The Kenyan Cabinet has given its nod to the Finance Bill, 2025, in a move aimed at enhancing efficiency and closing loopholes within the country's financial framework.

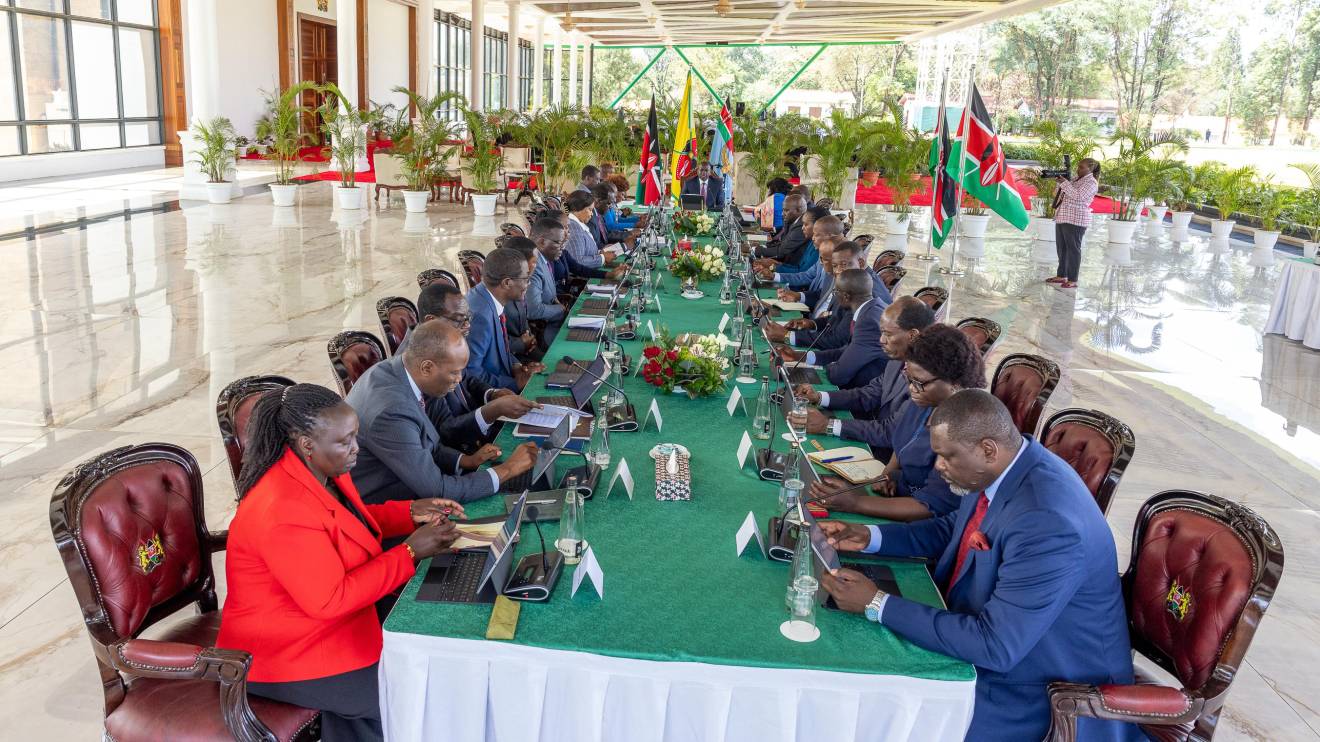

This decision was reached during a Cabinet meeting chaired by President William Ruto at State House, Nairobi, on Tuesday.

The bill is a key component of the government's broader strategy to implement significant budget realignments, aligning with the policy of fiscal consolidation and a commitment to living within its means.

A primary focus of the Finance Bill, 2025, is to address loopholes, particularly those related to tax expenditures that have historically been exploited to siphon funds from public coffers, such as through inflated tax refund claims.

While the bill seeks to minimise tax-raising measures, it aims to enhance tax administration efficiency through a new legislative framework.

Read More

Key provisions of the bill include streamlining tax refund processes, sealing legal gaps that delay revenue collection, and reducing tax disputes by amending the Income Tax Act, VAT Act, Excise Duty Act, and the Tax Procedures Act.

To support small businesses, the bill proposes allowing them to fully deduct the cost of everyday tools and equipment in the year of purchase, eliminating unnecessary delays in accessing tax relief.

Furthermore, the bill includes measures to benefit retirees, as all gratuity payments, whether in public or private pension schemes, will now be fully tax-exempt, ensuring dignity for Kenya's senior citizens after retirement.

Employers will also be required to automatically apply all eligible tax reliefs and exemptions when calculating Pay As You Earn (PAYE) taxes for employees.

This measure addresses the current issue where many employers omit these reliefs, forcing employees to seek refunds from the Kenya Revenue Authority.

These reforms are designed to underpin the Bottom-Up Economic Transformation Agenda (BETA) and reinforce the Government's commitment to building a stronger, more inclusive economy.

The approval of the Finance Bill, 2025, is part of a series of fiscal decisions made by the Cabinet to strengthen fiscal discipline, reduce public debt vulnerabilities, and create the fiscal space necessary to deliver essential public goods and services.

This includes directing Cabinet Secretaries to work closely with the National Treasury to identify and implement necessary adjustments within their respective ministries and State departments, with the aim of capping the fiscal deficit at no more than 4.5 per cent of GDP for the 2025/26 financial year.

Read the full Cabinet news below:

-1729145378.jpg)