NCBA Group announced its 2024 Full Year financial results in March 2025 exhibiting a strong show across all its core businesses in Kenya as well as in all its regional banking subsidiaries.

During the year in review, the group posted a 2 per cent growth in its net profit to Sh21.9 billion in FY 2024, compared to the Sh21.5 billion profit after tax it recorded in FY 2023.

But key to note in the Group results was the significant growth in disbursement of digital loans, which increases by 13 per cent from Sh930 billion in 2023 to Sh1.409 trillion in 2024.

Leading the loan growth was Fuliza, an overdraft facility enabling M-Pesa users in Kenya to conclude payments, which grew from Sh789.6 billion in 2023 to Sh906.4 billion in 2024.

M-Shwari, an integrated loans and savings partnership between NCBA and Safaricom, expanded its processed loans from Sh102.4 billion in FY 2023 to Sh98.8 billion in FY 2024.

Read More

Similarly, the loans accessed through the Loop B2C digital platform in Kenya more than doubled from the Sh1.2 billion recorded in FY 2023 to Sh2.5 billion realised in FY 2024.

In Uganda, loans accessed by MoKash customers grew from Sh12.5 billion to Sh14.7 billion, while Tanzania’s M-Pawa digital loans rose from Sh5.3 billion in 2023 to Sh5.5 billion in 2024.

In Rwanda, MoKash expended Sh17.5 billion in loans in 2024, up from Sh15.0 billion in 2023, even as Ivory Coast’s MoMo loans reduced from Sh4.3 billion in 2023 to Sh3.6 billion in 2024.

The Sh1.094 trillion digital loans disbursed in 2024 is a shared effort between NCBA and other firms to boost financial inclusion and diversify its Sub-Saharan Africa customer base.

The growing appetite for loans on NCBA Group’s digital platforms across the East African region is testament of the growing customer confidence in the security of its systems.

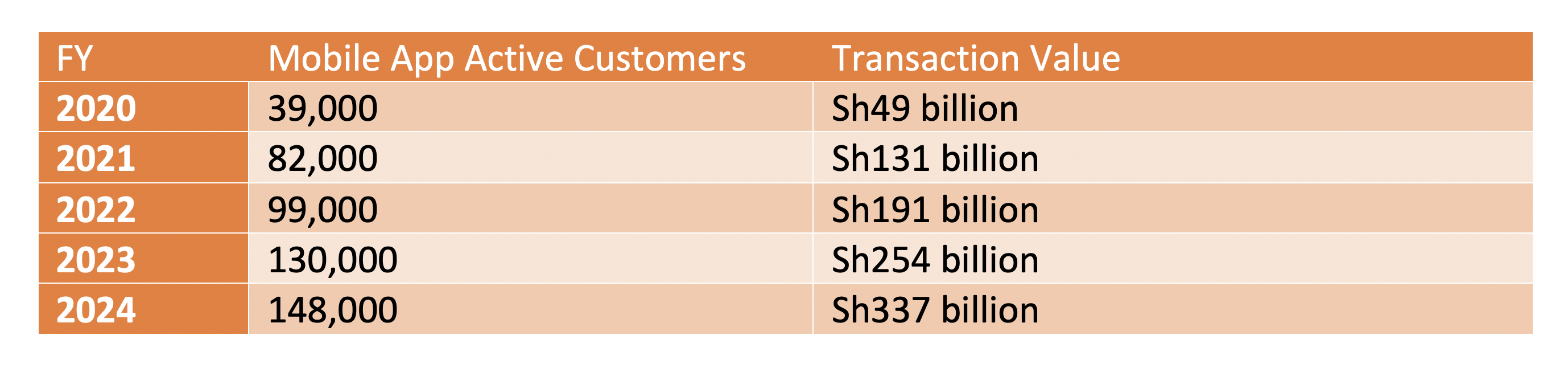

Additionally, the strong adoption on NCBA Group’s mobile banking app in Kenya has also resulted in an exemplary increase in active users as well as a growth in transaction values.

Here is how active customers utilized the NCBA Now mobile app (2020-2024):

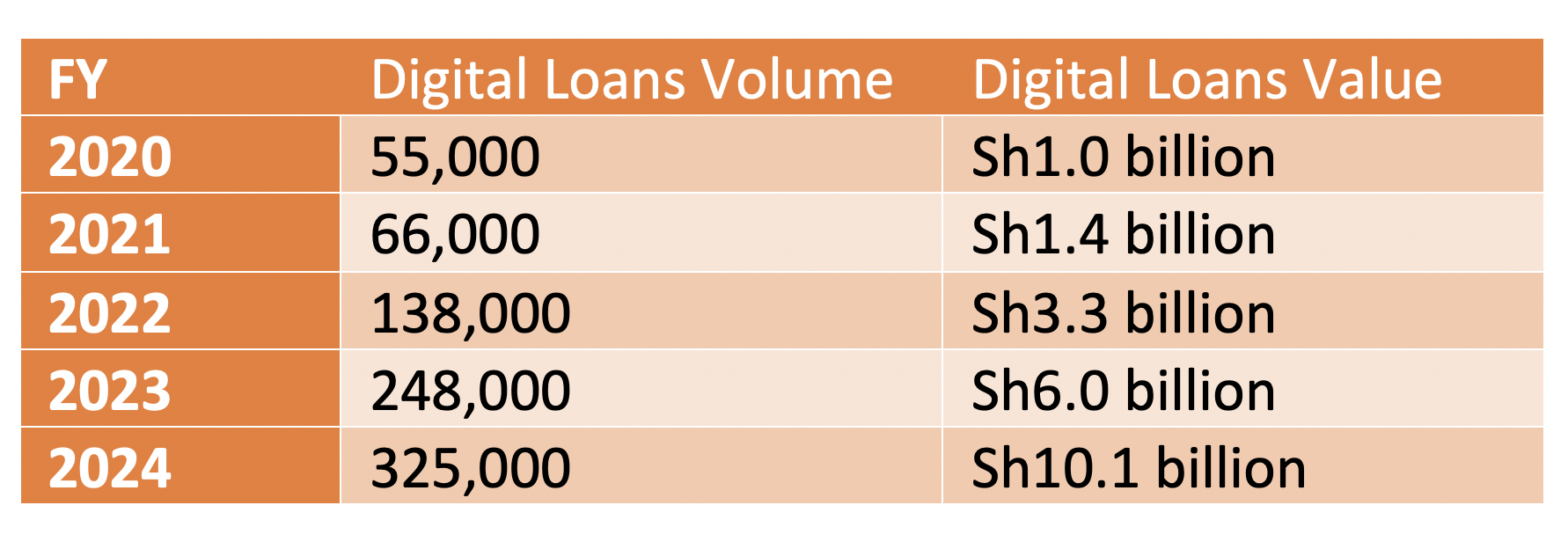

Benefits accruing from targeted mobile loan campaigns aimed at driving uptake: