The Central Bank of Kenya (CBK) has released a list of companies licensed as digital online lenders.

This comes after the period of six months given to the lenders to apply for operation licences has lapsed.

CBK considered new players in the digital lending sector to receive their licenses.

According to CBK, other applicants are still in different stages in the application process, pending the submission of the relevant documents.

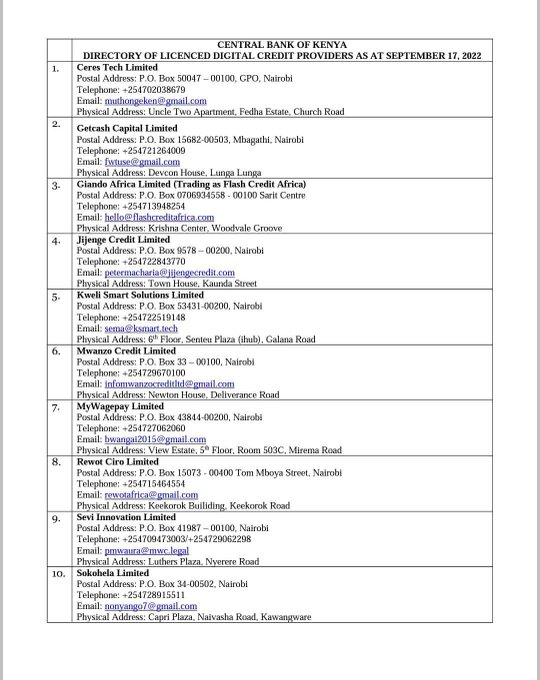

So far, the CBK has licensed only 10 applicants as digital lenders out of 288 applicants and the 10 licensees represent a majority of new entrants and local players in the sector.

Read More

"So far, 10 applicants have been licensed as DCPs, pursuant to the CBK Act and the Regulations," CBK said.

“Other applicants are at different stages in this process, largely awaiting the submission of requisite documentation. We urge these applicants to submit the pending documentation expeditiously to enable completion of the review of their applications."

CBK asked those applicants who are yet to submit the required documents to make haste in doing so and warned those that are unregulated to cease conducting such a business.

“All other unregulated digital credit providers (DCPs) that did not apply for licensing must cease and desist from conducting digital credit business.”

The following is the full list of licensed digital

This announcement comes as a relief to many Kenyans who have complained of harassment and embarrassment by most of the digital money lenders after failing to settle their loans, which often attract exorbitant interest rates.

CBK published the new regulations on March 21, 2022, which required all digital lenders operating in Kenya to obtain licenses from the regulator.