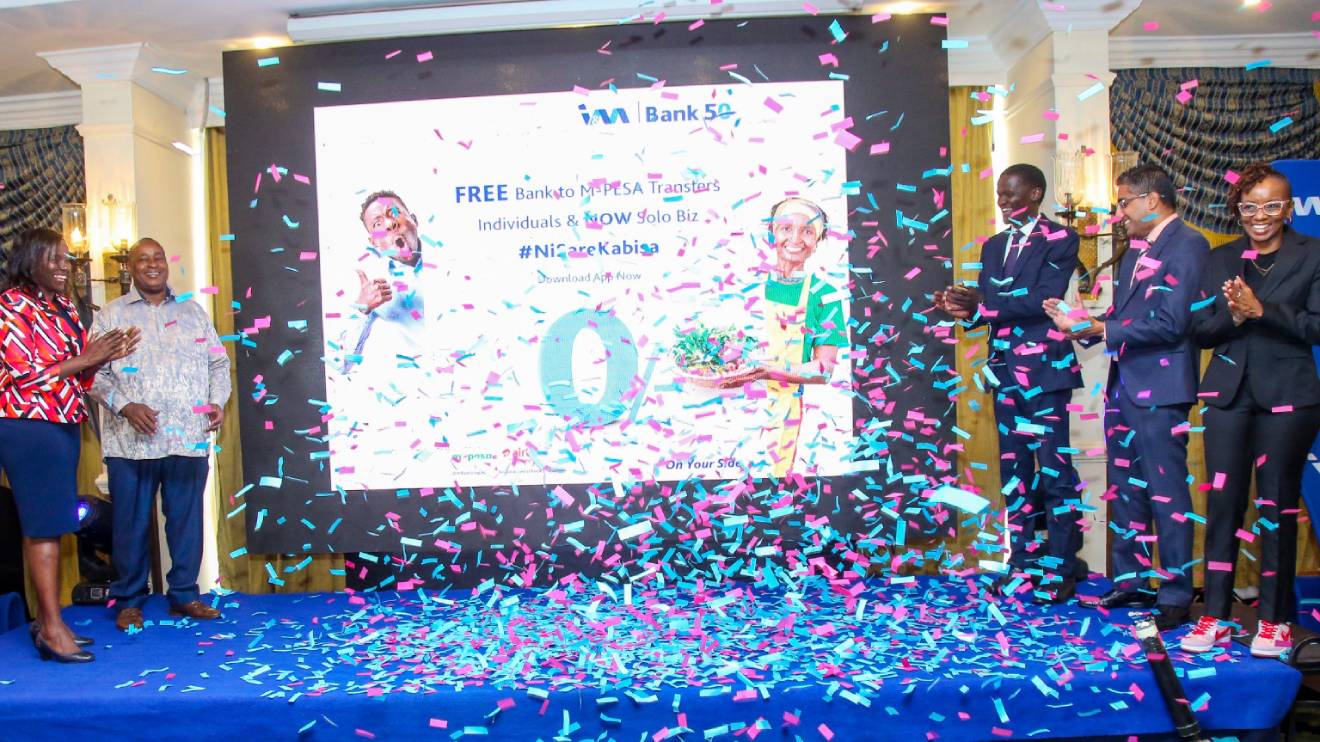

In a bid to bolster the growth of small businesses and enhance financial inclusivity, I&M Bank has extended its offering of free M-Pesa and Airtel Money transfers to sole business owners.

This initiative follows a similar provision introduced last year, which catered to personal account holders.

Shameer Patel, Head of Personal & Business Banking at I&M Bank, underscored the institution's commitment to supporting small enterprises, stating, "In addition to the free bank to M-PESA and Airtel Money transfers, individual customers will have access to Unsecured Personal Loans, a newly launched 30 Day loan and up to 12 per cent per annum interest on savings via the I&M Savers Account."

Gul Khan, CEO of I&M Bank Kenya, emphasized the vital role played by small businesses in driving economic activity.

"Small business owners are the heartbeat of the economy and they contribute to over 80 per cent of the employment in the country," Khan stated.

Read More

Ben Muhati, Chairperson of the MSME Alliance, echoed this sentiment, affirming the significance of initiatives tailored to support small-scale entrepreneurs.

"They are conscious of each coin they spend as they seek to generate maximum business value for their hustles," Muhati added.

The decision by I&M Bank to expand its support beyond personal accounts and waive business registration search fees has been praised by stakeholders.

Muhati described it as "a step in the right direction," highlighting the positive impact it will have on the entrepreneurial landscape.

With these measures in place, I&M Bank is poised to empower small business owners, facilitating their financial transactions and providing access to essential financial services.

shares a light moment with the company's Group CEO Dr Patrick Tumbo (right) at a past event-1758121528.jpeg)

-1758116028.jpeg)