KCB Group has integrated the Pan-African Payment and Settlement System (PAPSS) into its banking systems in a move aimed at augmenting transactions between African countries.

KCB is the first bank to adopt PAPSS in East Africa and this will enable its clients to make cross-border settlements and currency conversions faster, cheaper and access a wider market.

PAPSS, developed by African Export- Import Bank (Afreximbank), is a centralized financial market infrastructure allowing faster and cheaper cross-border payments and trade transactions.

The system supports a more efficient and sustainable regional trade framework by helping to alleviate foreign currency demand pressures through its new net settlement mechanism.

KCB says the pact will enable it to continue playing a greater role in spearheading economic transformation across Africa as it continues to lead in financial inclusion in the continent.

Read More

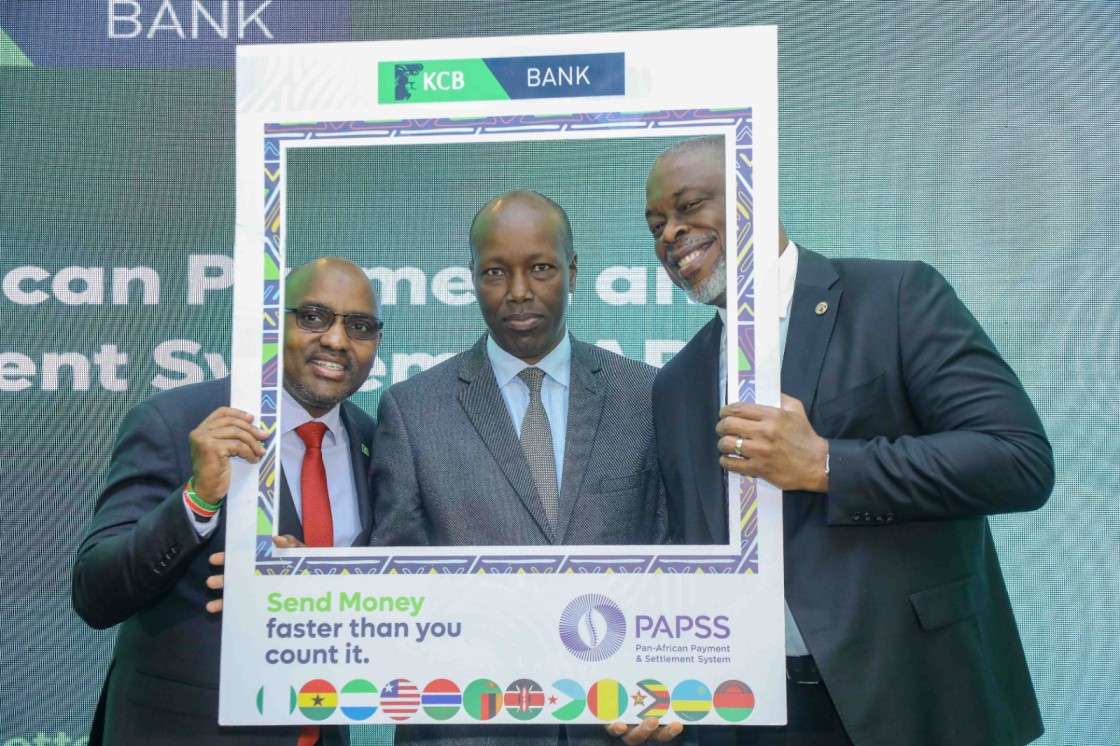

KCB Group CEO Paul Russo said the bank wants to play a greater part in catalyzing trade and payments within and without Africa, leveraging its digital capabilities and regional footprint.

“Our entry into PAPSS aligns perfectly with our strategy of supporting economic growth in Kenya and across Africa by facilitating seamless financial transactions,” Russo indicated.

Customers of KCB, with a presence in seven East African nations, will now access vast opportunities across Africa via the bank’s payments and collections expertise and network.

PAPSS CEO Mike Ogbalu lauded KCB for adopting PAPSS saying it showcases the Tier 1 bank’s pledge to boosting financial connectivity and supporting the implementation of the African Continental Free Trade Area (AfCFTA).

“With PAPSS, KCB customers will experience unprecedented ease in cross-border transactions, paving the way for enhanced trade opportunities and economic growth across the continent,” noted Ogbalu.

Central Bank of Kenya (CBK) Director, Banking & Payment Services Michael Eganza said CBK will continue supporting Kenyan banks to improve their cross-border payment ecosystems.

“We are increasingly looking at reinvigorating the regulatory regime to promote innovation and deepen financial inclusion within the industry,” he indicated.

On his part, Investments, Trade and Industry Cabinet Secretary Lee Kinyanjui urged African countries to work to eliminate balance of payment challenges to liberate their economies.

“With intra-Africa trade currently at 14 per cent, there is an opportunity for players within the ecosystem to progressively evaluate the opportunities that can be harnessed to support with PAPSS leading the way on this,” stated Lee.

PAPSS has roped in 15 Central Banks, more than 150 commercial banks, and 14 switches across Africa with many more showing interest towards realizing economic integration.

PAPSS is set to improve cross-border real-time payments, reduce commercial banks liquidity needs, promote favorable exchange rates, and strengthen oversight by African central banks.

-1757101509.jpg)