Sendwave has launched a new banking product that permits users to earn interest and pay reduced fees on international remittances and targets Kenyans living in the United States.

The new international financial product is christened Sendwave Pay and allows existing Sendwave users to access an FDIC-insured bank account with an accompanying debit card.

The digital remittance company says Sendwave Pay is available in the US to users through the Sendwave app on iOS and Android.

Sendwave Pay features:

• A bank account with no hidden account creation, maintenance or minimum balance fees.

Read More

• Access to up to 0.4 per cent improvement on exchange rates and up to 25 per cent savings on transaction fees on remittances to Kenya, Ghana, Tanzania, Uganda, Nigeria, and Liberia when using the funds in their accounts.

• A Sendwave Pay debit card to use on every day transactions;

• Reimbursements for international transaction fees when using their Sendwave Pay debit card outside of the US;

• Earn up to 0.51 per cent APY on the money held in their Sendwave Pay account.

Sendwave Pay is the first neobank offering within Zepz, the Group powering global remittance brands Sendwave and WorldRemit.

Zepz has indicated its intention to continually invest in migrant-focused financial offerings around the world, including Kenya.

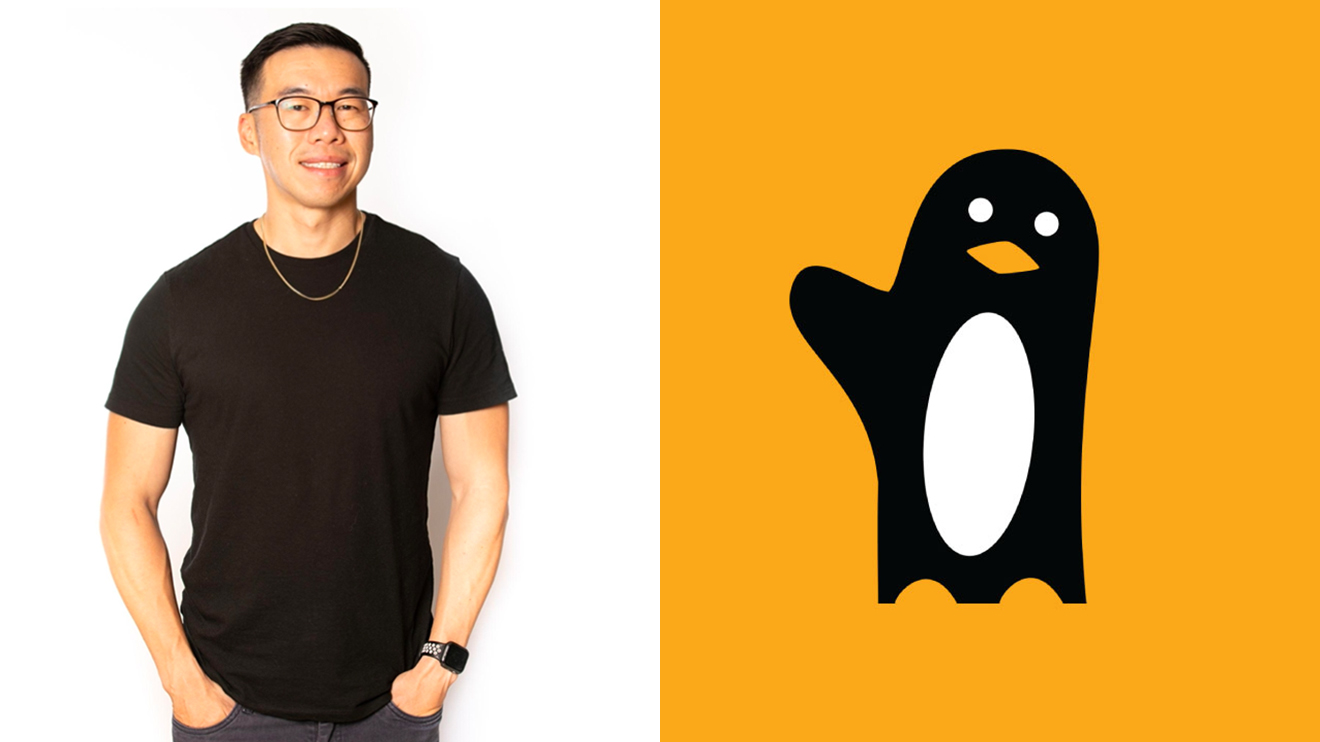

“The way that people use and access money has drastically changed over the last decade. We created Sendwave Pay to better meet the needs of our customers, who are dynamically considering how they manage their money both for themselves and for loved ones abroad,” said Sendwave Pay, Zepz Product Lead Eric Huynh.

Zepz’s launch of Sendwave Pay comes in the middle of a global economic slump and higher borrowing costs in the US, which is currently the leading source of remittances to Kenya.

Data from Central Bank of Kenya (CBK) shows Kenyans living in the US sent back home $2.33 billion in 2022, accounting for more than half of the $4.02 billion of diaspora remittances.

-1757663582.jpeg)