Kenya Electricity Generating Company PLC (KenGen) has issued a dividend payout of Sh4.3 billion, with the Government taking Sh3 billion as the majority shareholder.

This represents a 117 per cent per-share increase compared to the previous year and follows the company’s profit after tax of Sh6.8 billion for the financial year ending 30, 2024.

The latest payout comes after an initial disbursement of Sh1.3 billion to private and institutional shareholders on February 13, 2025.

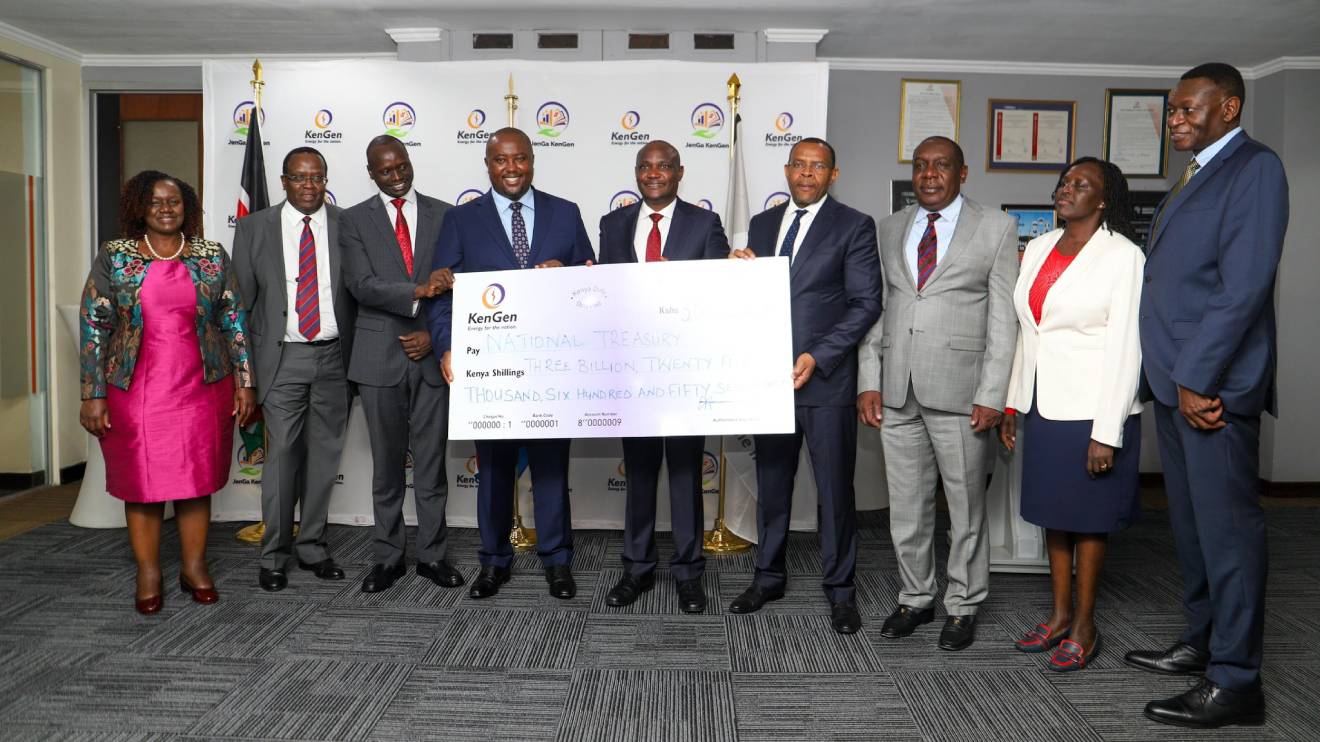

KenGen Chairman Alfred Agoi and Managing Director and CEO Eng. Peter Njenga made the announcement at Stima Plaza in Nairobi, where they presented a dummy cheque to National Treasury and Economic Planning CS John Mbadi.

The event underscored the government’s financial stake in the power generator and its role in the country’s energy sector.

Read More

“Their stability, cost efficiency, and reliability in energy supply are key indicators of our nation’s economic performance, and KenGen stands at the heart of our energy value chain,” Mbadi stated.

"We value your work for the economic survival of our country and will continue to support new projects with funding from development partners."

Energy PS Alex Wachira also weighed in on KenGen’s performance.

“KenGen is well run, consistently delivering profit year after year. Moving forward, our focus will be on supporting new projects in geothermal, hydro, solar, and wind through backing from the National Treasury to help access funds from development partners," he said.

Agoi attributed the dividend payout to a combination of increased electricity production, efficiency improvements, and sound financial management.

“Our dividend payout is not merely a financial milestone but a clear reflection of effective policy collaborations and our commitment to Kenya’s growth,” he stated.

Njenga highlighted the company’s strategy of balancing short-term shareholder gains with long-term energy investments.

"Our performance demonstrates our ability to balance immediate shareholder returns with long-term investments in Kenya’s energy future," Njenga remarked.

"This dividend is a tangible affirmation of our strategic focus, which has optimised our operations and reinforced our leadership in the power generation sector.”

He also pointed to favourable public policies, strategic partnerships, and regulatory support as factors that had contributed to KenGen’s performance.

Agoi and Njenga noted that ongoing investments in operational efficiency and new technologies would help enhance the country’s energy security and economic development.

During the cheque presentation, Mbadi acknowledged that it was uncommon for the government to receive funds from a local agency.

With the latest dividend, KenGen remains among the top dividend-paying companies on the Nairobi Securities Exchange.

It is important to note that government owns 70 per cent of the company, while private investors hold the remaining 30 per cent