In a bold move to cement its leadership in sustainability, Safaricom has secured a second Sh15 billion Sustainability Linked Loan, doubling its total to an impressive Sh30 billion.

This latest financing, which now stands as the largest in East Africa, underscores the company’s commitment to advancing its Environmental, Social, and Governance (ESG) objectives, following the successful closure of a similar loan last year.

The loan, extended by a consortium of four prominent banks—KCB, ABSA, Standard Chartered, and Stanbic—will propel Safaricom’s strategic investments in sustainability.

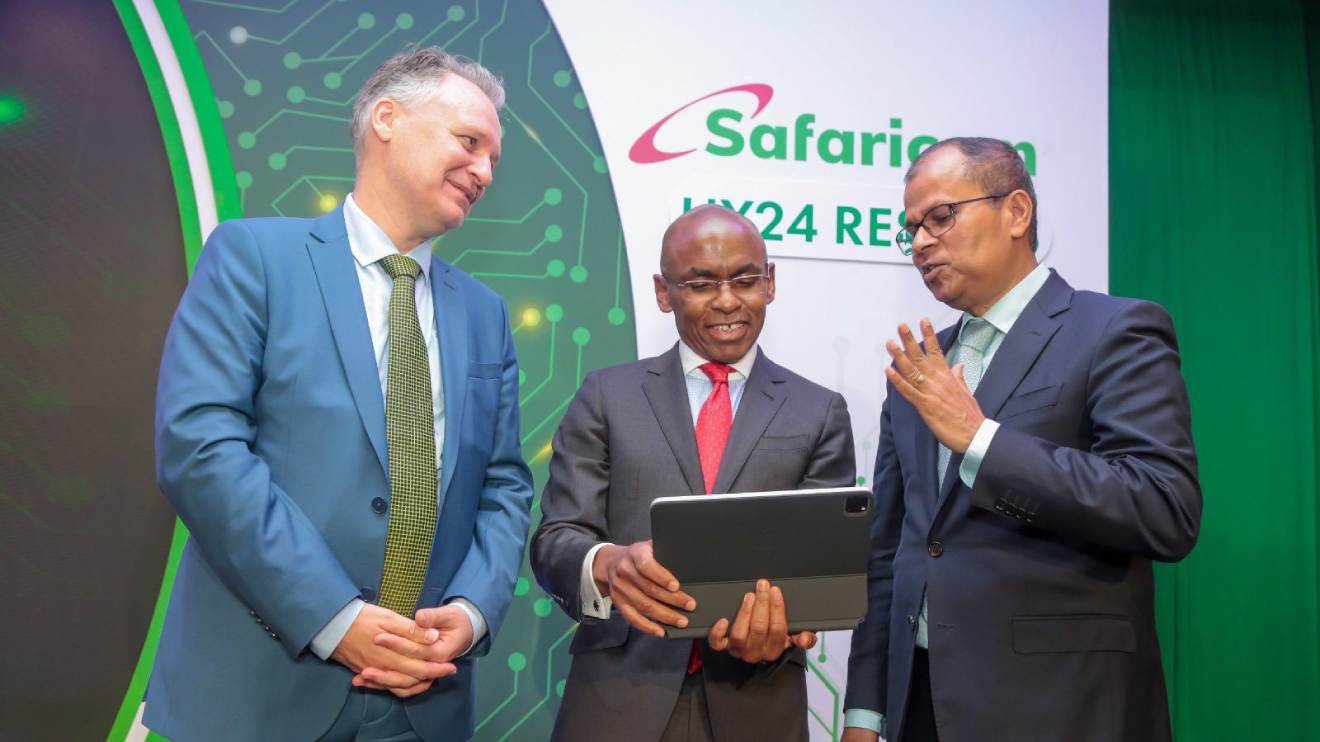

Speaking about the landmark deal, Safaricom CEO Peter Ndegwa said, “This deal helps to accelerate the advancement of our sustainability agenda. It is a testament that we have achieved the targets we set out to achieve with the first one where we aligned our sustainability agenda with our financial strategy.”

The funds are slated to fuel Safaricom's ambitious transition into a fully-fledged technology company.

Read More

With this transformation, the company aims to reduce its carbon footprint, foster gender diversity, and expand its monitoring of social impacts.

Safaricom’s ultimate goal is to become a Net Zero carbon emitter by 2050, with carefully structured programmes already in motion to guide the journey.

Reflecting on the importance of collaboration, Ndegwa highlighted the role of partnerships in driving the company's sustainability progress.

“We are delighted that we have tapped into partnerships with key leaders in the region in the latest chapter of sustainability financing. It will improve our accountability measures on ESG reporting where we will have an opportunity to attract more investment and growth,” he noted.

Dilip Pal, Safaricom’s Chief Financial Officer, echoed this sentiment, emphasising the alignment between Safaricom’s financial and sustainability strategies.

“Safaricom is dedicated to making conscious efforts to ensure that our projects and initiatives align with the ESG agenda. This deal highlights our commitment to sustainability and the inherent alignment of our sustainability and financing strategies,” Dilip remarked.

The transaction was expertly handled by Standard Chartered, which acted as the Mandated Lead Arranger, Bookrunner, Global Coordinator, and Sustainability Coordinator.

Kenya Commercial Bank was the Mandated Lead Arranger, with Stanbic Bank Kenya and ABSA Bank Kenya also playing key roles as Arrangers.

This expanded loan facility further solidifies Safaricom’s vision of a sustainable future, positioning the company as a trailblazer in responsible business practices and a leader in the region's green financing space.

-1757663582.jpeg)