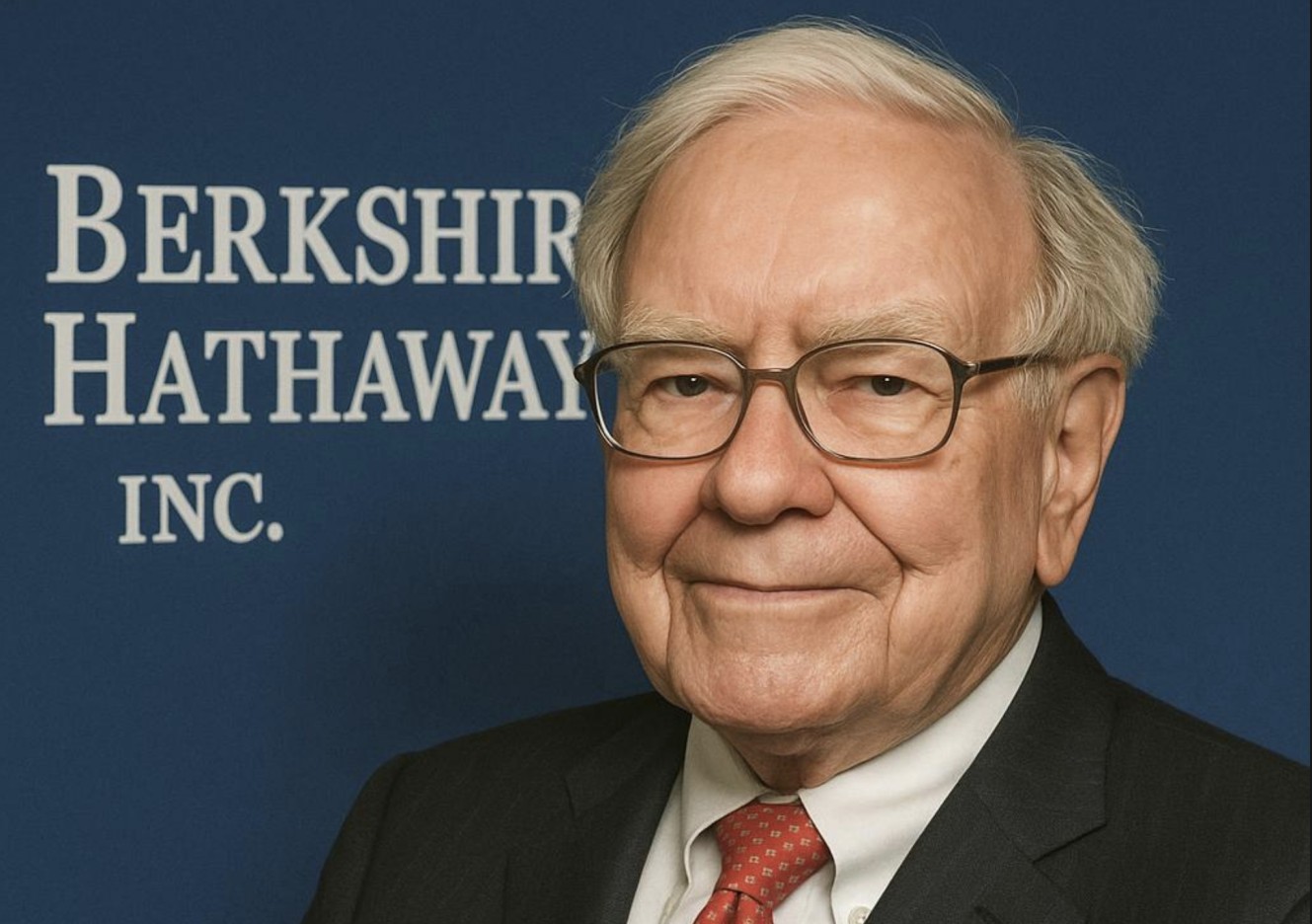

Warren Buffett, who is often referred to as the “Oracle of Omaha,” is one of the most iconic and successful investors the world has ever seen.

With a net worth that has often placed him among the top five wealthiest persons globally, Buffett’s journey from a paperboy to a multibillionaire investor is fascinating and inspiring.

The story of the ‘Oracle of Omaha’ is not just one of personal wealth, but also of wisdom, discipline, and a steadfast belief in establishing long-term value.

For Kenyan entrepreneurs and investors navigating an increasingly complex financial landscape, his life offers instrumental lessons on how to build sustainable wealth.

Early Life: Flair for Numbers

Read More

Warren Buffett was born in 1930 in Omaha, Nebraska, in the US during the Great Depression, to Howard Buffett, a stockbroker who later became a US Congressman.

From early in his childhood, he showed an uncanny interest in money and business and by the age of six, he was buying packs of Coca-Cola and selling them for a few pennies in profit.

At 11, Buffett bought his first stock—three shares of Cities Service Preferred—an early indication of his passion for investing.

