KCB Group has announced an impressive financial performance for the nine months ending September 30, 2023.

The bank reported a net profit of Sh30.7 billion showcasing resilience in the face of a challenging economic and market environment.

The significant increase in profitability from Sh30.5 billion in the same period last year is attributed to the expansion of the balance sheet, which grew by an impressive 64.5 per cent to Sh2.1 trillion.

This growth was driven by the consolidation of the DRC-based subsidiary Trust Merchant Bank (TMB), acquired in December 2022, and organic expansion.

Read More

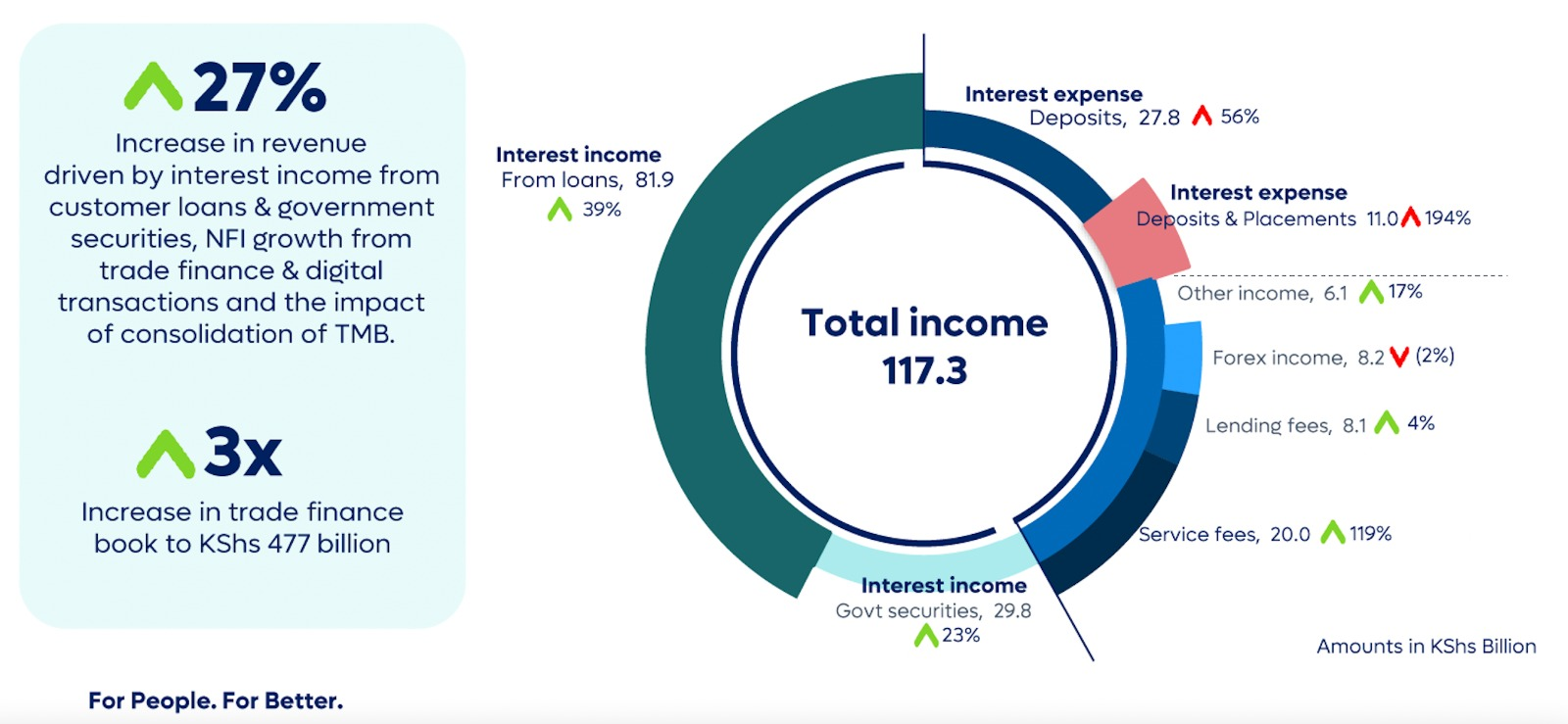

The diversified income streams of the group played a crucial role in this success, with revenue soaring by 27.3 per cent to Sh117.3 billion.

Non-funded income was a major contributor, increasing by 38.7 per cent to Sh42.4 billion, driven by enhanced investments in digital capabilities.

KCB Group CEO Paul Russo highlighted the strategic approach, stating, "Our focus has been on the speedy and sustainable resolution of our customers' pain points and ring-fencing the business to guarantee long-term growth."

He added that, with a solid and well-diversified balance sheet, the Group was on track to meet its full-year ambitions based on the improved performance in the third quarter, supported by resilient business segments and subsidiaries.

He mentioned that KCB had made great strides by investing in modernizing both its hardware and application infrastructure to enhance capacity and systems capability.

"With a solid and well-diversified balance sheet, we are on track to meet our full-year ambitions going by the improved performance in the third quarter, supported by resilient business segments and subsidiaries," Russo stated.

"We have been made great strides investing in modernizing both our hardware and application infrastructure to improve capacity and systems capability."

