous commitment in supporting our customers, especially with the prevailing economic challenges. Airtel Money will continue providing flexible and personalized solutions while at the same time delivering exceptional services and value for their money," Kinuthia-Otieno highlighted.

The revised charges will be applicable to all Airtel Money customers, ensuring that the reduced paybill charges become a standardized benefit across the user base.

Notably, Airtel Money customers will also continue to enjoy the added perk of zero charges on utility bill payments, such as electricity, contributing to a seamless and cost-effective payment experience.

The overarching objective behind these revised charges is to align Airtel Money's services with the evolving financial needs of the consumer base, striving to offer greater convenience and financial relief in their day-to-day transactions.

The table below shows the revised transaction charges according to each tariff band:

-1757663582.jpeg)