The Insurance Regulatory Authority (IRA) has announced a joint initiative with the Advocates Complaints Commission (ACC) to curb the increasing number of complaints against advocates accused of withholding insurance compensation.

The move comes amidst concerns about insurers' reluctance to cooperate with investigations into these cases.

The IRA and ACC signed a Memorandum of Understanding (MoU) on Monday, formalizing their existing collaboration to address the issue.

“The MoU formalises the existing collaborative efforts between IRA and ACC to address concerns related to increased complaints against advocates, particularly in the settlement of insurance compensation claims,” IRA stated.

Read More

The regulator noted that a significant number of complaints lodged with the ACC involve advocates withholding compensation from settled insurance claims.

However, the ACC has faced challenges in obtaining information from insurance companies, hindering its ability to effectively investigate and resolve these complaints.

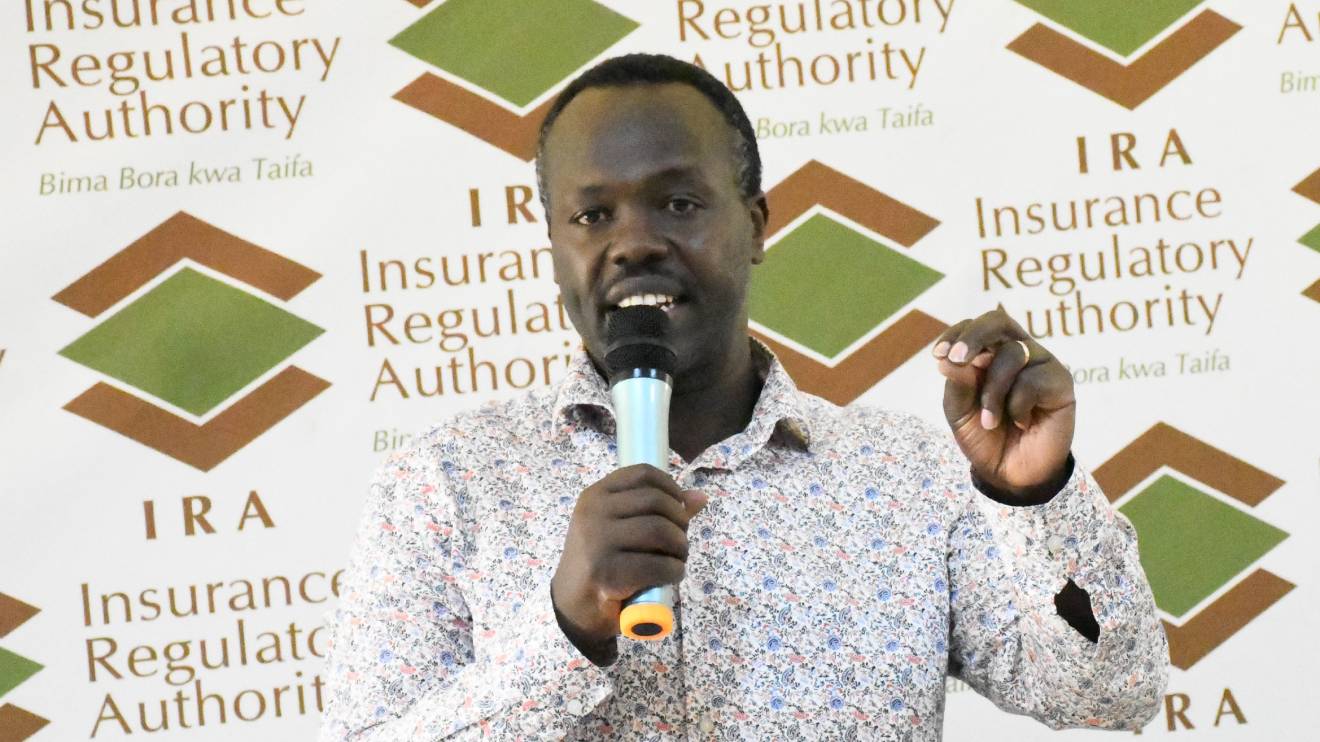

Commissioner of Insurance, Godfrey Kiptum, emphasized the importance of this partnership in ensuring the integrity of the insurance industry.

"This partnership is a critical step in our ongoing efforts to ensure that the insurance industry operates with the highest levels of integrity and accountability," he said.

"We are committed to addressing any gaps that allow for the exploitation of policyholders and ensuring that justice is served."

Under the terms of the MoU, the IRA has committed to ensuring that insurance firms cooperate with the ACC whenever it requires information to strengthen transparency and fair treatment of insurance policyholders and claimants.

In cases where insurers are uncooperative, the ACC will be allowed to formally request the IRA's intervention.

The partnership also includes provisions for regular information exchange, capacity building, and collaborative policy development to bolster consumer protection.

ACC Chairman, Moses Cheboi, expressed optimism about the collaboration's potential to benefit the public.

"This MoU provides us with the necessary tools and support to effectively investigate and resolve complaints, particularly those involving the remittance of insurance compensation by advocates. We look forward to a fruitful collaboration that will ultimately benefit the public," he said.

The announcement comes as the insurance sector faces scrutiny over its handling of consumer complaints.

In the year to June 2023, the sector contributed 60 per cent of the abuse of buyer power cases investigated by the Competition Authority of Kenya (CAK), with a majority of the cases involving delayed payments.

The IRA's intervention is expected to provide greater accountability and transparency in the insurance industry, ultimately protecting the rights of policyholders.

-1756474472.jpg)

-1753733469.jpeg)