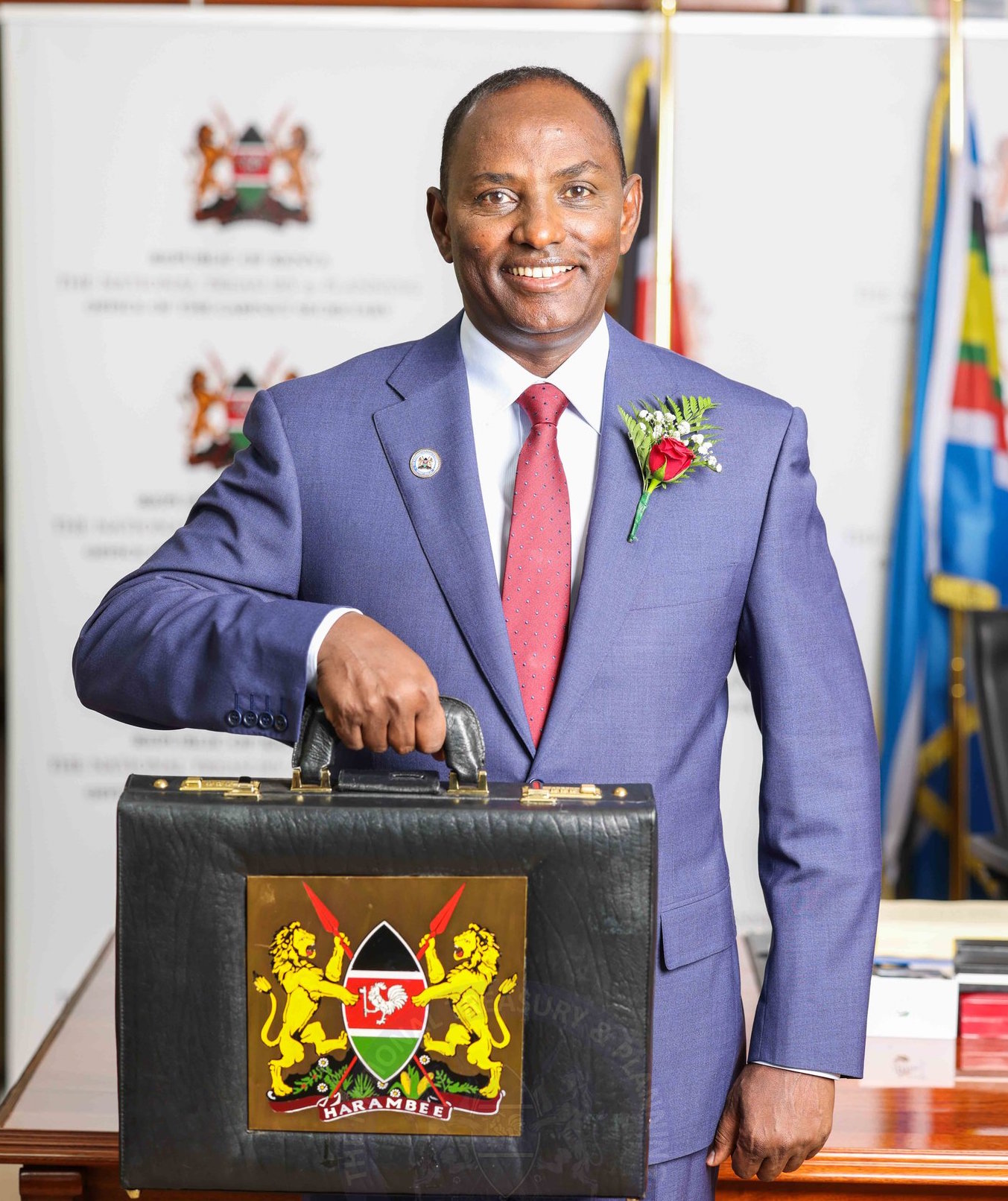

The Cabinet Secretary for National Treasury and Planning Ukur Yatani tabled the 2022/2023 budget estimates on Thursday.

In what was referred to as President Uhuru Kenyatta’s last budget, Yatani made several proposals that pitched winners against losers.

Generally, most of the proposals that were made in the budged favoured all Kenyans since we are users of petroleum products.

In the recent Treasury proposal, petroleum products are now exempt from excise duty hikes based on the inflation adjustments, which means the rate of excise duty on Petrol, Diesel and Kerosene will remain constant.

Local manufacturers of locally assembled passenger service vehicles are the second biggest winners in the proposed budget.

Read More

The budget also proposed an exemption from VAT of inputs and raw materials used by the manufacturers to assemble passenger service motor vehicles.

Likewise, the locally manufactured vehicles will be exempted from paying excise duty.

Following on the list of winners are companies donating to charitable organisations. Yatani proposed to allow entities that are not registered as Non-Governmental Organisations (NGO) or Societies to deduct their donations from taxable income.

Also in the winners' category are industries making plants and machinery used for manufacturing pharmaceutical products. They have also been exempted from VAT.

Suppliers of medical oxygen have also been exempted from the VAT.

Another group in the winners' category are the importers of eggs for the sole purpose of hatching. They have been exempted from the excise duty. This is because local production cannon meet the demand for eggs.

Farmers and pastoralists also have won big as Yatani reduced export fees on raw hides and skins. The fees were imposed to promote local value addition and discourage the export of raw hides and skin.

Leading the other category that is not so happy are the alcohol and gaming industries.

The Treasury CS has slapped a 15 per cent excise duty on the two and defended the move saying it is aimed at curb gaming, gambling and drug addiction among the youth.

Coming second in the list of losers are the producers of liquid nicotine. Liquid nicotine products are now going to attract Sh70 per millilitre in excise duty up from Sh1.

The other lot to feel the weight of the 2022/2023 proposed budget is the boda boda operators.

The Treasury CS has proposed changes to the Insurance Act to make motorbikes and tuk-tuk owners intending to use them for passenger transport to have third party covers in order to protect their clients.

The rising number of accidents and fatalities involving boda bodas and tut-tuks informed this decision.

The next group of losers are all taxpayers involved in tax disputes with the Kenya Revenue Authority (KRA).

Any taxpayer with a tax dispute will be required to deposit 50 per cent of the disputed tax revenue in a special account at the Central Bank of Kenya If the Tax Appeals Tribunal (TAT) makes a ruling in favour of the taxman even if a taxpayer appeals against such a ruling.

However, should the TAT rule in the taxpayer's favour, the deposited amount will be reimbursed to the taxpayer.

The government has also slapped an extra 10 per cent in excise duty on all excisable products save for petroleum products.

Yatani hopes to increase duty collection from Sh260 billion to Sh297 billion.

-1752586683.jpg)

(1)-1752516757.jpg)

(1)-1746786193.jpg)