NCBA Bank Kenya has struck a strategic pact with Mobikey Truck & Bus Ltd to provide tailored asset financing solutions for a wide range of commercial vehicles and equipment.

The financing solutions touch on a host of commercial vehicles and equipment including MAN trucks and buses, Randon trailers, and Hyundai construction and mining equipment.

Under the strategic agreement signed by NCBA Bank, businesses in Kenya will be able to access financing of up to 100 per cent for new assets and up to 80 per cent for used assets.

The package also offers a 60-day moratorium, competitive processing fees, and the option to bundle insurance premiums and related costs into the loan facility.

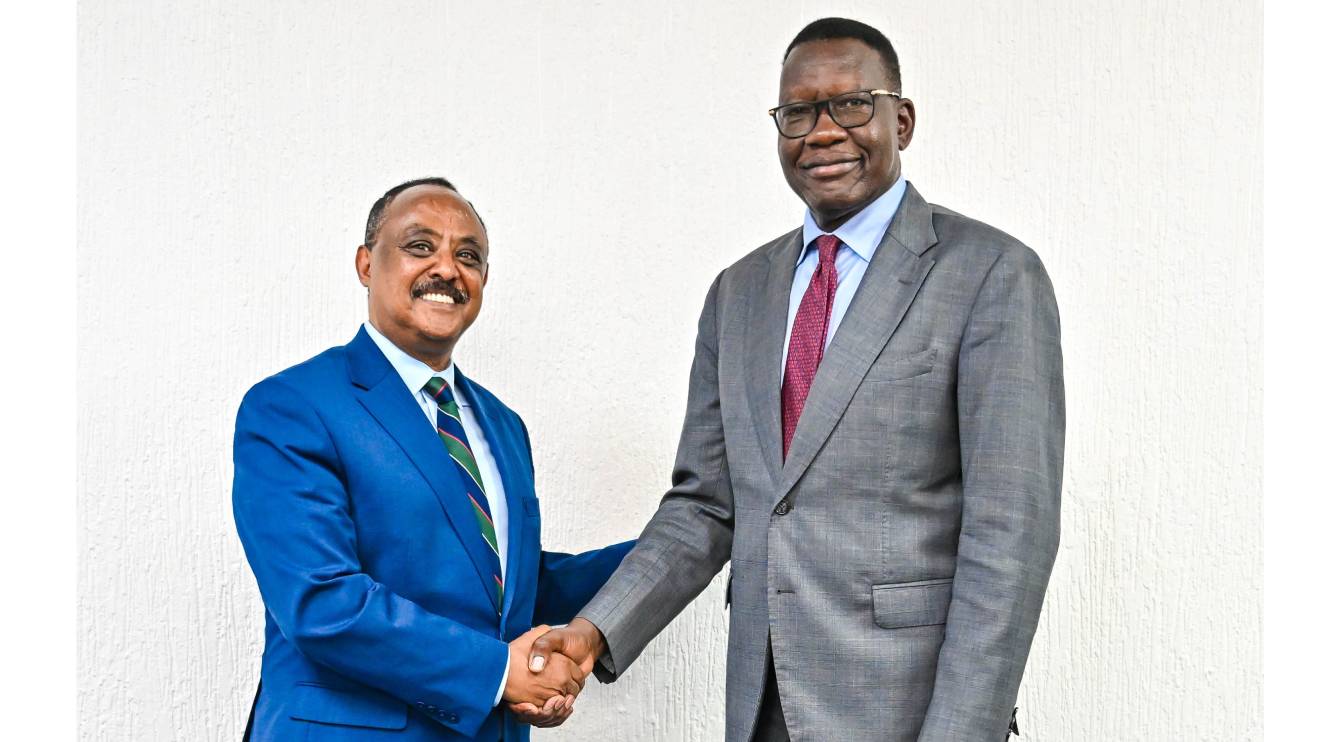

NCBA Group Director of Asset Finance and Business Solutions Lennox Mugambi noted that this comes at a time when businesses need innovative financing options to stimulate growth across key economic sectors.

Read More

“This collaboration will allow us to offer our customers an unrivalled range of asset financing options to grow and expand their operations as they pursue their financial goals,” said Mugambi.

The 2025 Economic Survey by the Kenya National Bureau of Statistics (KNBS) indicated a slowdown in construction and transport sectors, both critical to Kenya’s economic growth.

The report by KNBS singled out liquidity constraints as a key factor hindering contractors and investors from acquiring the necessary equipment, further impacting productivity.

NCBA believes the flexible financing solutions will spur investment by SMEs and larger enterprises, particularly in logistics, transport, construction, agriculture, and education.

“By providing flexible financing solutions to contractors and logistics companies for the acquisition of Man trucks, Man buses, Randon trailers, and Hyundai construction equipment, NCBA is actively addressing the challenge of limited access to capital, thereby empowering businesses and enabling economic growth,” he added.

The strategic partnership between the Tier-1 Kenyan lender and Mobikey Truck & Bus Ltd is expected to have a ripple effect across various sectors of the Kenyan economy.

In agriculture, better access to transport and construction equipment will improve rural infrastructure, mechanisation, and market access.

In education, Man buses will enable schools to expand student mobility and enhance learning opportunities beyond the classroom.

Mobikey CEO Ricardo Teixeira indicated that the new alliance will strengthen their capability to reach more customers with solutions that enhance productivity.

“We are delighted to partner with NCBA Bank Kenya to make our movable assets more accessible to businesses and individuals across Kenya,” stated Teixeira.

He added: “Their strong presence and solid reputation in the market make them an invaluable ally in our mission to empower enterprises with the assets they need to succeed.”

As asset financing continues to gain traction in Kenya, the partnership gives businesses a chance to invest in key capital assets while managing cash flow well for long-term growth.

-1754300838.jpg)

-1756319289.jpg)