LOOP has introduced a short-term credit facility offering customers immediate access to funds for urgent financial needs, with disbursement done instantly via its app and a repayment window capped at 30 days.

Known as the LOOP Quick 30-Day Loan, the product is now available to all registered LOOP users who have been assigned a credit limit and have no overdue loans on record.

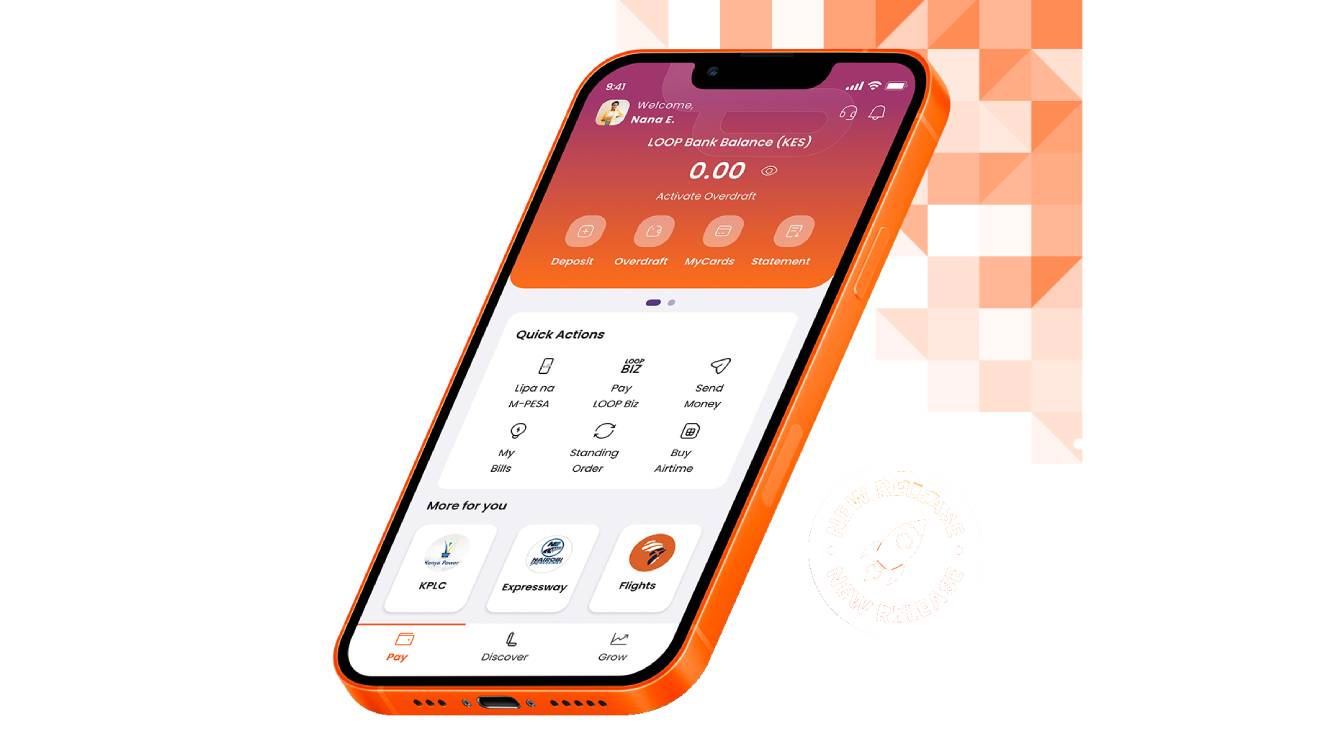

The facility allows borrowers to access between Sh2,000 and Sh100,000 directly into their LOOP wallets with just a few taps on their smartphones.

The loan comes with several distinct features tailored to address short-term cash flow gaps while maintaining flexibility.

Disbursement is immediate upon approval, and borrowers are allowed to top up their loan within the first 20 days, provided they remain within their allocated limit.

Read More

LOOP charges a 7 per cent facility fee upfront on the principal borrowed.

Should the loan remain unpaid past the 30-day mark, an optional 7 per cent roll-over fee is applied on the outstanding amount from day 31.

Both the facility and roll-over fees attract an excise duty of 20 per cent.

Explaining the thinking behind the new offering, LOOP DFS Chief Executive Officer Eric Muriuki said the focus was on providing customers with autonomy and convenience during financial crunches.

“The LOOP Quick Loan is about putting control into the hands of our customers," Muriuki stated.

"We understand that sometimes people just need a boost to bridge short-term cash flow gaps, and now they can access that help through their phones with just a few taps."

Muriuki noted that the process is seamless and designed around the realities of modern life.

The rollout of this credit line forms part of LOOP’s wider strategy to build a digitally anchored financial ecosystem that enhances user lifestyles through accessibility, innovation, and inclusion.

To apply, eligible users must log into their LOOP app, verify their available credit limit, and proceed to accept the loan’s terms and conditions.

With the digital loan market in Kenya growing ever more competitive, LOOP's latest product signals its intent to carve out a niche in short-term digital lending, especially among mobile-first users looking for speed and simplicity in financial services.

-1757101509.jpg)