In a move set to impact Kenyans amidst the rising cost of living, the latest budget proposals reveal significant changes to taxation policies, aimed at addressing various socio-economic issues.

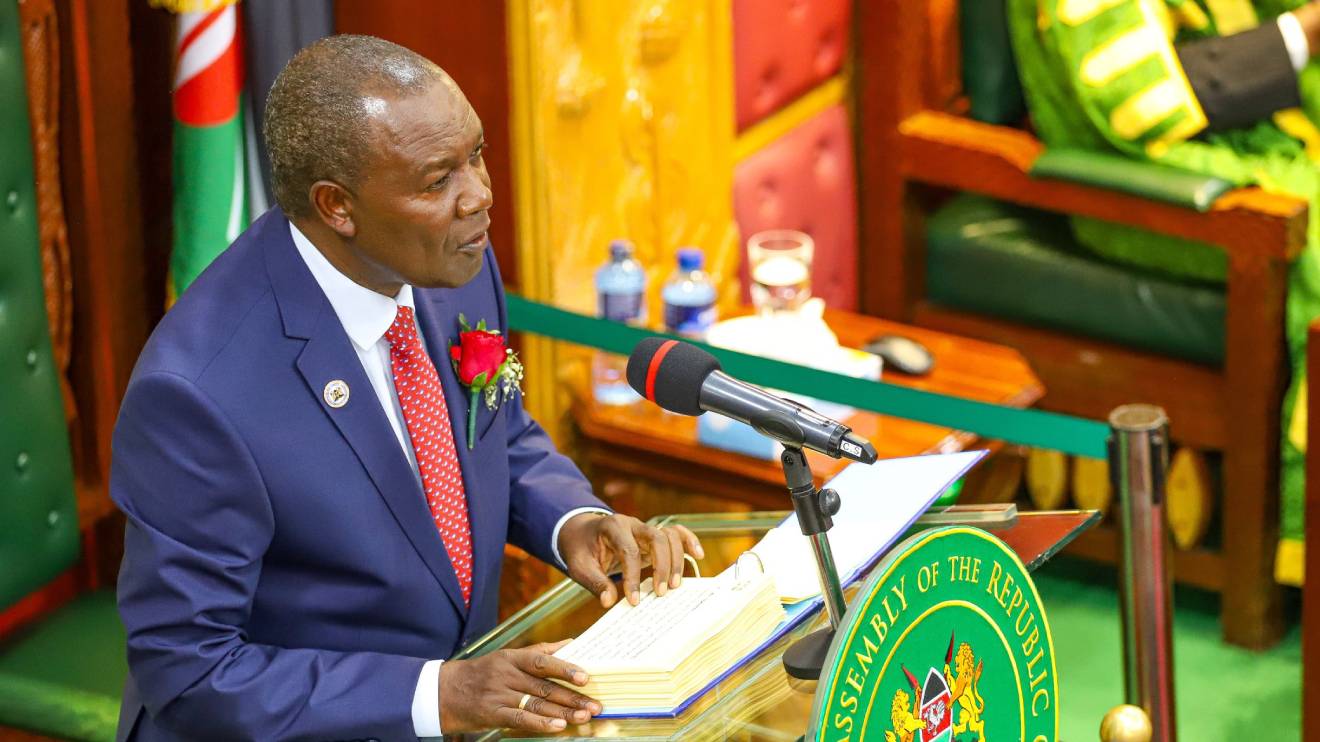

These adjustments comntained in the national budget read in the National Assembly by National Treasury CS Njuguna Ndungu come at a time when many Kenyans are already feeling the financial strain.

Relief for Private Sector Employees

The current tax-free amount on subsistence allowance for private sector employees during official duties outside their usual place of work is capped at Sh2,000 per day.

Acknowledging the inadequacy of this amount due to inflation, a proposal has been put forth to review this threshold to not exceed 5 per cent of the employee's monthly gross earnings.

Read More

This measure is intended to cushion employees against the high cost of living.

Tackling Betting and Gaming Addiction

The government has also turned its attention to betting, gaming, prize competitions, and lotteries, activities which have been affecting the socio-economic fabric due to their addictive nature.

Despite raising excise duty from 7.5 per cent to 12.5 per cent last year, participation, particularly among school-going children and young adults, remains high.

To further curb this behaviour, a proposal has been made to increase the excise duty rates to 20 per cent.

Excise Duty on Alcohol and Cigarettes

In line with research commissioned by the National Treasury, a new excise duty structure on alcoholic beverages is proposed.

The specific rates per litre for wines and beer are to be replaced with a rate of Sh22.50 per centilitre of pure alcohol, and for spirits, a rate of Sh16 per centilitre of pure alcohol.

This structure aims to encourage responsible consumption without distorting the market.

Cigarette excise duty will also see changes, with a proposal to harmonise the rates for cigarettes with and without filters at Sh4,100 per mile, aimed at reducing mis-declaration and illicit trade.

Additionally, the excise duty rate on products containing nicotine or nicotine substitutes is set to rise from Sh1,594.50 per kg to Sh2,000 per kg, excluding approved medicinal products.

The duty on liquid nicotine for electronic cigarettes will increase from Sh70 per millilitre to Sh100 per millilitre.

Digital Services and Advertising

To ensure fair treatment of both residents and non-residents offering excisable services in Kenya, an amendment to the Excise Duty Act is proposed, which will charge excisable services offered through digital platforms by non-residents.

The Finance Act 2023's introduction of excise duty on advertisements of alcoholic beverages, betting, gaming, lotteries, and prize competitions on traditional media has led to a shift towards internet and social media advertising.

To level the playing field, the scope of this tax is proposed to be expanded to include fees charged on internet and social media advertisements.

Trade and Excise Duties

In a bid to promote trade within the East African Community (EAC) region, the proposed removal of the 25 per cent excise duty on imported eggs, potatoes, and onions originating from EAC Partner States, subject to compliance with EAC rules of origin, is expected to bolster regional trade relations.

Communication and Financial Services Duties

Lastly, the excise duty of 15 per cent on telephone and internet data services, fees charged on money transfer services by banks, and other financial service providers will remain unchanged. This is intended to benefit the retail electronic payments ecosystem.

These proposed changes are a mixed bag, with some aimed at providing relief amidst economic hardship, while others seek to address social issues and promote regional trade.

The coming months will reveal how these measures impact the daily lives of Kenyans already grappling with the high cost of living.