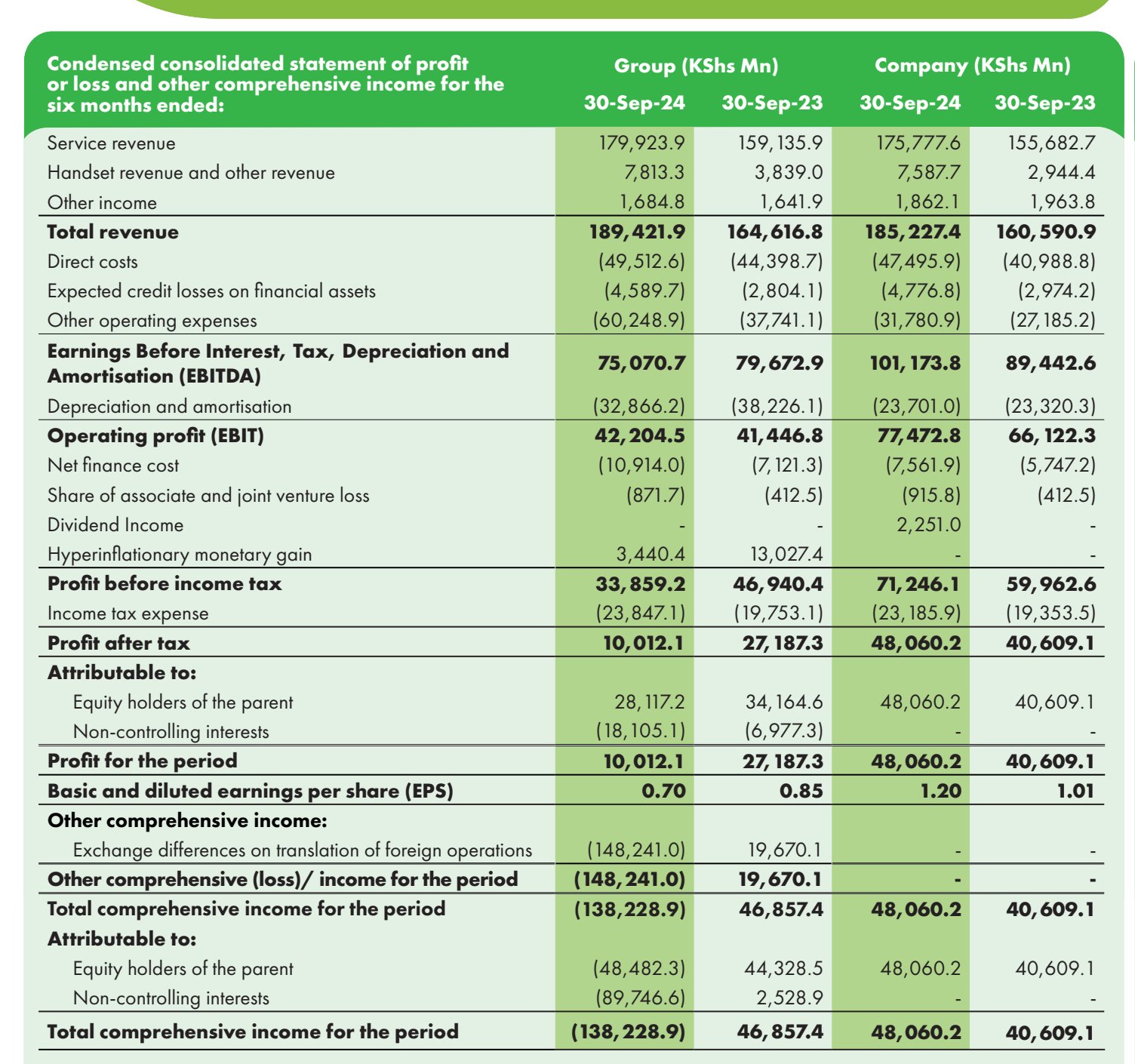

Safaricom has reported a 17.7 per cent drop in profit to Sh28.1 billion for the half year ending September 30, 2024 due to the effects of Ethiopia’s Birr currency depreciation.

Safaricom CEO Peter Ndegwa also revealed the noteworthy contraction of the net income excluding minority interest was also occasioned by Ethiopia’s hyper inflationary accounting.

The Ethiopia unit is renegotiating foreign currency denominated contracts, onboarding local suppliers for certain products and services and decreasing expatriate’s base to lessen the short-term effects of the ongoing foreign exchange regime reforms.

“Despite the short-term challenges, we remain confident in the long-term commercial success of our Ethiopian business, and we are very encouraged by the commercial acceleration,” noted Ndegwa.

Safaricom CFO Dilip Pal was optimistic the sizeable dent left by the correction of the Birr's exchange rate on the half-year results will have much lower effect on its full-year results.

Read More

However, Safaricom Group service revenue expanded by 13.1 per cent to Sh179.9 billion as the Group Earnings Before Interest and Taxes (EBIT) also grew by 1.8 per cent to 42.2 billion.

Safaricom Kenya recorded a 14.1 per cent growth in net income to Sh47.5 billion in the six months ended September 30, 2024.

The Kenyan unit's service revenue grew 12.9 per cent to Sh177.5 billion, as EBIT and Net income grew 18 per cent to Sh79.2 billion, and 14.1 per cent to Sh47.5 billion respectively.

In the half year to September 30, 2024, Safaricom Group service revenue expanded 13.1 per cent to Sh179.9 billion, as its EBIT also witnessed a growth of 1.8 per cent to Sh42.2 billion.

“This performance, which comes at a time when we are marking 24 years of connecting and transforming Kenyans’ lives, reflects the relentless execution of our strategy,” said Ndegwa.

The technology-driven company also revealed that its net income excluding minority interest on underlying basis expanded by 27.1 per cent to Sh36.7 billion during that period.

.jpg)

“We are proud of the value that we have given our customers through use of technology, and we will continue growing our core business while expanding into new services through our innovative spirit,” added the CEO.

Similarly, mobile voice, data and SMS contributed Sh93.9 billion of the Group’s total revenue (52.2 per cent), while M-Pesa contributed Sh77.2 billion (42.9 per cent).

“The Board is pleased with the great performance recorded in the period under review,” stated Safaricom Board Chairman Adil Khawaja.

He added: “We remain focused on our vision of becoming Africa’s leading purpose-led technology company as we advance our propositions in both Ethiopia and Kenya.”

In the half year, the Group’s voice revenue grew 4.5 per cent to Sh40.9 billion, mobile data revenue grew 21.5 per cent to Sh37.6 billion as customers spiked 7.8 per cent to 52 million.

Similarly, its one-month active M-Pesa customers increased by 4.5 per cent to 40.9 billion year-on-year, as one-month active mobile data customers grew 10.8 per cent to 39.8 billion.

Safaricom Ethiopia has a 46 per cent network coverage after its October 6, 2022 launch to become the first private operator in the country with a population of about 120 million.

Safaricom Ethiopia’s customer base grew by 47.3 per cent to 6.1 million monthly active customers, while data use closed at 6.6GB per average user compared to Kenya’s 4.1GB.

The Ethiopia currency challenge has forced the telco to revise its break-even year to the fiscal year ending in March 2027, from the earlier four-year projection of March 2026.

-1731013976.jpg)

-1732228005.jpg)

-1732185003.jpg)

(1)-1732264169.jpg)