In a remarkable display of civic responsibility, Kenyan taxpayers have rallied to file their tax returns in unprecedented numbers, according to the Kenya Revenue Authority (KRA).

As of June 28th, 2023, over 5.4 million returns have been submitted, reflecting a remarkable 16 per cent growth compared to the same period last year.

This is according to a press release the taxman issued on Thursday just hours before the dreaded deadline for Kenyans to file their returns.

With just one day remaining before the filing deadline, the KRA has been diligently processing an average of 150,000 returns per day, with expectations of even higher numbers.

Read More

The significant increase in tax return filings demonstrates a commendable rise in tax compliance rates across the nation.

Over the span of five years, tax compliance has experienced substantial growth, with the number of returns filed soaring from 2 million in 2017 to an impressive 5.5 million for the 2021 year of income.

KRA said this upward trajectory can be attributed to the unwavering dedication of taxpayers who have wholeheartedly embraced the call to contribute their fair share of taxes.

"Tax compliance has experienced significant growth over a five-year period, from 2 million returns filed for 2017 to 5.5 million returns filed for the 2021 year of income," stated the KRA.

"The growth is fueled by taxpayers who have embraced the call of patriotism, to pay their fair share of taxes. KRA appreciates all taxpayers (individual, non-individual, resident and non-resident) for consistently taking initiative and complying with their return filing obligations."

The KRA acknowledges and expresses its gratitude to all taxpayers, regardless of their status or residency, for consistently demonstrating their commitment to fulfilling their return filing obligations.

This surge in tax compliance has been further bolstered by the KRA's proactive measures to enhance its service support framework.

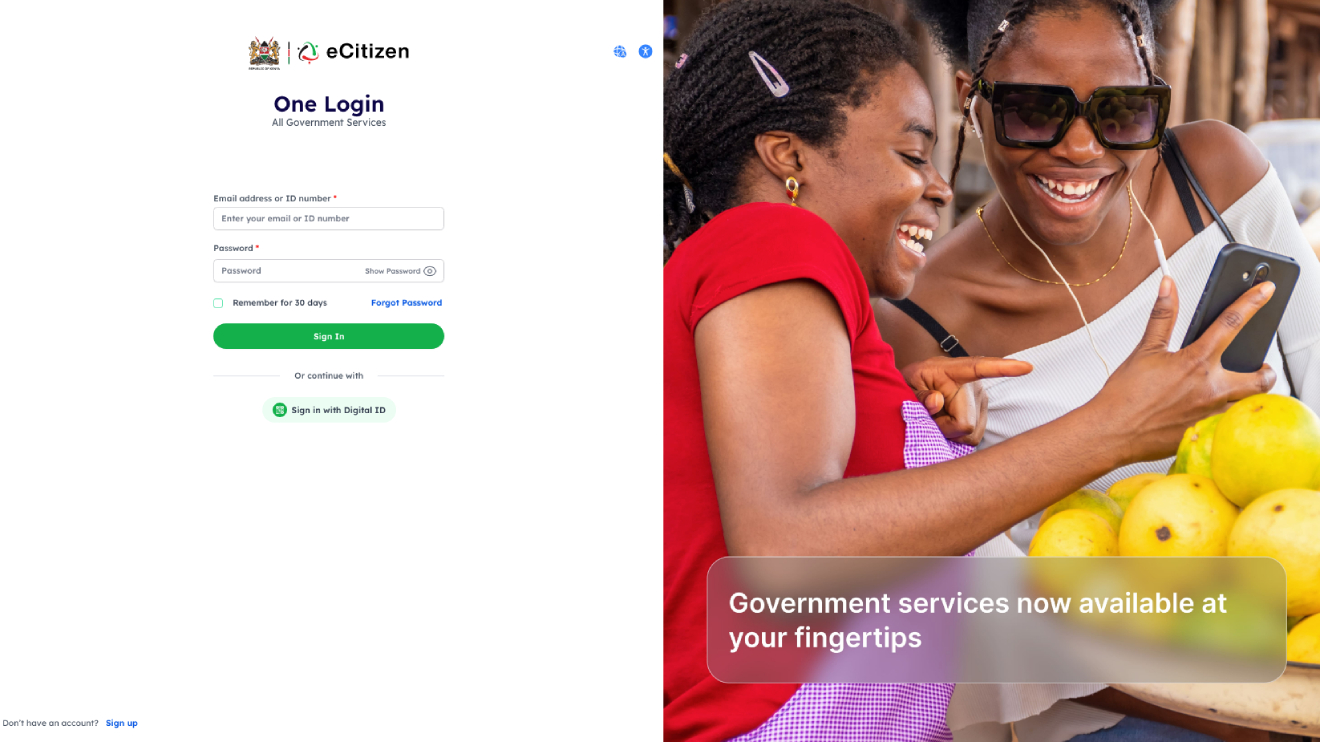

By providing offsite filing support during ushuru mashinani engagements, extending working hours at KRA service centres and select Huduma Centres, and delivering comprehensive return filing guides and video tutorials on their website, the KRA has ensured that taxpayers have the necessary tools and resources to navigate the filing process.

Furthermore, the KRA has leveraged technology and digital platforms to provide virtual support through its Contact Centre and various social media channels.

Collaborative efforts with government agencies, community leaders, business member organizations, religious institutions, and academic establishments have also been instrumental in offering onsite filing support.

By joining forces with these entities, the KRA says it aims to provide personalized assistance and address any challenges taxpayers may encounter during the filing process.

With the imminent deadline fast approaching, the KRA urges all taxpayers to promptly file their tax returns before June 30th.

"KRA encourages all taxpayers to file their tax returns before the 30th June deadline. KRA Service Centres will continue to provide filing support to all customers from 7:00 am to 7:00 pm, and the Contact Centre (0711 099 999) will operate from 7:00 am to 12:00 midnight," KRA stated.

The overwhelming response from Kenyan taxpayers in fulfilling their tax return obligations showcases a growing awareness of the significance of taxation in fostering national development.

-1756319289.jpg)

-1757101509.jpg)