Equity Bank Kenya has made a compelling plea to the High Court, urging the removal of an order that currently halts the receivership of TransCentury and East African Cables Ltd.

The financial institution contends that the orders to block the receivership were secured without revealing critical information to the court, raising questions about the legitimacy of the claims.

In a courtroom appearance before Justice Alfred Mabeya, Equity Bank representatives, led by senior counsel Kiragu Kimani and Lawson Ondieki, argued that TransCentury had failed to provide pertinent details to support its case against intervention.

Notably, the bank emphasized that TransCentury omitted to inform the court that the company's capacity to repay its loans was severely constrained, given that it had raised a mere Sh828 million from a recent rights issue.

Furthermore, the bank asserted that TransCentury's claim of raising Sh2 billion was unsubstantiated and thus challenged the veracity of this statement.

Read More

The bank's senior counsel, Kimani, made it clear that the company's actions were dubious.

"This is a party that approached the court in bad faith by failing to disclose material facts," Kiragu stated.

Equity Bank's move to place both TransCentury and its subsidiary East African Cables under receivership stemmed from their refusal to consider the bank's request to forgive a debt of over Sh2.8 billion ($20 million) owed by TransCentury Plc, along with an additional Sh1.948 billion owed by East African Cables.

Backing the bank's application, Paul Ogunde, representing the receiver managers, dismissed TransCentury's apparent efforts to portray the receivership as an attempt to disrupt operations.

"The truth is that there was amiable and amicable engagement on the takeover," Ogunde asserted.

He urged the court to overturn the initial injunction obtained in June, thereby allowing TransCentury to allocate Sh108 million from the rights issue funds for loan repayment.

In response, TransCentury, represented by lawyer Philip Nyachoti, opposed the bank's application, adding another layer of complexity to the ongoing legal battle.

Equity Bank's call to lift the restraining order adds another dimension to the protracted receivership dispute.

The court's decision will undoubtedly have far-reaching implications for both the financial industry and the broader business landscape, as the judicial process seeks to unravel the complexities of this intricate case.

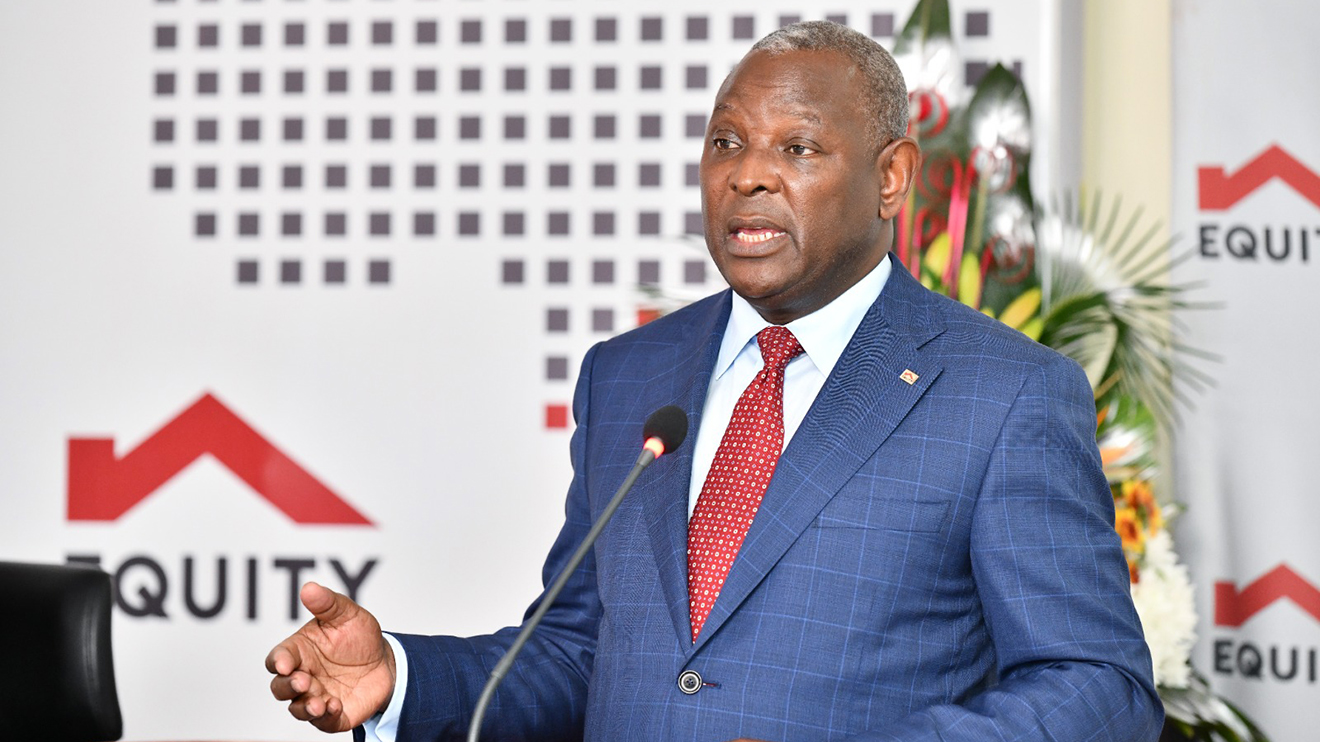

shares a light moment with the company's Group CEO Dr Patrick Tumbo (right) at a past event-1758121528.jpeg)