The contribution of Group businesses (excluding KCB Bank Kenya) to overall profitability increased to 27.9 per cent from 16.4 per cent, with profit before tax from these entities reaching Sh11.3 billion, up from Sh7.1 billion in the previous year.

The total assets also saw a historic milestone, surpassing the two trillion shillings mark to close at Sh2.1 trillion.

In terms of income, non-funded income growth was complemented by a 21.6 per cent increase in funded income, reaching Sh74.9 billion.

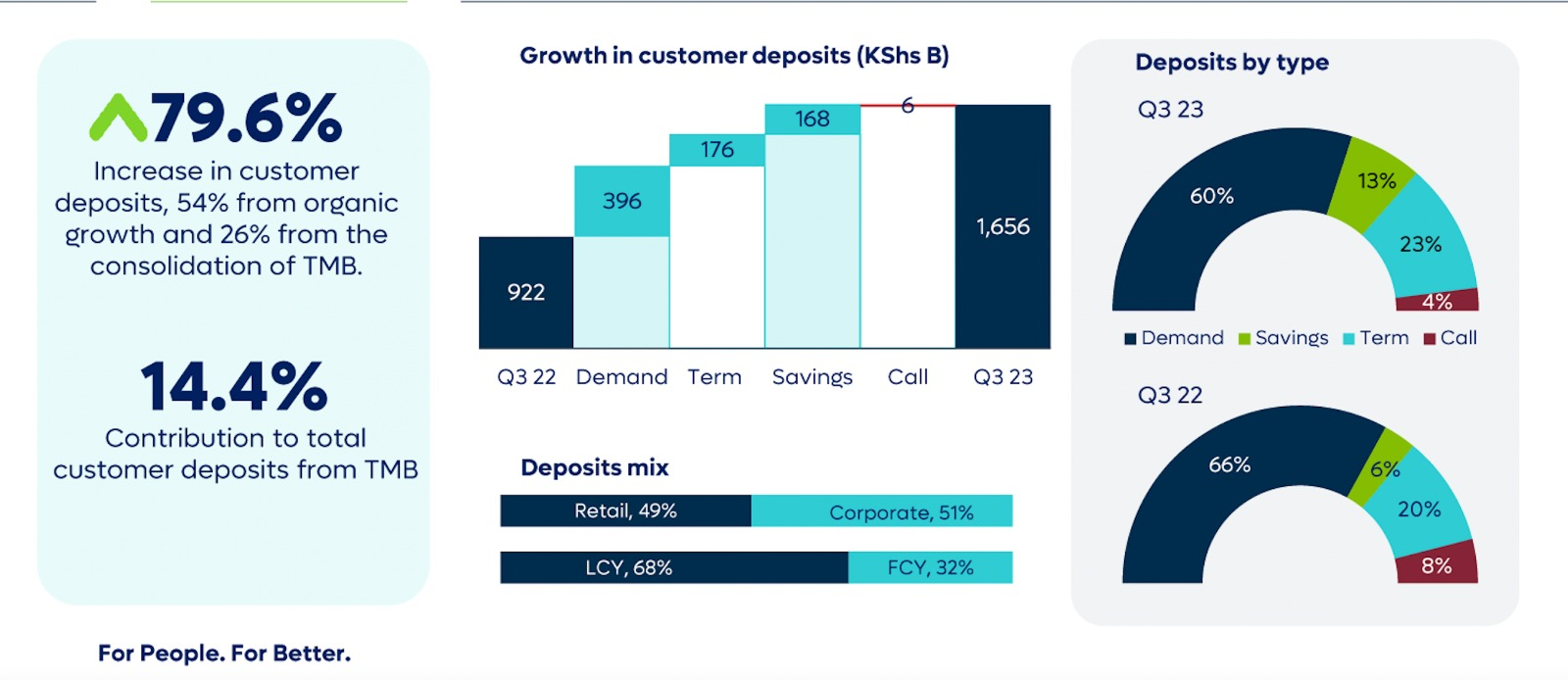

Customer deposits surged by 79.6 per cent to Sh1.7 trillion, while net loans and advances crossed the one trillion-shilling mark for the first time, closing the period at Sh1.05 trillion.

The bank's commitment to prudence in credit management is evident in the 118.1 per cent increase in loan provisions, driven by additional cover taken up in Kenya due to the depreciation of the Kenyan Shilling on foreign currency-denominated loans.

Despite challenges such as legacy legal claims at NBK, staff restructuring expenses, and TMB consolidation contributing to total costs of Sh60.8 billion, KCB Group's outlook remains optimistic.

Shareholders' funds increased by 19 per cent to Sh226.1 billion, and the bank's capital buffers were within regulatory limits.

KCB Group Chairman Joseph Kinyua emphasized the institution's agility and strength, stating, "We have deliberately continued to build strong governance and risk management frameworks to cushion the business against shocks and to guarantee shareholder returns."

"While we continue to operate in a tough operating environment, our subsidiaries have shown great resilience," he added.

Looking ahead, he expressed confidence in sustained momentum, citing easing inflation and government interventions supporting economic growth across the region.

-1757663582.jpeg)