Absa Bank Kenya has reported a remarkable Sh14.7 billion in profit after tax, a 20 per cent increase from last year, marking a year of impressive financial resilience.

This surge, driven by strategic investments and innovation, underpins the bank’s commitment to supporting Kenya’s economic landscape and enhancing financial inclusion.

The bank’s strong performance was underpinned by a 19 per cent rise in funded income, now totalling Sh34.5 billion, alongside a 13 per cent increase in non-funded income, which has reached Sh12.2 billion.

The bank’s loan book also experienced substantial growth, expanding to Sh311 billion, supported by Sh94 billion in new lending.

These funds have been primarily directed towards critical sectors such as agriculture, infrastructure, and small-to-medium enterprises (SMEs).

Read More

Additionally, customer deposits have seen an upward trajectory, now standing at Sh352 billion, reflecting the trust and confidence placed in Absa by its customers.

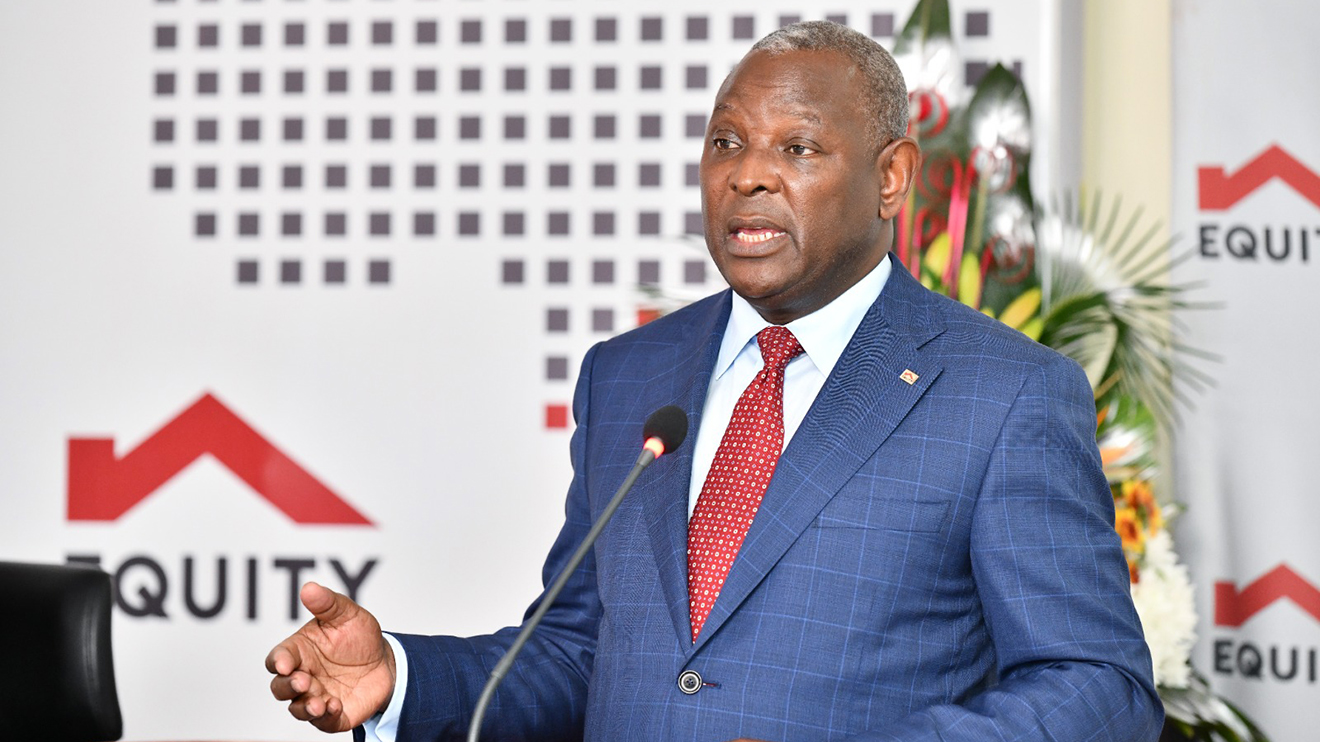

Abdi Mohamed, the bank's CEO, praised the disciplined execution of Absa’s long-term strategy, highlighting how it positions the bank to adapt to the dynamic needs of its customers.

“Our strategic objective remains on track to position Absa as a modern, holistic financial services provider, leveraging innovation and strategic partnerships to meet the evolving needs of our customers,” he stated, underscoring the bank’s future-focused vision.

Despite these positive results, Absa faced a 13.7 per cent increase in operational costs, which can be attributed to its ongoing investments in transformation and the digitalisation of its services.

These strategic costs are expected to pay dividends in the long term, ensuring Absa’s continued leadership in the competitive banking sector.

In an increasingly digital world, Absa has continued to champion financial inclusion, expanding its offerings to meet the growing demand for accessible financial services.

Initiatives such as Wezesha and Microinsurance highlight the bank’s determination to provide affordable and effective financial solutions, particularly in underserved segments of the population.

By embracing technological advancements, Absa is not only enhancing customer experiences but also contributing to Kenya’s broader economic development.

As Absa Bank Kenya continues to innovate and invest in both digital and financial solutions, its growing portfolio and commitment to inclusivity ensure it is well-positioned for long-term success.

This profit surge represents not just financial growth but a strategic pivot towards the future of banking in Kenya.