According to a McKinsey report, African financial services are now undergoing a structural shift. About 10 percent of all transactions in Africa are digital and fintech revenues reached 4-6 billion USD in 2020, average fintech penetration level is from 3 to 5 per cent, which is in line with global market leaders.

Furthermore, Kenyan online business is facing abundant political and economic challenges. However, being one of the African fintech key markets, Kenyan businesses are still driven by the right incentives and support, “the marvel of African unicorns is just waiting to emerge” (Source: McKinsey & Co).

But what has precipitated the rise in online fraud? There are a number of trends that may be regarded as a key factor to why Kenyans started to use digital financial services actively last year.

To name but a few, increase in smartphone owners, fast urbanization of the population (especially among young people), increasing need for borrowed funds.

However, the Covid-19 wave had one of the strongest effects and was a real growth driver: a large number of users switched to the digital channel as the main source of obtaining financial services.

Read More

In fact, digital channels allow companies to reduce operating costs significantly, as well as to gain access to a wider audience on the one hand, and not to risk one's health speaking about the clients on the other hand.

Despite all the above-mentioned opportunities, today we are witnessing a really big leakage of personal data day by day and when it comes to the Internet it leads to an increasing number of online fraud cases in Africa.

That is why the secure storage of user data is becoming one of the most critical issues in today's online business. Those companies which are going to take advantage of the rise and implementation of new advanced technologies will eventually win the market.

How do our technologies help to assess risks?

Index variables are an essential part of JuicyScore data vector attributes. In order to understand the technological essence of our approach better, we need to look at a variable of the IDX type in our standard data vector, which we create using the algorithms of deep machine learning.

It also should be noted that all the data provided in this research refer to Kenya.

IDX1 is a combination of 50+ rare events, which show a high probability of fraud through technical manipulation of the device.

This variable includes the whole variety of device randomization tools, and techniques of interference into "digital fingerprint" as well as determines the most dangerous markers of user high-risk behaviour and network connection markers.

The variable can be used both in rules and also as a component of a fraud prevention model to identify the most dangerous customer segments.

The risk level raises along with the parameter value, high values may be used as filters for automatic denial.

Variability indicator 0 means low risk, 1 - middle risk, when additional verification/validation should be carried out, indicator 2+ means high-risk level and in such cases, we recommend denying such applications.

Apart from the use of randomizers, which are identified with IDX1 as well as with the separate stop factors - for example, copying of another device's session (vector's variable session clone), identification of anomalies in the header of the web session (vector's variable User Agent Issue), an indication of manipulation with the color palette (variable Canvas blocker) - also great attention should be paid to browser or operating system anomalies.

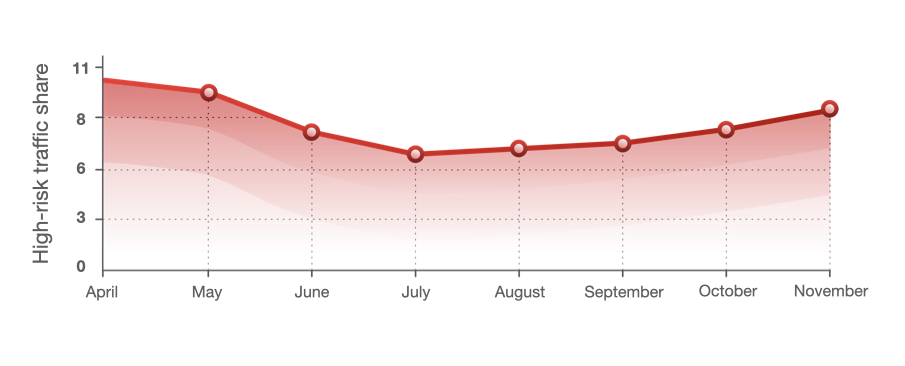

As we can see, despite a short decline in the relative fraud level in online business in Kenya, there has been an increase in the level of fraud in recent months.

There will be more, for traditionally in December in the high festive season the average value of some high-risk markers rises significantly compared to the previous period.

How can Kenyan online businesses reduce the cost of risk through investments in risk assessment technology, new data, and increasing the proportion of loans provided with mobile applications?

Risk reduction can be achieved by improving the methods for risk assessment, including developing a technology stack, dynamic authentication, and processing of all data sources available on the market to increase information value, quality, and speed of decision-making.

Increasing the proportion of loans provided with mobile applications will also reduce the level of risk for it will also increase the amount of data available for risk assessment.

Chris Akolo, the Regional Business Director at JuicyScore.

-1757243598.jpg)

-1757244564.jpg)