In a move aimed at enhancing financial inclusion and promoting economic growth, President William Ruto unveiled the Central Securities Depository Dhow (DhowCSD) on Monday at the Central Bank of Kenya (CBK) headquarters in Nairobi.

The launch of this innovative depository infrastructure marks a significant milestone in the government's efforts to eliminate trade barriers, deepen the domestic capital market, and expand access to investment opportunities for all Kenyans.

President Ruto emphasized the government's commitment to facilitating meaningful participation in the country's development.

"The deliberate access to opportunities will create wealth and improve people's lives," Ruto stated.

The DhowCSD is designed to enable traders in government securities in local, regional, and international financial markets to conduct electronic transactions efficiently and securely.

Read More

The system, domiciled at CBK, provides centralized custody of securities and ensures the secure updating of transaction statuses.

Ruto expressed his vision for the platform, saying, "It will foster the growth and stability of our financial market."

This initiative aligns with the government's objective to drive economic growth from the grassroots level, as exemplified by the Hustler Fund.

One of the notable advantages of the DhowCSD is the elimination of the need for investors to physically visit CBK to open a CDS account.

Instead, the CSD investor portal and mobile app offer convenient access to the securities market for individuals of all statuses.

Ruto emphasized the significance of this development, highlighting how it aligns with the government's mission to expand opportunities for all Kenyans.

He drew a parallel with the Hustler Fund, emphasizing the importance of automation through digital platforms in uplifting the economy "from the bottom-up."

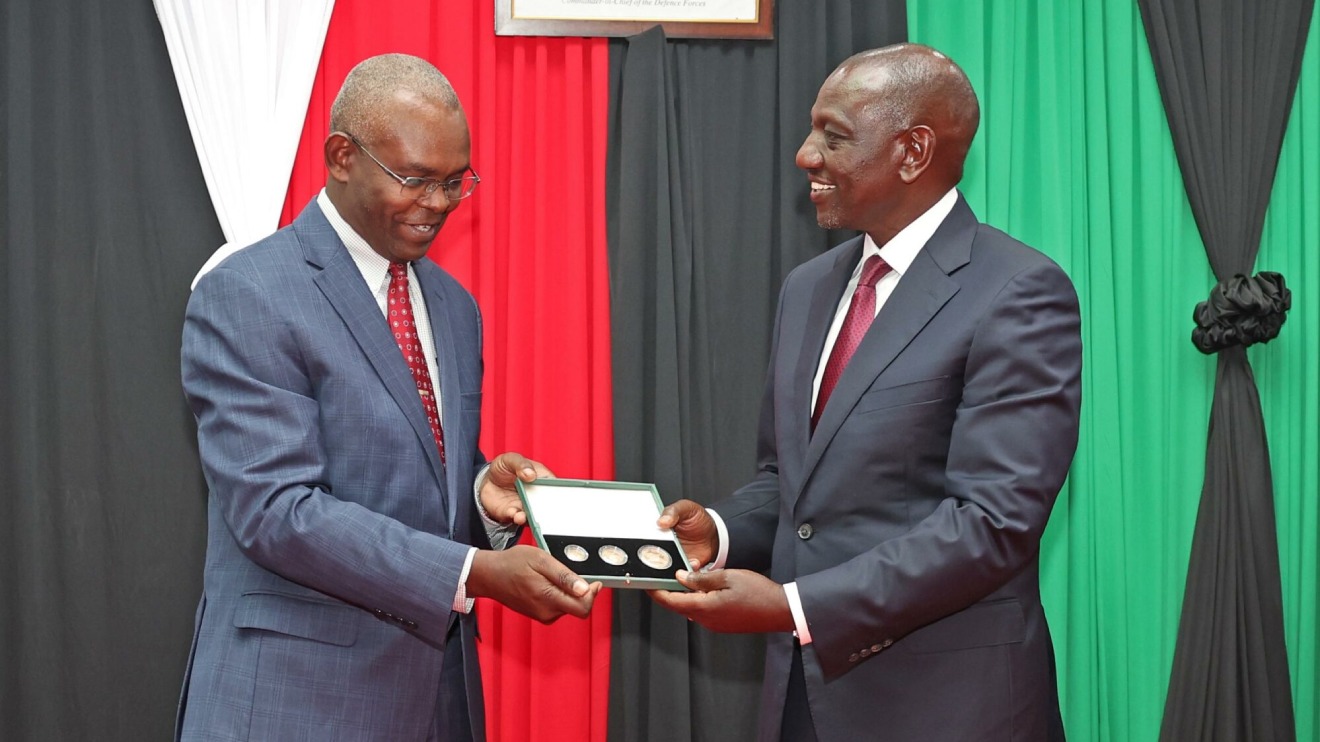

Cabinet Secretaries Njuguna Ndung'u and Moses Kuria, along with CBK Governor Kamau Thugge, joined President Ruto at the launch event.

Prof Ndung'u described the DhowCSD as a diversity milestone that will enrich the market, while Governor Thugge emphasized the system's potential to boost operational efficiency and enhance liquidity distribution in the domestic market.

Furthermore, the DhowCSD extends its reach beyond Kenya's borders, enabling Kenyan citizens living abroad to participate in government securities trading digitally.

This development underlines the government's commitment to expanding digital access, deepening financial markets, and aligning with international financial markets.

Ruto stressed that the platform would enable Kenyans without bank accounts to participate in purchasing state securities.

"This will expand the scope of participants and democratize this space even further and make it possible for a bigger majority of Kenyans and investors to participate in this endeavour," Ruto stated.

Since its launch in July, the platform is reported to have witnessed the creation of over 7,000 new accounts, demonstrating its growing popularity and potential to transform Kenya's financial landscape.

With the introduction of the Central Securities Depository Dhow (DhowCSD), Kenya takes a significant step toward fostering economic growth, expanding financial inclusion, and creating a more accessible and efficient investment environment for all its citizens.

shares a light moment with the company's Group CEO Dr Patrick Tumbo (right) at a past event-1758121528.jpeg)