NCBA Bank has partnered with Dentsu School of Influence to empower young creators with tools to improve their online brands, negotiate better deals, and invest their money wisely.

NCBA says enabling the next generation of creators to make big money moves through financial literacy is in accordance with its mission of empowering people and communities.

The Tier-1 lender says such collaborations are needed to grow the creative economy in Kenya saying the bank considers influencers as significant drivers of the country’s economy.

Read More

“We are fusing our commitment to financial literacy with real conversations on money, influence, and growth—arming content creators with the knowledge to not just survive, but thrive,” NCBA stated in a statement on the novel partnership.

Jacquie Muhati, the NCBA Group Deputy Director, Marketing, Communications, & Citizenship, noted the role of Kenya’s creative economy in enabling the youth to convert their passions into careers.

Muhati indicated that the move by NCBA to support the creative sector in Kenya will help to nurture new talent, create employment, and foster value addition to expand the economy.

“That’s why at NCBA, we have teamed up with the Dentsu School of Influence to grow the next wave of influencers and help them level up their skills, build meaningful brands, and make their mark,” Muhati added.

NCBA Digital Marketing Manager Stephanie Odhiambo enlightened the creators that brands look for relatable and authentic content creators when they select their influencers online.

Odhiambo said NCBA Group has been instrumental in pushing for authentic conversations and impactful connections to enable young people to establish sustainable careers online.

“Great financial influencers blend financial savvy with authentic storytelling, passion and relatability to simplify money talk, build trust and inspire action,” stated Odhiambo.

She added: “Beyond likes, we value real conversations and measurable impact,” she added.

According to NCBA Head of Go Banking Jenniffer Kanyi, creators selected for the workshop will get relevant knowledge and tools to empower them to better handle money matters.

“Mastering good money habits is easier than you think. Start by creating a realistic budget that balances your needs and wants—this helps you take control of your spending,” she said.

Kanyi challenged upcoming and established influencers to make saving a priority, no matter how small, and also establish an emergency fund to cushion them for emergency expenses.

“When it comes to credit, be intentional—borrow responsibly and avoid debt traps.

“Financial success begins with discipline. Start today and watch your money work for you.”

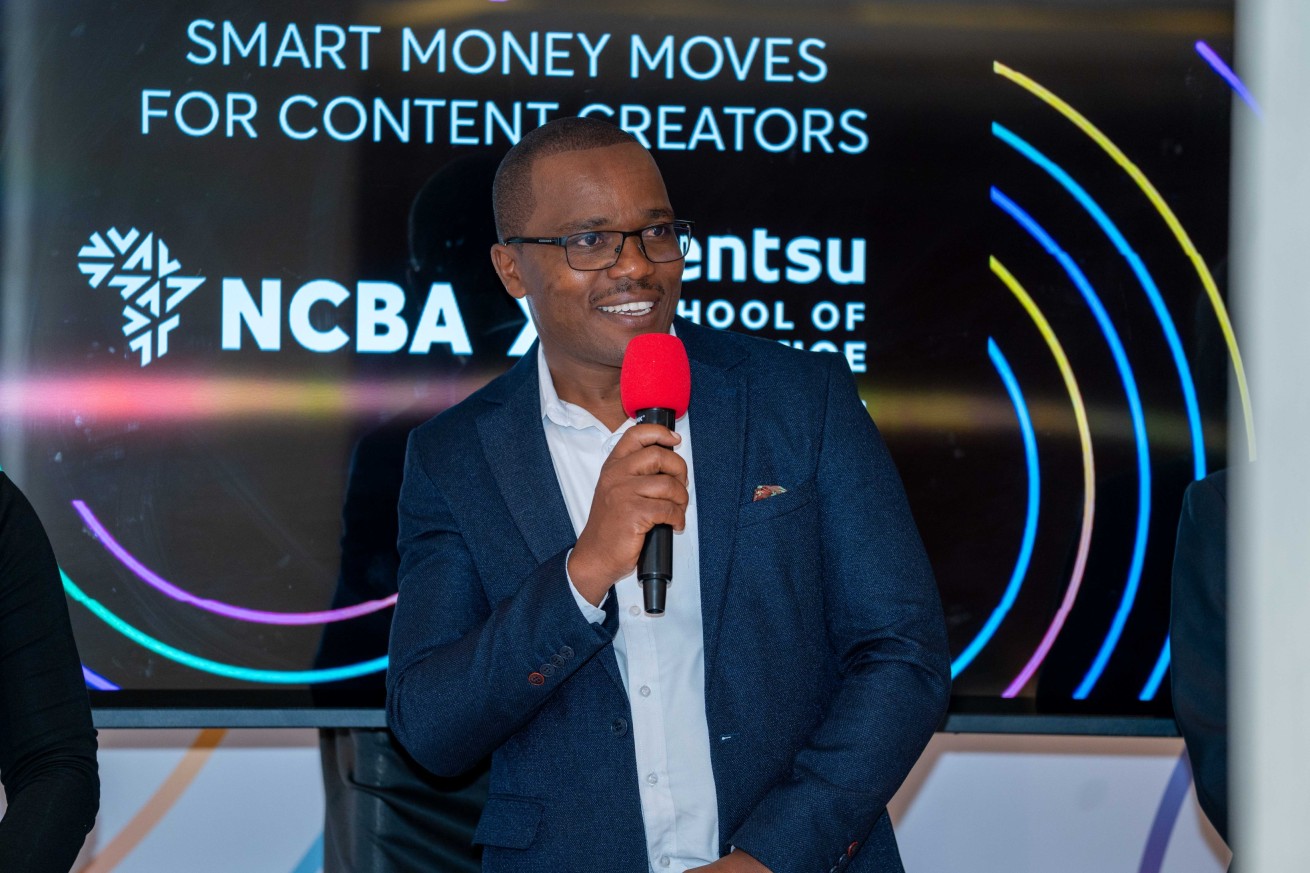

On his part, Paul Gicheru, the Chief Investment Officer at NCBA Investment Bank, urged creators to understand their behavior around money then make wise money decisions.

“The first place to start is to understand your behavior around money; are you a super saver or a super spender? Or do you invest more?” posed Gicheru.

He added: “What's the first thing you do when you get your money? This forms the basis of your personality.”

The partnership between NCBA Bank and Dentsu School of Influence is part of the bank’s engagements to empower Kenyans financially during this year’s financial literacy month.

-1745507952.jpeg)