The Kenya Pipeline Company (KPC) is considering an Initial Public Offering (IPO) at the Nairobi Securities Exchange (NSE), according to National Treasury Cabinet Secretary John Mbadi.

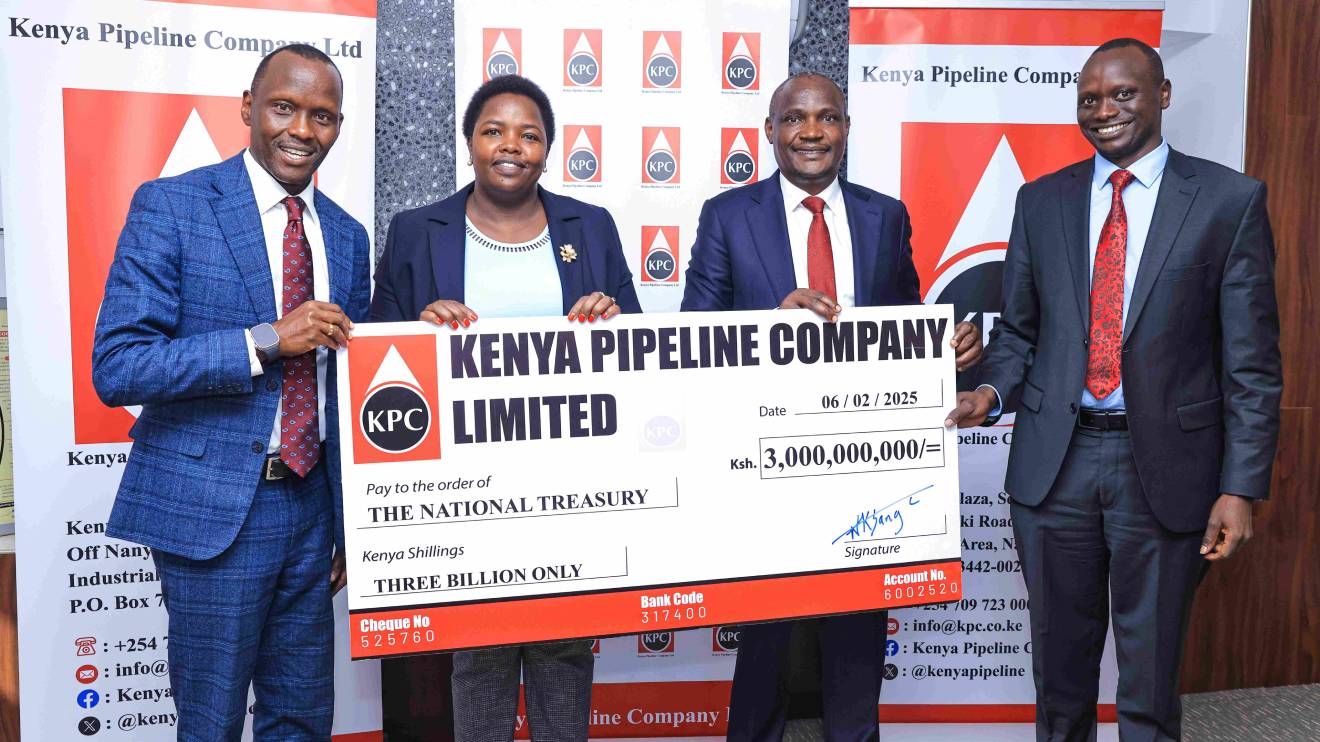

This announcement came as he received an interim dividend cheque of Sh3 billion from KPC Board Chair Faith Boinett at the company’s headquarters in Nairobi.

This payment brings KPC’s total dividend contribution to the National Treasury to Sh10.5 billion in the past 12 months.

“We have this feeling that KPC needs to realise the benefits that will accrue from a listing at the Nairobi Securities Exchange,” stated Mbadi, citing the success of listed companies like Safaricom and KenGen.

He emphasised that an NSE listing would provide KPC with “much-needed liquidity and capital for expansion and diversification into LPG,” particularly as the company pursues regional growth.

Read More

Furthermore, it would allow Kenyans to own a stake in the strategically important asset.

KPC has ambitious plans for regional expansion, including the development of a trading hub in Mombasa for petroleum products.

This hub is intended to boost the regional oil and gas industry.

Mbadi also pledged support for the winding down of the Kenya Petroleum Refinery (KPRL) and its integration into KPC, stressing the need for a swift transition within the current financial year.

The government’s commitment to enhancing the performance of state-owned enterprises was further underscored by Lawrence Kibet, Director General, Public Investments and Portfolio Management.

He announced that the Government Owned Enterprises (GOE) Bill 2024, recently passed by the Cabinet and currently under review by the Attorney General, will establish “commercial principles and the procedure for establishing a Government Owned Enterprise” and its governance structures.

The Bill aims to “ensure that the public get a worthy ROI (Return On Investment) from public-owned institutions” by granting autonomy, reducing red tape, and fostering competitiveness.

Mbadi lauded KPC’s financial performance for the year ending June 2024.

“Recording a Sh10.5 billion profit is no small feat. It speaks volumes about the company's operational efficiency, sound management, and dedication to delivering value to its stakeholders,” he commented.

He also stressed the importance of strong corporate governance frameworks within state corporations, stating, “Today, as I receive this dividends cheque of Sh3 billion from the KPC Board, I am reminded of the critical role State Corporations play in driving our economic growth and supporting national development goals.

"I would like to emphasize that such achievements must be anchored on robust corporate governance structures. Strong governance is essential for ensuring transparency, accountability, and sustainable financial performance," Mbadi stated.

"I urge all State corporations to tighten their corporate governance frameworks to not only enhance their profitability, but also safeguard public resources and build stakeholder confidence.”

KPC’s Managing Director, Joe Sang, along with KPC Board Members and senior management, were also present at the event.

Boinett attributed KPC’s strong financial results to “efficient operations and diversification into new revenue streams such as Fiber Optic Cables (FOC) and LPG.”

She highlighted KPC’s regional dominance, noting their 90 per cent stake in fuel transportation to Uganda and their pursuit of a similar share in Rwanda.

“KPC remains steadfast in its commitment to regional competitiveness,” she affirmed, expressing gratitude to the National Treasury for their support.

Over the past decade, KPC has contributed Sh63 billion in taxes and dividends.

In the 2023-24 financial year, the company achieved a Profit Before Tax (PBT) of Sh10.1 billion, up from Sh7.6 billion the previous year.