Unlike many children his age, he loved reading books on investing, mathematics, and business including “The Intelligent Investor” by Benjamin Graham, which shaped his investing philosophy.

This intellectual foundation he erected in his early life, added to his natural analytical abilities, laid the groundwork for his future success in the global investment world.

Education and Graham

Warren Buffett attended the University of Nebraska and later studied under Benjamin Graham, who is considered the father of value investing, at Columbia Business School.

Graham taught him the importance of buying undervalued companies with strong fundamentals, a principle that Buffett would improve and champion his entire life.

After working briefly for Graham’s investment firm, Buffett returned to Omaha and started his own partnerships allowing him to apply his teachings to gain market-surpassing returns.

Buffett’s disciplined approach, sharp focus on fundamental value, and deep understanding of company essentials became his trademarks.

Berkshire Hathaway Makeover

In 1962, he started buying shares in a struggling textile company called Berkshire Hathaway and by 1965, he had fully taken control.

Even though the textile business eventually failed, Buffett used Berkshire as a holding firm to acquire other businesses, a move that would define his investment strategy for decades.

Instead of buying and selling stocks like a normal investor, he used Berkshire Hathaway to buy whole businesses or major stakes in firms with strong advantages in fundamentals.

Buffet’s takeovers included iconic American brands like GEICO, Dairy Queen, BNSF Railway, and later, significant holdings in big companies like Coca-Cola, Apple, and Bank of America.

Simplicity and Patience Philosophy

Buffett’s success involves adopting simple and consistent investment philosophy:

1. Invest in what you understand: Avoid businesses you cannot understand, no matter how profitable they seem. This principle kept him out of trouble during market bubbles like the dot-com era.

2. Look for value: Buy stocks and businesses that are undervalued relative to their fundamental worth, and hold them for decades.

3. Focus on management: Place immense value on strong, ethical, and competent leadership. Buffett often retained existing management teams when acquiring businesses.

4. Be patient: One of Buffett’s most prominent quotes is, “Our favorite holding period is forever.” This long-term approach contrasts sharply with the short-termism of most modern-day investors.

5. Avoid debt: He believes in financial prudence, keeps substantial cash reserves and avoids disproportionate leverage.

The above principles have seen him avoid many of the financial downsides that entrap other investors with Berkshire Hathaway's stock outperforming the S&P 500 many times over in the last few decades, compounding investor returns and elevating him to legendary status.

Personal Traits

Although investment strategy plays a pivotal role in his success, Buffett's personal characteristics were equally at play:

• Discipline: He sticks to his principles even when the market moves in the opposite direction.

• Integrity: He emphasizes ethical behavior in his personal life and in the firms he invests in.

• Frugality: His minimalist lifestyle is a testimony to his firm belief in value over luxury.

• Humility: Despite his immense wealth, Buffett still lives in the same modest house he bought in 1958 and famously eats simple meals like McDonald’s breakfast.

These traits exhibited by Buffett resonate strongly in most African cultures where humility and long-term thinking are often emphasized in the long treacherous journey to success.

His story reminds Kenyans that wealth does not need to change one's character or disconnect one from their community values.

Key Lessons for Kenyan Investors and Entrepreneurs

Warren Buffett’s success journey offers everlasting lessons for Kenyan businesspeople who are looking to build long-term wealth:

1. Start early and be consistent: Compounding works best over time. Even small, regular investments can produce impressive returns if done over many years.

2. Understand your investment: Whether you're buying land, starting a business, or trading on the Nairobi Securities Exchange (NSE), know what you are getting into.

3. Avoid speculative trends: Kenyan investors should be cautious about hype-driven investments such as pyramid schemes or unregulated forex platforms.

4. Invest in people: Whether you are investing in a startup or hiring for your own company, prioritize people.

5. Think long-term: Don’t chase quick profits. Instead, build wealth that can sustain you, your family, and even future generations.

Giving Back Legacy

Buffet is well known for his philanthropy and in 2006 he undertook to give away more than 99 per cent of his fortune, mainly through the Bill and Melinda Gates Foundation.

The wealthy investor from Omaha also co-founded the Giving Pledge, which encourages billionaires across the globe to commit to giving away the majority of their wealth.

This sense of responsibility is a key reminder for African entrepreneurs that wealth is a tool for personal gain and uplifting the community, education, healthcare, and social progress.

In Conclusion

The story of Warren Buffett is a testament that wealth can be built through patience, discipline, and integrity.

He did not invent a new product, launch a startup, or inherit vast wealth from his parents but he studied businesses, stayed disciplined, and let time work its magic on his ideas.

For Kenyans navigating the current volatile economic landscape, whether in Nairobi’s fast-growing fintech scene, rural agribusiness ventures, or in the Nairobi Securities Exchange (NSE), Buffett’s legacy is a blueprint for long-term, principled success.

As the African proverb goes, “Wisdom is like a baobab tree; no one individual can embrace it” hence through Buffett’s wisdom, we can grasp a branch each and begin our journey toward lasting wealth.