Safaricom has announced it will slash tariffs for its mobile money transfer service M-Pesa once the zero-rating of transaction initiated by the Central Bank of Kenya expires on December 31.

The largest mobile telecommunications service provider said the tariff reductions will affect more than 90 per cent of all customer transactions when sending money.

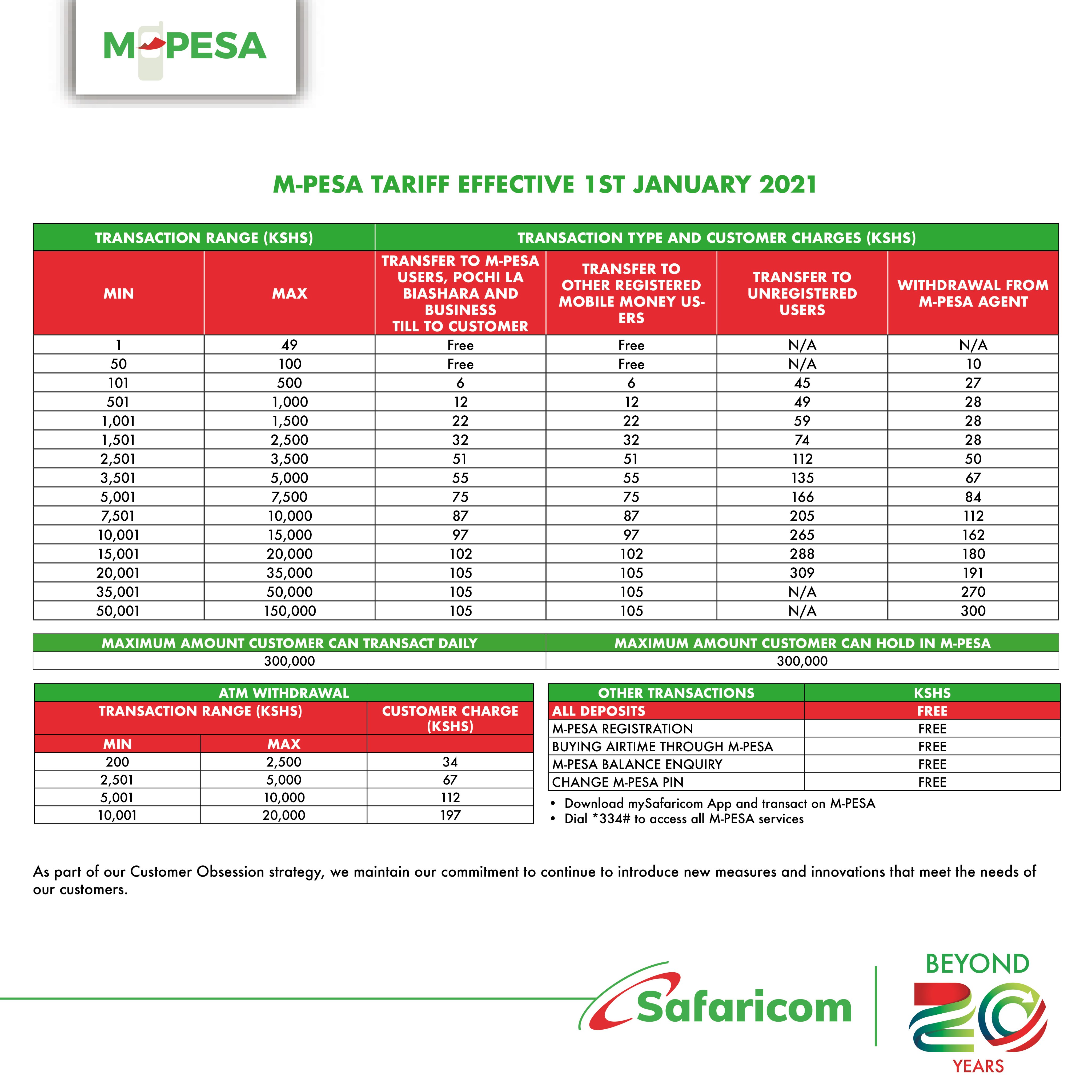

According to Safaricom, it will now cost Sh6 to send between Sh101 and Sh500, down from Sh11 and transactions of between Sh1,501 and Sh2,500 will cost Sh32 down from Sh41.

All M-Pesa transactions of Sh100 and below will remain free and all M-Pesa customers will continue to enjoy free transactions between mobile money transfer service and bank accounts.

The permanent tariffs take effect on January 1 and will enable the firm’s more than 26.8 million clients to continue enjoying lower costs when sending cash, said Safaricom CEO Peter Ndegwa.

Read More

The new tariffs will also apply to transactions for micro-businesses under Safaricom’s new Pochi La Biashara service and for Lipa Na M-pesa businesses using Transacting Till to make payments.

The temporary zero-rating of M-Pesa transactions was announced by Safaricom in March as part of measures mean to help Kenyans cope with the adverse effects of Covid-19 Pandemic.

The move followed an initiative led by CBK headed by Dr Patrick Njoroge and was part of measures in the banking sector to help the economy weather tough Coronavirus times.

-1757243598.jpg)

-1757244564.jpg)

-1757101509.jpg)