Equity Group employees are smiling into the future after they were granted five per cent shareholding of the company at the group’s 19th Annual General Meeting (AGM) in Nairobi on Wednesday.

The move approved by shareholders will see Equity staff get 198 million shares worth Sh10 billion as at Wednesday’s closing share price via an Employee Share Ownership Scheme (ESOP).

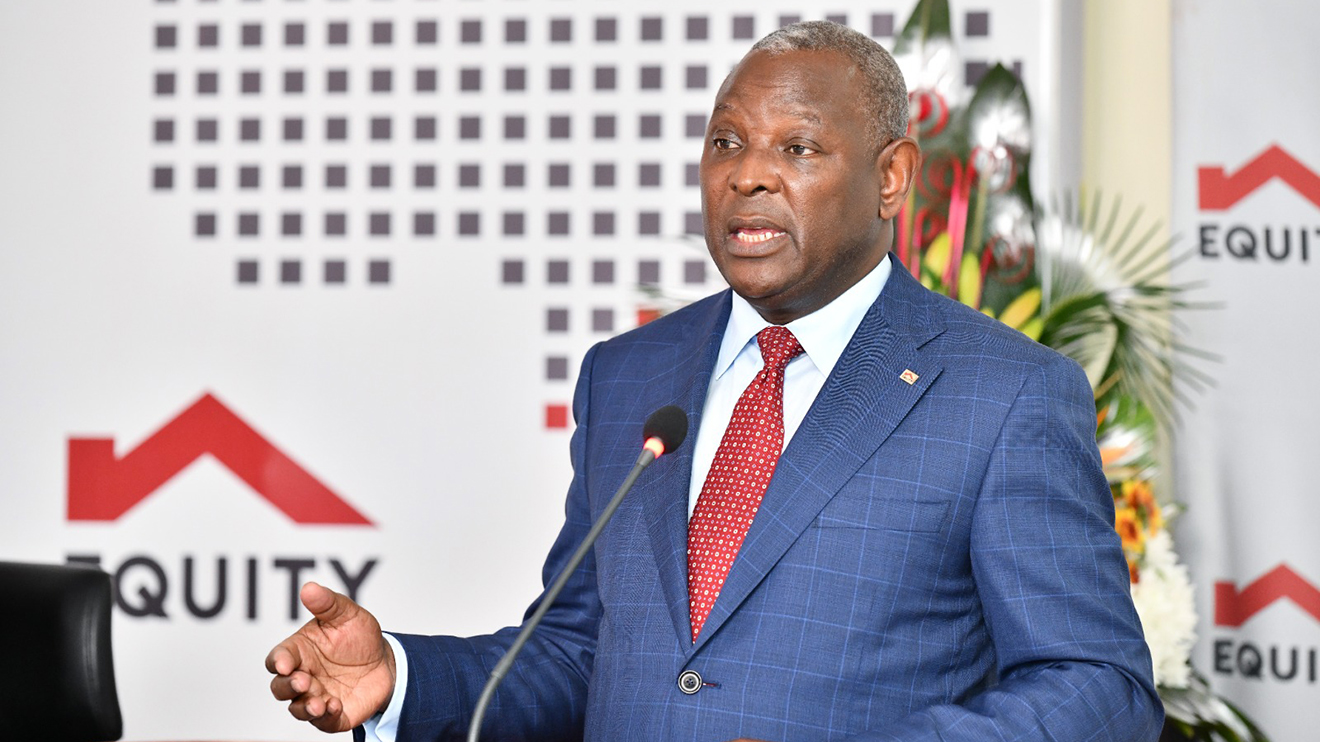

Speaking during the AGM, Equity Group MD and CEO Dr James Mwangi said the move seeks to reward staff for their role in improving the group value during a challenging seven years.

“The recognition and reward to staff by the shareholders follows sustained resilience in creation of shareholders’ value over a period of 7 years characterized by a series of challenges including interest capping, the Covid-19 pandemic, the Russia-Ukraine war and the current macro-economic turbulence marked by sticky and stubborn inflation, high interest rates and volatile exchange rates,” said Dr Mwangi.

He revealed that since 2016, Equity management and other staff members grew the Group assets from Sh428.1 billion as of January 1, 2016 to Sh1.537 trillion as of March 31, 2023.

Read More

The Profit After Tax posted for the year ended December 31, 2015 also spiked from Sh17.3 billion to Sh46.1 billion as of December 31, 2022.

Similarly, during the seven-year period under review, funds for Equity Group shareholders significantly increased from Sh72.1 billion to stand at the current Sh182.2 billion.

Equity noted that during that period, the Group also witnessed massive regional expansion to become among the top three banks in Kenya, Uganda, DRC, Rwanda and South Sudan.

It boasted of executing the East and Central Africa region expansion with funds generated internally to become the 4th strongest banking brand on earth, according to Brand Finance.

The Board noted that the Group needed global expertise, talent and skills to drive regional expansion and diversification further to boost and sustain its ambitious business strategy.

During the AGM, Equity Group shareholders also accepted a record dividend payout of Sh15.1 billion at a rate of Sh4 per share, a 33 per cent increase from the 2022 payout.

Similarly, the shareholders also approved a plan by Equity Group to establish technology and insurance business companies as part of its bold and strategic diversification plans.

Equity says the ESOP seeks to;

(i) Align the interests of staff to the long-term interests of shareholders by structuring the ESOP as performance share awards with vesting conditions matching shareholder return, to achieve value creation through strong performance, Return on Equity and Assets and competitive dividend payouts;

(ii) Attract superior talent and global skills from global multinationals that have similar employee total reward and compensation schemes;

(iii) Drive a strong performance culture and embed performance measurement and a transparent and open reward system to incentivize staff;

(iv) Be part of attractive variable pay package that would also include immediate cash bonuses and reflect the performance of the Group while complementing the guaranteed monthly salaries.